It’s probably the biggest blockbuster to hit the stock market this year in the US.

Yesterday, American telecommunications giant AT&T announced a deal that would see them acquire the world’s second largest entertainment brands group, Time Warner.

The deal is done: AT&T, Time Warner boards meeting today to approve merger. Announcement coming tonight. w/ @tgryta https://t.co/HYf1Kydltd

— keachhagey (@keachhagey) October 22, 2016

AT&T Now Owns Time Warner’s Most Influential Media Brands

News outlets worldwide first exploded when whispers of the deal surfaced on Friday, and again yesterday when the deal was done.

AT&T are now the new owners of some of the world’s most recognisable media brands.

First, there’s HBO.

HBO is the one behind some of the best television shows and documentaries out there. Think cult hits such as Sex and the City, The Sopranos and their most notable name in recent times, the super popular Game of Thrones.

Aside from these shows, they also have offshoot localised sub-brands based in several continents. These distribute all the media content, with HBO Asia close to home right here in Singapore.

Then there’s Turner, a broadcasting media company, home to brands such as Adult Swim, Cartoon Network, Turner Sports (with deals in NBA, NASCAR, and NCAA). and most importantly, news network CNN.

AT&T now controls a major news network, as well as sports and animation channels that are widely viewed not just in the US, but globally as well.

So yeah, the likes of Adventure Time and The Powerpuff Girls have new owners.

And finally, we have Warner Bros Entertainment Inc.

The big one here is definitely DC Comics, which houses geek-favourites Batman, Superman and Wonder Woman. Being the only ‘real’ rival to Marvel, it will be interesting to see what kind of effect this deal will have in the future.

Of course, Warner Bros is also the one behind many popular movies (Harry Potter, for instance) and television shows (Anthony Bourdain’s series), so basically, AT&T has more than likely just hit the jackpot.

Why This Happened

It all started innocently enough.

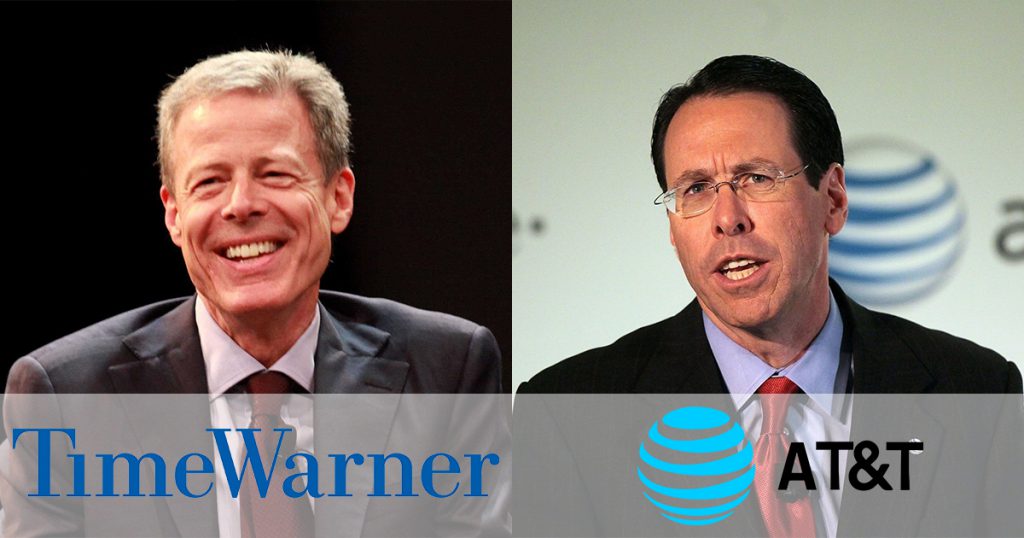

CEOs of both companies, Randall Stephenson (AT&T) and Jeff Bewkes (Time Warner), were in discussion about how Time Warner could reach more customers through AT&T’s mobile network, and how that could be made possible through closer ties and partnerships between both companies.

Inspired by an earlier, and equally controversial, merger by Comcast and NBC, Randall Stephenson proposed that AT&T and Time Warner do the same. This sparked further conversations between both companies with everything seemingly falling into place, and that “there would be benefits that might be significant and might allow us to evolve the ecosystem faster”.

However, I do think that there’s more to this, as there are other underlying reasons as to why they are doing this now.

For one, slowing mobile phone sales and the intense competition of providing internet and telephone services may have finally caught up with AT&T, and the declining subscribers and revenue have finally prompted them to look at other income avenues.

For Time Warner, it is the declining viewership of all their media outlets due to people weening off mainstream television viewing in favour of on-demand online offerings.

With live sports coverage no longer being the number one source of entertainment for Americans and DC Comics not exactly winning against their rival, it seems HBO is the only one geared to adapt to the changing behaviours of media consumers.

What This Means For Consumers

The administration should kill the Time Warner-AT&T merger. This deal would mean higher prices and fewer choices for the American people.

— Bernie Sanders (@BernieSanders) October 23, 2016

Perhaps Bernie Sanders perfectly summed up the problem with this deal.

In a tweet sent out today, he mentioned that this “would mean higher prices and fewer choices for the American people.”

Unfortunately though, with Time Warner being second only to Disney as one of the world’s biggest entertainment conglomerates, the fallout will have repercussions on international audiences as well.

To put things into perspective, soon, catching up your favourite HBO shows such as Game of Thrones in Singapore with services such as Starhub’s HBO Go may potentially be more expensive.

Now that AT&T controls both the bandwidth and content, it is in a position to price and withhold content from competitors. With this also comes the likelihood of it being partial to its own customers and subscribers before making it available to other networks.

How Serious Of A Problem Is This Deal?

In a word: Very.

Looking back at Bernie Sanders’ tweet, he mentioned that “the administration” should kill the merger. This of course, refers to the American government and its relevant legislators.

In fact, the Senate was quick to convene about bringing this deal under scrutiny, with a hearing to be scheduled in November.

Even both candidates in line to be the next US President, Hillary Clinton and Donald Trump, have released statements through their spokespeople to denounce this deal.

While Donald Trump has outrightly said that he will block the merger should he become president, while Hillary Clinton has said that this deal represents “a number of questions and concerns” that regulators should heavily scrutinise.

The common sentiments shared by all seems to be that too much market power is now consolidated within a singular company. This has sparked an intense anti-competition debate, with chairman for the US antitrust subcommittee, Senator Mike Lee, saying that it could “potentially raise significant antitrust issues, which the subcommittee would carefully examine”.

A Sign Of Things To Come

Although it might be totally unrelated, the closest example that I could find in Singapore would probably be the recent IMDA merger.

With one being a private corporation and the other a government body, you cannot deny that in the current digital economy, info-communications and media cannot survive individually.

While the sight of Singtel acquiring Mediacorp is not something we will see in Singapore (not yet at least), back in the US, the market is already preparing itself for other potential mega-mergers that may arise due to the AT&T-Time Warner deal.

With the convergence of telecommunications, technology and media, it won’t be far off the radar from us seeing another big US ISP buying over a content producer (Verizon and Yahoo), or a major tech company like Facebook, Google, or Apple going on an acquisition spree of brands and networks, in a fight to see who can provide their users an all-in-one entertainment solution.