- Khazanah is looking to invest into smaller tech companies nowadays, owing to some “stretched” valuations in the tech industry today.

- And the types of companies they invest in as a GLC includes ones that add value to the Malaysian ecosystem, more of those that are involved in manufacturing, and they go where the trends take them.

Once particularly bullish on tech companies, Khazanah Nasional revealed that 2017 was a pretty slow year for them in terms of tech investments. Nevertheless, the sovereign wealth fund was able to record a rise in the value of its portfolio by 8.2 percent last year, despite an investment outlook that was more cautious.

It will still continue its successful bid into US technology investments, but the outlook on the local scene may initially seem unpromising.

This is due to some “lofty valuations” given to tech companies in the market lately, which has made Khazanah a bit reticent to venture there.

Khazanah is now keener on smaller tech companies as a result, which may spell some good things for some of the local players.

Nevertheless, it could be valuable to see what are the similarities between these companies that Khazanah invests in, either as budding investors, or as a budding business looking to understand how investments work with these large-scale investors.

1. The companies chosen add value to the Malaysian ecosystem.

The reason that Khazanah even exists in the first place is to put a stake into companies that could also bring value back to Malaysia. It is a Government-Linked Company (GLC) after all. So even in the tech sector, their investments reflect this. Take Alibaba. Besides monetary returns to Khazanah’s portfolio, Alibaba is now taking a pretty solid stance on the Malaysian economy.

We all know that Jack Ma is advising our tech sector on how to do things, and now their first project outside of China looks at setting up traffic control system using artificial intelligence.

But let’s look at Khazanah’s other tech companies.

At least 2 other companies—SilTerra and Aemulus—were developed to help grow the Malaysian economy. SilTerra was built to promote front-end semiconductor manufacturing and serve as a catalyst for high-technology investments in Malaysia.

Meanwhile, Aemulus (that now works on automated test equipment) was a holding company to “undertake a proposed listing on the ACE Market of Bursa Malaysia”.

Recent investments include Sigfox, an IoT company, as Malaysia continues to build smart cities, between the established Cyberjaya to Iskandar Puteri, Penang and the aforementioned KL.

2. Many of its companies are involved in manufacturing.

Of Khazanah’s publicly listed companies, besides SEA (formerly Garena) and Alibaba Group (and the affiliated logistics partner Cainiao), all of its investments have gone into companies that manufacture components for the tech industry.

General Fusion is in the works of developing the fastest and most practical path to commercial fusion energy possible. Aemulus Holdings is involved in the design, engineering and development of automated test equipment (ATE) to test semiconductor wafers and packaged devices.

Fractal Analytics helps Fortune 500 companies bring artificial intelligence and analytics into their business decisions. SilTerra Malaysia is a wafer foundry provider that offers complementary metal-oxide semiconductor wafer technology.

While these companies are probably invisible to the eye of the average consumer, their value as business-to-business ventures is clear. Perhaps it is also relevant that Khazanah more likely invests into established companies, and on average, B2B-type ventures do tend to deal with larger amounts of cash.

On another note, technology trends do come and go, but hardware developments is a moneymaking side of tech that is valuable no matter what your favourite smartphone brand is.

3. They invest based on where trends are heading.

When Khazanah invested into Garena (now SEA) in 2016, they killed two birds with one stone. Early 2016 was when both e-commerce and e-sports were on the rise, and this particular investment covered both.

We’ve also already mentioned how their Sigfox IoT investment tallies with Malaysia’s move into smart cities—an ongoing project that has seen renewed vigour lately.

There’s also Khazanah’s investment into Alibaba—now a powerhouse respected by tech players all around. When Khazanah invested into them, e-commerce was booming in China, yet still on the rise, which both showcases its proof of value and potential for the investment body to find confidence in.

This year, Khazanah stated that they are renewing interest into China, now that the nation’s technology sector has enjoyed more respect among international players.

Even going back to the era right before smartphones became a big deal, the aforementioned SilTerra and Aemulus Holdings are two companies that deal with semiconductor wafers and were the “in” things to invest into back in the day.

Going where the trends take them has been a pretty successful diversification strategy for Khazanah over the years even in the tech sector, allowing them a stake in some of the”sexier” emerging areas while still presenting a varied portfolio worthy of a large-scale GLC that doesn’t want to solely rely on local investments. This style of diversification has given them some returns too.

###

Khazanah is known to be quite picky about the companies that they do stake a claim in, evaluating about 30 to 40 companies per year while only investing in 20 of those. So potential investees still need to try and prove themselves before Khazanah will put it any cash.

Perhaps owing to this evaluation process, Khazanah is known to be quite smart in their investments, and time will show if their venture into smaller tech companies will prove just as fruitful for them as their bigger tech investments have.

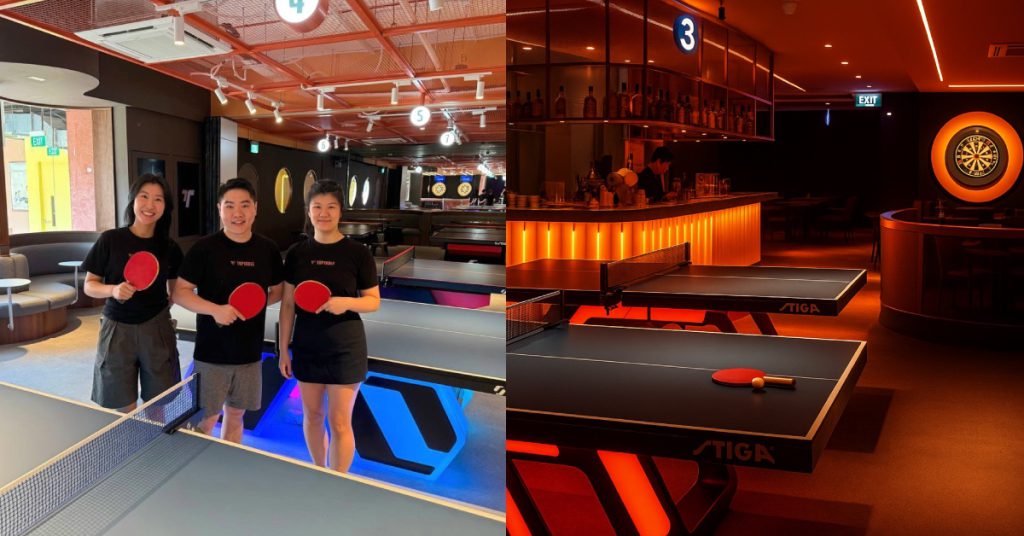

Feature Image Credit: Khazanah