- In a Facebook Live video uploaded by the Chairman of the Shariah Advisory Council, he expresses his thoughts about Bitcoin and Blockchain in Malaysia, both legally and under Shariah law.

- He argues that Blockchain could help fight against money-laundering.

- Datuk Mohd Daud also disagrees that cryptocurrencies are haram under Shariah law due to its fluctuating value. Both fiat money and cryptocurrency are based on trust. The value of fiat money internationally also fluctuates—yet they are not considered haram even if there is risk.

While things have quieted down slightly since Bitcoin’s value fell, the cryptocurrency craze is still very much ablaze. These days though, attentions are slowly shifting towards some other aspects, like Altcoins (such as Ethereum) and the blockchain that powers Bitcoin.

Hopefully, this means that the bandwagon-jumping will end, leading us to a more thoughtful cryptocurrency adoption.

Bank Negara Malaysia has issued some rules for players to follow in Malaysia, and some restrictions—Luno’s bank accounts were frozen by tax authorities while it probes for information on all of Luno’s Malaysian customers.

There is movement in the local regulation scene, but it’s clear that there has been no final say on the actual outlook of cryptocurrency yet.

Notably, one of the concerns raised by Malaysian authorities is the possibility of dirty money being “cleaned up”, or black market purchases facilitated with cryptocurrency.

Meanwhile, among Muslim circles, there has been concern about whether cryptocurrency would be considered illegal under Shariah law. An Egyptian mufti has declared Bitcoin haram on grounds of gambling, and again, opening the doors to money laundering.

Turkey has also stated that Bitcoin goes against Islam, because of its nature as an unregulated currency.

TL;DR, Malaysian authorities’ opinion on cryptocurrency is still up in the air—but it doesn’t look good.

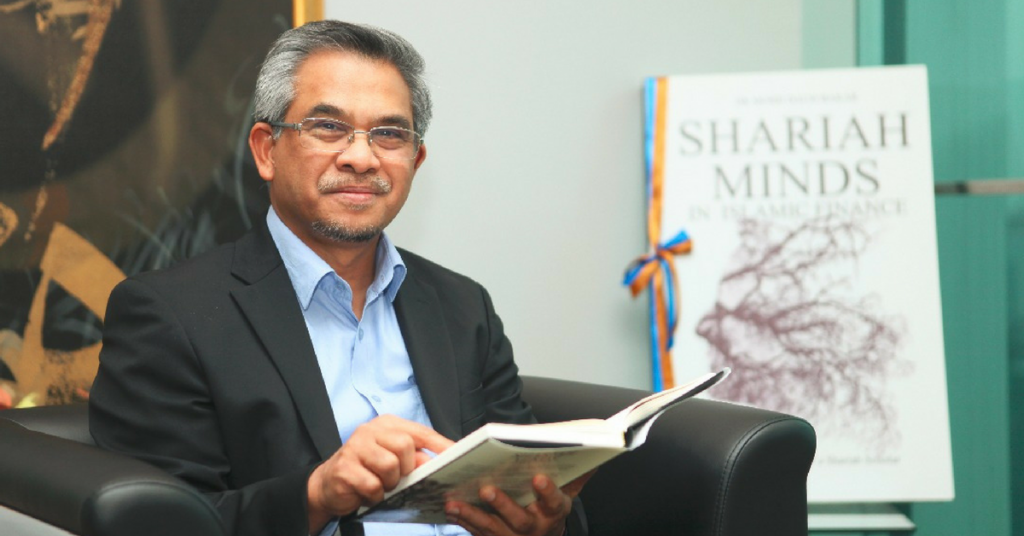

However, there is a ray of hope for crypto-fans. Among those deliberating on cryptocurrency is the chairman of the Shariah Advisory Council, Datuk Dr. Mohd Daud Bakar, who addresses the above concerns quite concisely.

He released a Facebook Live of his talks to break down his opinion of cryptocurrency adoption in Malaysia, particularly in relation to Shariah. His thoughts were expressed in Malay, so we’ve translated his quotes into English for the purposes for this article.

If you’re interested in hearing his thoughts for yourself though, you can check out this video, which has seen 8.2k shares at the time of writing.

Point 1: Blockchain is more than just a currency.

“I am a man of Shariah, and I see ways to preserve Shariah within digital currencies, especially because digital currencies are a phenomenon that will happen, whether we like it or not.”

He starts out by describing blockchain, which is actually a ledger system that is recorded by more than one party. This helps prevent tampering. You can read up more about it here.

“The problem is, blockchain has been touted as a currency, even though its purpose extends beyond that. Its purpose is a tool for firstly, exchanges, and secondly as a tool for remittances. The usual way for remittances between currency to currency would take up cost and approximately two days to go through.”

“Meanwhile, with these tokens, it could take only 10 seconds or even 5 seconds, and the money will already reflect in your e-wallet.”

Point 2: Blockchain could help the fight against money-laundering.

Datuk Mohd Daud outlines some examples of how this could be applied in Malaysia.

“For example, if we pay zakat though Bitcoin—if this is allowed by fatwa—then we can see exactly how the money is spent. Another example is BR1M allowances. We can observe exactly where the money is spent, whether in schoolbooks and etc.”

Note: Zakat is a form of alms-giving; fatwa is a ruling on a point of Islamic law given by a recognised authority.

Seeing exactly how these monies are spent could help with accountability. Zakat-payers, for example, could ensure that their contributions are actually going to help those actually in need, and the government could get valuable data on where BR1M is spent, to better strategise where and how they’re distributed.

Blockchain can help ensure that any identities linked to their monies are kept on-record, rather than fiat money (regular currencies) where one can more easily hide their identities—especially using cash.

Datuk Mohd Daud points out Know Your Customer (KYC) verification procedures, which can be applied to ensure that identities linked to any cryptocurrency can be kept on-record. You can find out more about what that means here.

In this way, blockchain could actually help combat money-laundering, if applied right and overseen by the right people.

Point 3: Cryptocurrency has many possible and practical applications in Malaysia.

Instead of just deliberating on Bitcoin, Datuk Mohd Daud has some thoughts about exactly how cryptocurrency can be applied in Malaysia in the first place.

He brings up Japan and Dubai as examples. Japan has acknowledged Bitcoin as legal, while Dubai has launched its own blockchain-based cryptocurrency in October last year.

Speaking about how Dubai has done things, Datuk Mohd Daud said, “It’s no longer a global cryptocurrency or borderless, but rather a local currency. That can be good. If Malaysia wants to adapt cryptocurrency, they can turn it into local currency.”

Point 4: Certain Islamic authorities might see cryptocurrency as haram—and why he respectfully disagrees.

“Ulama today consider it as haram because it is gharar (uncertain). But in my humble opinion, they misunderstand the difference between uncertainty and risk.”

Datuk Mohd Daud thinks that, “In Shariah, risk is part of everyday life. Buying houses, buying shares, and even buying gold is risky. In fact, any fitrah from Allah S.A.W has its risks.”

Note: Fitrah does not have an English equivalent, but can be termed as instinct, or original human nature.

The value of Bitcoin can fluctuate—going from being valued at 11 thousand per token, to 12 thousand and back down to 10 thousand, Datuk Mohd Daud think that this is what has caused some authorities to declare Bitcoin haram.

In regards to religious leaders from Qatar, Egypt and Turkey declaring it haram, Datuk Mohd Daud thinks that, “From a fatwa standpoint, a government can declare something haram because of the risk. But in terms of Shariah, it can’t be said that something is haram because there is a risk.”

“Digital currency was created based on a feeling of trust or peer-to-peer. Meanwhile, fiat money is also based in trust.”

Datuk Mohd Daud brings up the USD, which has been used as a global currency. Its value has fluctuated over the years, gaining and losing trust as it goes along—including being used by the World Bank to balance the international exchange.

“If even America can lost faith in its own currency, does that mean the USD is not a currency? Not necessarily. In fact there have been cases such as wars and boycotts that led to currency values falling. This did not take its values as currency away.”

Point 5: Malaysian regulators can already take active steps right now.

To help regulators better understand cryptocurrency, Datuk Mohd Daud even suggested that they create their own e-wallets.

“We try to put in RM100, or RM200 to buy anything so that we can see the ecosystem alive in our e-wallets. This is not necessarily for investments, that is a risk subject to each individual. Instead, we only use a small amount of money to learn how it works.”

Throughout the Facebook Live, Datuk Mohd Daud was clearly deferring to others who are more knowledgeable about Blockchain and cryptocurrencies to figure out his opinion of it, even referencing that they’ve given a presentation about what they all are prior to expressing his own opinions.

Besides just this Facebook Live, he has also committed his thoughts into text in this article he penned for Utusan Malaysia, which may explain things more clearly and outlines how hed views cryptocurrency based on Mazhab Syafie.

He has also uploaded another video last November outlining similar points in more detail that has garnered 143k views.

A blog post that outlines some of the major points of the above video (written in Malay) can be found here.

And if Malaysia, a majority Muslim nation is going to apply cryptocurrency in its day-to-day life, it is important for us to figure out exactly how we feel about cryptocurrency’s existence and use today—and it is heartening that someone in high power and esteem is giving it the benefit of the doubt.

I personally have my worries about individuals using cryptocurrency as a form of investment or using it like stock-broking, but it doesn’t mean that we should shy away from cryptocurrency altogether.

Investors do play their part, but actually using it for its intended purpose—to exchange goods and services—is crucial if we want to seriously look at cryptocurrency as a viable in the long run.

Feature Image Credit: Armanie Advisors