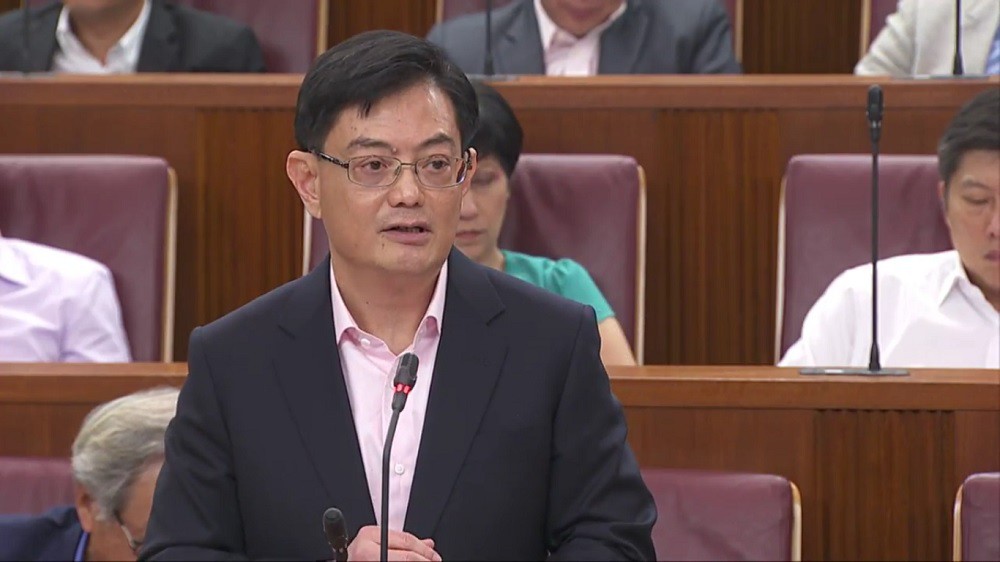

Finance Minister Heng Swee Keat will be delivering the Budget at 3:30pm, and we’ll be updating this article live with pointers mentioned during the speech.

Longer term goals of economic restructuring and transformation are expected to be covered this year.

In the meantime, watch this video and find out more about the purpose of the annual Budget!

Join us at 3:30pm, and watch the livestream here, or keep refreshing this page for the Budget’s pointers as they are delivered.

Budget 2018

- Singapore’s GDP grew by 3.6% last year, up from 2.4% in 2016, exceeding Govt’s forecast of 1% to 3%.

- We’ve been experiencing good productivity growth – highest since 2010

- As a result of good productivity, real median income growth for Singaporeans rose by 5.3% last year

- With the support of businesses, Trade Associations and Chambers (TACs), and unions, Govt has launched 21 out of 23 Industry Transformation Maps (ITMs)

- Industries such as construction and marine & offshore engineering will still face some resistance in growth

- Budget must be strategic to identify future needs and preparations

- Budget looks to pull resources together and integrate efforts across all stakeholders

- Govt must prepare for 3 major shifts in the coming decade: rise of Asia, emerging tech, and ageing society

- First shift – global economic weight towards Asia

- Advanced economies are now focusing inward in reaction to domestic pressures

- Brexit and the recent US tax changes and trade pacts are fuelling anxieties worldwide

- Asia will play a larger role in global trade and investment flows

- Cited China’s Belt and Road Initiative, India’s economy reformation, and ASEAN countries rising up the value chain as examples

- All developments represent opportunities for us – ride on and contribute to Asia’s growth

- Potential threats to our stability and growth – tensions on South China Sea and Korean peninsula

- Second shift – emergence of new technologies

- New technologies are changing the way we live, work and play

- Industry 4.0 and the rapid rise of e-commerce and a sharing economy

- Interacting with traditional businesses – they can be seen as competitors but can also be complementary enablers

- Focus more on intellectual property, first-mover advantage are key

- Securing better jobs and higher wages will not be just about how well we do in school, but how well we adapt and grow

- Third shift – the ageing population

- Significant increase in healthcare, and resident workforce will shrink

- Need to support our workforce with calibrated inflow from abroad

- Continue to invest in education and skills upgrading

- Promote sports, arts and heritage, and volunteerism and philanthropy

- These shifts will present new opportunities – tech will help older workers stay productive and for companies to meet demands of tech-savvy consumers

- These shifts will present new challenges – older workers may feel marginalised, rising discontent over technological disruptions, and increase in risk of cyberattacks

- Anchoring Singapore as a Global-Asia node of technology

- Welcome investments and talents to Singapore and be bold in venturing out into the world

- Develop deep capabilities and strengthen relationships locally and abroad

- Build a smart, green and liveable city to improve the quality of lives of Singaporeans

- Be more carbon-efficient as a society

- Foster a caring and cohesive society through collective efforts

- Govt to continue to strengthen social safety nets to tackle ageing population issues

- Preparing for a fiscally sustainable and secure future needs more resources amidst geo-political uncertainty and increasing tax competition

Vibrant And Innovative Economy

- Need to ensure we have enough resources to do everything we need to do

- Must support firms and workers to capture new opportunities and near-term challenges

- Though economy picked up last year, we remained concerned about business costs

- Wage growth is good for Singaporeans, but we need to keep improving productivity and achieve quality growth

- Govt will extend the Wage Credit Scheme (WCS) which co-funds wage increases for Singaporean employees up to a gross monthly wage of $4,000

- 20% co-funding for 2018, 15% for 2019, 10% for 2022

- Set to spend about $1.8 billion over next 3 years

- Govt will enhance and extend the Corporate Income Tax (CIT) rebate to YA2019, will cost $475 million over the next 2 years

- For YA2018, CIT rebate will be raised to 40% of tax payable, capped at $15,000

- For YA2019, CIT rebate will be at a rate of 20% of tax payable, capped at $10,000

- Will benefit all tax-paying companies especially smaller ones

- Govt will defer the increases in Foreign Worker Levy rates for another year for sectors in the Marine Shipyard and Process that still face weakness

- Strengthen support for workers – for lower to middle income support

- Those facing career transitions can stay employed and employable through the Adapt and Grow initiative

- Convert Work Trial scheme into a Career Trial scheme

- Our companies must keep up and workers must adapt as the skills required are evolving

- Need to differentiate themselves and venture abroad

- Reduce manpower demand while enabling older works to continue contributing

- Made a good start with ITMs, need more cluster-based approach

- First key enabler: Innovation. Must make innovation pervasive for firms of every size, and make use of technologies

- One of the Singaporean companies lauded for innovation: Pan-United

- This Budget will support firms across the entire value chain

- Support businesses to buy and use new solutions, streamline existing grants supporting the adoption of pre-scoped, off-the-shelf technologies into a single Productivity Solutions Grant (PSG)

- Will raise the tax deduction on licensing payments for the commercial use of intellectual property (IP)

- Tax deduction on licensing payments reverts to 100% for YA2019 and beyond as the Productivity and Innovation Credit (PIC) scheme expires

- Licensing payments raised to 200%, capped at $100,000 per year

- To encourage businesses to innovate originally – tax deduction for IP registration fees raised from 100% to 200%, capped at $100,000 of IP registration fees per year

- Tax deduction for R&D done in Singapore for IP raised from 150% to 250%

- Govt will pilot the Open Innovation Platform – virtual crowd-sourcing platform, where companies can list specific challenges that can be addressed by digital solutions

- Sustained public sector R&D spending at 1% GDP annually

- Maritime and aviation transformation – will provide support of up to $500M for these two programmes

- National Research Foundation (NRF) and Temasek Holdings will launch an NRF-Temasek IP Commercialisation Vehicle

- New investment venture will bring together Temasek’s global investment networks and NRF’s connections with the Singapore R&D community, to grow companies that draw on IP from publicly-funded research

- At least $100 million from Govt and Temasek Holdings

- Implement National Robotics Programme – particularly in the construction industry

- Second key enabler: Building deep capabilities. Our firms and workers to have capabilities to internationalise, digitalise, and be more productive

- In April, we will merge SPRING and IE Singapore into Enterprise Singapore

- Combine IE’s Global Company Partnership grant with SPRING’s Capability Development Grant, to form an integrated Enterprise Development Grant (EDG) that will provide up to 70% co-funding

- Double Tax Deduction for Internationalisation (DTDi) – Startup Tax Exemption (SUTE) and Partial Tax Exemption (PTE)

- SUTE – Will exempt 75% of tax instead of 100% for startups for their first $100,000 wef YA2020

- PTE & SUTE – Restrict tax exemptions to the first $200,000 of chargeable income

- Corporate tax will remain low for startups and SMEs – Taxable income of $100,000 is 4.3% for startups and 8.1% for older firms

- Under the SME Go Digital programme, more than 650 SMEs have benefitted

- Developed nationwide e-invoicing framework to enhance cashflow and improve productivity

- 27,000+ people have taken up the Tech Skills Accelerator (TeSA) programme since 2016

- TeSA will expand into sectors like manufacturing and services

- Will set aside $145 million for TeSa over the next 3 years

- More emerging skills like AI, IoT, cybersecurity and data analytics

- Infineon applauded for training their workers

- SkillsFuture Earn and Learn Programme and Go Southeast Asia award matches undergrads with regional internships

- SkillsFuture Mid-Career Enhanced Subsidy and Professional Conversion Programmes (PCPs) such as the PCP for Southeast Asia Ready Talent programme prepare Singaporeans with work experience to do well regionally

- Since the SkillsFuture Leadership Development Initiative (LDI) started last year, 200 Singaporeans have been trained with 180 in the pipeline

- ASEAN Leadership Programme will be launched this year under the LDI for business leaders

- The Singapore Business Federation (SBF) and the Singapore Management University (SMU) will pilot the SBF-SMU LEAD-CHARGE Initiative targeted at SMEs

- As workforce ages, firms must harness the experience of these people

- Re-employment age raised to 67

- Extended Special Employment Credit and enhanced WorkPro

- Singapore’s employment rate for residents aged 65 and above rose from 14.4% in 2007 to 25.8% in 2017

- Govt will continue to encourage age-friendly workplaces and review support for older workers

- The Capability Transfer Programme (CTP) to support skills transfers from overseas trainers to Singaporeans

- Third key enabler: Forge strong partnerships

- Ascendas-Singbridge and IE Singapore led a group of Singaporean SMEs specialising in Industry 4.0 tech solutions to set up a Singapore Manufacturing Innovation Centre in Guangzhou, China

- Centre provides SMEs with a platform to co-create their solutions and reach out to the large Chinese market

- PACT scheme – companies can receive up to 70% co-funding for projects undertaken in partnership with others

- $800 million will be set aside over the next 3 years for PACT, the Productivity Solutions Grant, and the Enterprise Development Grant

- Global Innovation Alliance (GIA) is for S’poreans to build network overseas

- Local unis have expanded overseas internship programmes to 8 new countries

- Launched GIA Beijing and established Block 71 in Suzhou and Jakarta

- Bring global innovation to Singapore through initiatives like the Singapore Week of Innovation and Technology (SWITCH)

- Developing an ASEAN Innovation Network to strengthen innovation between countries

- To contribute to Asia’s infrastructure development, they will set up an Infrastructure Office

- An Infrastructure Office will be set up to bring together local and international firms to develop, finance, and execute infrastructure projects in Asia

- Importance of Trade Associations and Chambers (TACs) – understand members’ challenges and opportunities better than Govt

- Examples of TAC leadership and partnerships – the Trade Association Hub (TA Hub) and Trade Association Committee

- Logistics Alliance formed by Republic Polytechnic, SPRING, and 4 TACs – launched the Transport Integrated Platform (TRIP) last year

- Govt will continue to support such efforts, through the Local Enterprise and Association Development (LEAD) programme

- $45 million has been spent for some 50 projects under LEAD in the last 2 years

Smart, Green And Liveable City

- Work on providing a high quality living environment

- More than 40% of our island is covered in greenery

- Govt designed HDB estates with common spaces, enacted laws against pollution, and cleaned up the Singapore River

- “We became innovators in water treatment – even otters have returned to our waterways!”

- Our reputation as green city has attracted tourists and investments to our shores

- Adaptable, flexible and innovative cities always did well

- The Govt is embarking on strategic national projects to lay the foundation for the Smart Nation movement

- Building a Smart Nation Sensor Platform that uses sensors and IoT devices to enhance municipal service delivery

- Increasing adoption of e-payments islandwide

- Developing a National Digital Identity system to enable citizens to authenticate their identities securely. Will set aside $250 million for this

- Opening up digital platforms for private sector to develop

- The Urban Solutions and Sustainability is one such strategy under the Research, Innovation and Enterprise (RIE) 2020 plan

- Cities of Tomorrow R&D programme – use tech to reduce waste

- Closing the Waste Loop project – use tech to reduce environmental impact of waste we generate

- Energy Grid 2.0 to launch this year – to develop grid architectures that can react efficiently to energy demand changes

- Govt will set aside $250 million for the above three programmes

- Tackling climate change

- A low-lying island, Singapore is vulnerable to rising sea levels

- Govt is investing in building a weather-resilient infrastructure and redesigning our flood management system

- Manage our greenhouse gas solution

- Make Singapore car-lite – further reduce emissions to combat climate change

- Implement carbon tax from 2019 on companies producing 25,000 tonnes or more of greenhouse gas emissions a year

- First payment will begin in 2020 based on 2019 emissions

- Currently will charge $5 per tonne of emission from 2019 to 2023

- Will review carbon tax rates by 2023 – intend to increase it to a rate between $10 and $15 per tonne of emissions by 2030

- Carbon tax will apply to all sectors, with no exemptions

- Major emitters that account for about 80% of Singapore’s emissions affected

- Govt is looking at how to account for the remaining 20%

- No additional carbon tax on diesel, CNG, and petrol but will continue to review and adjust current excise duties

- Expects to collect carbon tax of nearly $1 billion in the first 5 years; Govt is prepared to spend more than this to support this move

- In the first five years, set aside funds from 2019 to support companies to be more energy-efficient

- Provide more grants and support to households

- Eligible HDB households will receive $20 more per year from 2019 to 2021

- MEWR will help households save more energy. MTI and MEWR will share more details later date

- Govt has designated 2018 as the Year of Climate Action to encourage all Singaporeans to fight climate change

- The Community in Bloom movement brought together over 36,000 gardening enthusiasts to cultivate more than 1,300 gardens all over Singapore

- Kayak Waterway Clean-Up Programme run by non-profit Waterways Watch society, brings volunteers together to clean up our waterways while raising environmental awareness

Caring And Cohesive Society

- SG Cares Movement to create a more caring society

- To provide all children access to quality education regardless of background

- Will increase annual Edusave contributions from $200 to $230 for each primary school student; $240 to $290 for each secondary school student wef January 2019

- Increase support to students from lower-income families

- Raise annual bursary for pre-U students from $750 to $900

- Cover more meals for secondary school students

- Students in special education schools will also benefit

- Overall, education enhancement schemes will cost almost $200 million per year

- Will plan a financial education curriculum in polytechnics and ITEs in the future

- Enhance existing services for Singaporeans when they buy flats or retire so that they can be informed

- Will review Eldershield

- Provide premium subsidies for middle and lower income Singaporeans

- Budget will support family members to live with or near each other

- Increase Proximity Housing Grant (PHG) for families buying resale flat to live with their parents or children to $30,000

- Those buying a resale flat near parents or children will continue to get PHG of $20,000

- Singles who buy a resale flat to live with parents will get PHG of $15,000, up from $10,000

- Singles who buy a resale flat near parents will now receive a PHG of $10,000

- Revise criterion of what’s near – radius to increase to 4km (so nearby towns are also included)

- Will take immediate effect and cost an additional $80 million a year

- A first-timer applicant can now receive up to $120,000 in housing grants when buying a resale flat to live with parents

- Will support households with expenses; extend these rebates till next year. Will cost $126 million and benefit about 900,000 households.

- Foreign domestic workers (FDWs) have increased by 40% over the past 10 years – 240,000 in 2017

- Avoid an over-dependency on FDWs – but some families need FDWs, so they will reduce the levy

- Young children, elderly or family members with disabilities retain monthly concessionary FDW levy of $60 – 80% of FDW employers benefit from this

- Raise qualifying age for levy concession under the aged person scheme from 65 to 67 years – persons aged 65 and 66 before 1 April 2019 will continue to pay the monthly $60 levy

- Non-concessionary FDW employers and multiple FDWs employers – levy raised from $265 to $300 and $400 for first and second FDW respectively

- Changes will take place on 1 April 2019

- Community Networks for Seniors (CNS) pilot in 2016 had helped an elderly couple with rehabilitation and social life

- CNS pilot showed them how to streamline and improve the delivery of services for seniors – the Ministry of Health (MOH) will now be in charge of this wef 1 April 2018

- Pioneer Generation Office will be renamed to Silver Generation Office, and Ambassadors will now be called Silver Generation or SG Ambassadors

- Top-up $300 million to the Community Silver Trust (CST) and will expand the CST to match donations for active ageing programmes

- Will top-up $100 million to the Seniors’ Mobility and Enabling Fund (SMF) which provides subsidies for assistive devices for seniors

- $150 million will be spent over the next 5 years for transport to support subsidised eldercare and dialysis

- Volunteerism rate has doubled from 17% to 35% over the last decade

- Donations have increased to $2.7 billion in 2015

- Govt will extend 250% tax deduction for people who donate to Institutions of a Public Character (IPCs) for another 3 years until 31 December 2021

- Giving.sg will be enhanced to better match donors and volunteers with charities

- Govt matches $3 for every $1 that the CDCs raise, up to a cap of $24 million annually

- Govt will increase current annual matching grant cap for CDCs to $40 million from FY2018 onwards

- Encourage corporates to get staff to donate or volunteer

- Business and IPC Partnership Scheme (BIPS) will be extended three more years until 31 Dec 2021

- Businesses that support their staff to volunteer to IPCs will receive a 250% tax deduction

- More than 440 new companies have come aboard for the SHARE scheme that allows businesses to donate to the Community Chest

- Dollar-for-dollar matching for the next 5 years. SHARE as One scheme will be extended until FY2021

- $190M a year to support these enhancements and encourage philanthropy and volunteerism

Fiscally Sustainable And Secure Future

- Believes Singapore has a financially sustainable and secure future with a “sound fiscal footing”

- Overall Govt expenditures is estimated to be $89.1 billion in FY2018

- Govt has sufficient resources to meet planned spending needs till 2020

- Spending needs will continue growing across all sectors. Healthcare more than doubled since 2011 from $3.9 billion to an estimated $10.2 billion in FY2018

- Average Govt healthcare subsidies received by an elderly person is more than 6x that of a young person

- By 2030, total number of elderly increase by about 450,000, to 900,000

- To build more nursing homes and eldercare

- Overall healthcare to rise from 2.2% of GDP today to almost 3% GDP over the next decade

- Within the next decade, healthcare spending is expected to overtake education

- Increase infrastructure spend to an estimated $20 billion in FY2018

- Building and upgrading flats, expanding rail and transport, and keeping public transport fares low

- Over the next 5 years, annual subsidies for all public transport operations will be comparable to the cost of pre-employment training in polytechnics and ITE

- Rail network to expand by over 100km

- Redevelop Jurong Lake District, Punggol Digital District, and Woodlands North Coast

- To build Changi T5, KL-Singapore High Speed Rail, Tuas Port – massive investments to anchor Singapore as a centre of economic development

- Invest in security, especially cybersecurity. Need to leverage on technologies to enhance response

- Sustain investments in education to give young good start

- Spending more per child to reach his/her potential – $12.8 billion for education in FY2018

- Will spend $1.7 billion per year on preschool sector by 2022, double the annual spending now

- Continue to invest in lifelong learning for Singaporeans to reskill and upskill

- Fundamental strategy is to grow and strengthen the economy; estimated overall Govt expenditure is 19.0% of GDP in FY2018 is leaner than most developed economies

- Moderation of Ministries’ budget growth; rates of block budgets to grow will be reduced from 0.4 times to 0.3 times from FY2019

- LTA has designed a 4-in-1 facility that integrates one bus and three rail depots – freed up to 44ha of land and saved costs

- JTC Corp has co-developed a robot with NTU to facilitate building inspection works, reducing manpower and time required by 50%

- Govt to save ahead in preparation for large upfront investments to reduce burden in future years

- There is now $4 billion in the Changi Airport Development Fund that was started in 2015 to save up for Changi T5

- Govt to set up a Rail Infrastructure Fund this year – start with an injection of $5 billion in FY2018, and can be topped up in future

- Govt to look at borrowing money from stat boards and Govt-owned companies which build infrastructure

- Will look at borrowing for Changi T5, KL-Singapore High Speed Rail, and JB-Singapore Rapid Transit System Link

- Govt will consider providing guarantees for some long-term borrowings for critical national infrastructure

- The reserves will be used to invest in healthcare, security, and social spending

- Responsible way is through taxation on citizens

- Should not rely on borrowing money for recurrent spending – Govt plans to raise GST from 7% to 9% sometime from 2021 to 2025

- Increase in GST will generate revenue of almost 0.7% of GDP per year

- Exact timing will depend on the state of economy, how much expenditures grow, and how buoyant existing taxes are

- Plans to implement GST hike in a progressive manner

- Govt will absorb GST on publicly-subsidised education and healthcare

- Govt will enhance the permanent GST Voucher (GSTV) scheme to provide help to lower-income households and seniors

- $2 billion top-up to the GSTV Fund this year

- Present an offset package to help Singaporeans adapt to the change

- GST on imported services will be introduced with effect from 1 Jan 2020

- For the import of goods, Govt will review international discussions, before deciding on the measure to take

- Change will ensure imported and local services have the same treatment

- Implement 10% increase across all tobacco products from today

- Overall budget surplus – increase of $7.7 billion, primarily from MAS and increase stamp duty collections from housing industry pickup

- Would use some of exceptional surplus this year to save for future spending

- Set aside $5 billion for rail infrastructure and $2 billion for premium subsidies when the Eldershield review is complete

- Will declare a one-off SG bonus, all S’poreans aged 21 above this year will receive an ‘angbao’ of $100, $200, and $300

Read the Budget speech in whole here.

Also Read: Singapore Budget 2017: A Quick Roundup Of What Startups And SMEs Need To Know