- Malaysia’s cryptocurrency guidelines determined that cryptocurrency isn’t legal tender in Malaysia, and that exchanges need to adhere to KYC rules.

- The public needs to be careful when transacting in crypto, due to its volatility, and how Bank Negara won’t be able to help in case of misconduct.

- Cryptocurrency is a nascent stage, but if it gains more commercial traction, countries might consider issuing a sovereign cryptocurrency as a safe alternative to counter the use of decentralised cryptocurrency.

After a long wait, Bank Negara finally issued a cryptocurrency guideline in Malaysia in February; it basically decrees Malaysians can trade in cryptocurrencies, as long as exchanges and individuals collect information like their full name, address, and date of birth of all customers, in addition to ID documentation.

This guideline came out after the market was left reeling from a recent crash in Bitcoin’s value.

The regulator has also concluded that cryptocurrency isn’t legal tender in Malaysia, so individuals who still choose to transact in them are encouraged to keep that in mind and conduct their own due diligence in case of robberies or losses.

Malaysia follows a global trend looking to increase transparency in cryptocurrency traders—in hopes of a clear money trail, insight on the cryptocurrency cashflow in and out of the nation, and to help circumvent issues like money laundering.

At the Malaysia Fintech Expo earlier this week, we managed to get some insight on why Malaysia has chosen to take a more permissive stance on the controversial coin.

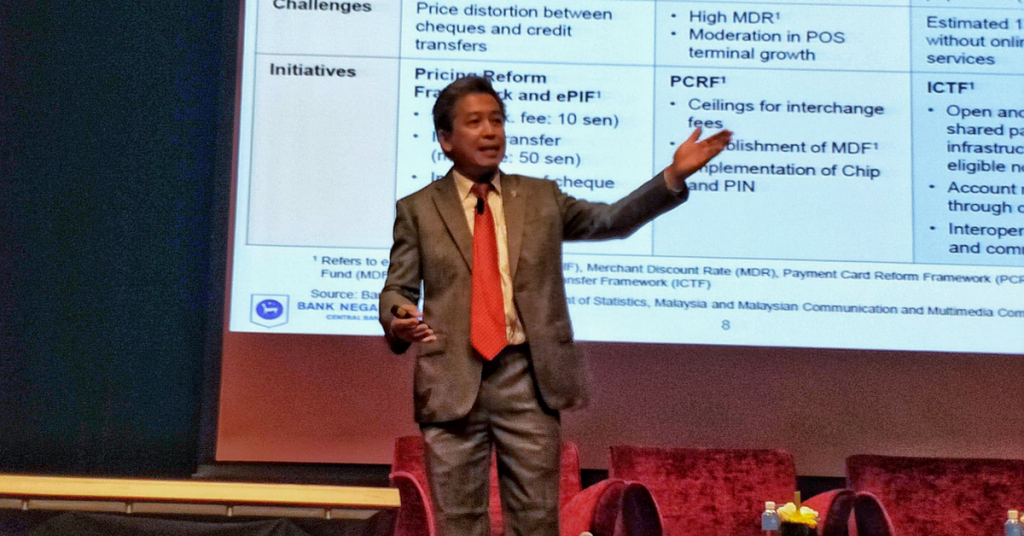

During a keynote speech by Tan Nyat Chuan, Director of the Payment Systems Policy of Bank Negara Malaysia (BNM), some among the crowd stood up to ask questions relating to cryptocurrency.

While Tan may not directly handle the crypto-regulation side of things, he does have his own personal thoughts.

There are many challenges to regulating cryptocurrency.

“The world, in general, has seen volatile movements in cryptocurrency,” said Tan. “We’ve also seen a lot of sad cases where these cryptocurrencies have been stolen in less robust environments and people suffer losses.”

“And when we look at cryptocurrency itself, it is so decentralised that you really can’t shut it down. You can’t take action on a particular issuer as you would an e-money issuance situation.”

“If there’s a problem with [local e-money issuer] I know how to find them. But if there’s a problem with bitcoin, who do I shut down?”

Tan thinks that it’s very challenging for a central bank to be able to put in sufficient safeguards and offer the public consumer protection measures.

“The situation and the approach that Malaysia has taken is to require exchanges to comply with our KYC (Know Your Customer) requirements under the Financial Intelligence and Law Enforcement Agencies department.”

“We’ve not banned exchanges, we’ve just put in the necessary safeguards for threats against money-laundering and terrorism financing.”

How would local players move to comply with BNM’s eKYC requirements while still remaining competitive on a global scale?

According to Tan, for eKYC, Bank Negara “[doesn’t] have a certain prescribed way for you to implement it. The onus is on you to prove to us that the technology you use is robust. That your electronic means to facilitate the identification of that person is of a sufficient strength that will not be subject to abuse.”

Tan thinks that cryptocurrency is in its nascent stage in Malaysia.

“It doesn’t have the components of what we would deem as something suitable or equivalent to that of fiat currencies. Level of volatility is extreme, and in some regards, the ability to control cryptocurrency is also beyond that of the central bank.”

Central banks might lose control over monetary policy when fiat currencies are not used as commonly as cryptocurrencies. That is when central banks of the world might consider offering an alternative to the decentralised cryptocurrencies.

“I suppose if it does get to a level where it becomes more ubiquitous in the use of it, as a means of making payments, then the central banks have a big problem.”

“They will have to counter the use of cryptocurrencies that are more decentralised to those that are issued by the sovereign. And to back those sovereign cryptocurrencies with tangibles—gold, or something that is of value.”

Since so many Malaysians have jumped onto the cryptocurrency bandwagon, it is heartening that Bank Negara is not banning cryptocurrencies outright, or disallowing exchanges altogether in Malaysia.

Enforcing eKYC regulations might make cryptocurrencies lose some of their lustre, but overall this is a positive move forward. Tan’s observations tally with my own personal prediction that our distant future does lie in sovereign-backed cryptocurrencies, particularly with governments using blockchain to keep things transparent.

- You can read more about BNM’s guidelines and stance on cryptocurrencies in their official release here.