Welcome to the “CEO Series”. Here, we talk about how entrepreneurs learn to become great CEOs, as the greatest technology companies in history, most often than not, are led by people like them.

Neglecting long-term investment, is a fault I often observe in young CEOs.

Everyone has their grand ambitions. Some want to change the retarded media ecology in the present world, some want to provide youngsters world class education, some want to build a brand that’s well-known to the whole world, some want to make planning a trip as simple as a click. There is nothing wrong with these ambitions.

The problem is, when we come to think of it, young leaders seldom realize that with only their cash, there is no way they could bring the company to reach the dream.

With AdWords alone, Google has been making positive cash flow of $18 billion annually. So Google could use the money to invest in big dreams, such as self-driving cars, fiber-to-the-premises service, and self-flying planes that require much time and would not benefit the company within the next three to five years. But most new companies have negative cash flow and a runway not longer than 12 months. It is hard to even predict where the company might end up a year from now, let alone long-term investments.

Facing Harsh Reality

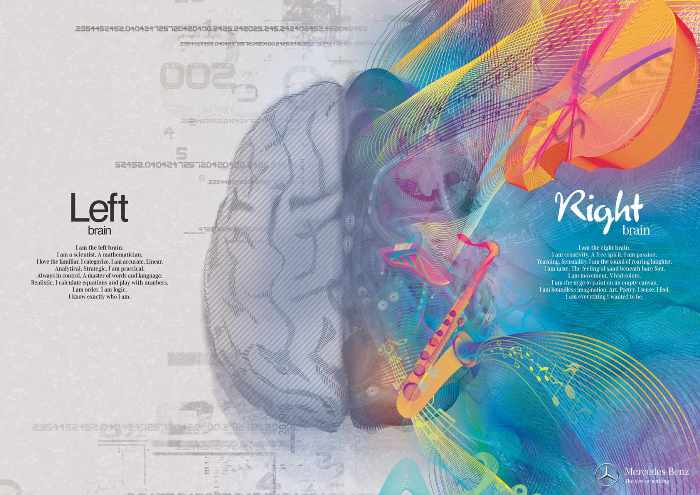

Therefore good entrepreneurs and CEOs can’t only have ambitions as great like Google’s. They also need to deal with cash flow problems that would happen soon, and thereby achieving the state of alternate use of the left and right brain, where they would keep embracing ambitions while facing reality with courage.

The harsh reality is that your company will inevitably fall back on ad-hoc work. With your profits played away, you will have no choice but to fall back on ad-hoc work to survive, at which point you will wonder if the effort you put into it is even worth it.

The most brutal reality is that your company has to find a way to survive – no, taking on ad-hoc work is not an option. Every new startup team who cannot carry on would eventually have no choice but to fall back on ad-hoc work to survive. Because of this, the profit from the “project industry” is over. Besides, if you want to take ad-hoc work, why spend so much energy to establish a product company in the first place (Note: with the exception of the few strategic techniques for taking projects)?

Pragmatically speaking, you only have about four options as below:

Start with Non-Scalable Business Models

There are some business models which might not be scalable, but can generate healthy positive cash flow and allow the team to grow. Maybe you should not look down on them, but use them as stepping stones instead. For instance, KuoBrothers first used models like Buy365 and Photo123 to gain a foothold in the business, and shifted the focus when they found models that are highly scalable like Fish123 and Buy123.

Find the Traction, Then Raise Funds from Venture Capitals to Boost Growth

Before you spend all your money, prove that your great plan really is what the market needs on a smaller scale first, then raise funds from your venture capital to speed up progress towards the goals. For instance, by the time EZTABLE have completed the first round of fundraising, they already have 200 restaurants signed up with them, and have also shown 30% of consumer reorder rate.

Prove Yourself on Other Platforms

Join an enterprise in related field first. When you have accumulated enough track records, then use this credit to raise funds from the venture capital and start up your own business. For example, the founder of Uitox, Vincent Xie was holding the position as the CEO of PChome group, when he led the epoch-making project of establishing 24-hour shopping services. When he decided to leave the group to work on “Global Shopping”, he could find many investors willing to support him in pursuing his dream.

Cut Unnecessary Expenses

Finally, if there really is no way to bring in positive cash flow, then you have to reduce your expenditure. If in the past, you had been over-optimistic and have added some unnecessary fixed costs; if things are not happening as you wish, and the runway is getting shorter, as the CEO, your task is to confront the overall risk it is bringing to the company, make crucial decisions in crucial moments, reduce the office, facilities and co-workers (Remember, if the cost consideration is the only reason you have to let your excellent co-workers go, be sure to do your best to help them find a good employer.), so that it would buy your team more time to find positive cash flow, or traction through which the company can raise funds.

An entrepreneur cannot be without dreams, but dreams alone are not enough. Do not forget your original intention, and also don’t forget to face the challenge of positive cash flow problems with a positive mind, so that you can develop leadership skills and achieve the state of the well-balanced use of both sides of your brain.

This article is originally written by Jamie Lin, a well-published author based in Taiwan. The article is translated from Chinese by Loh Sin Yee and is reproduced here with permission. Images were added into the article for visual purposes.