Singapore-based mobile marketplace Carousell launched today the company’s first integrated payment system on its platform called CarouPay, which aims to help its users transact safely and more securely.

Developed together with financial institutions DBS, Stripe and Visa, CarouPay lets users pay directly within the app using DBS PayLah!, credit or debit cards.

This feature will reduce reliance on third-party fund transfer platforms and users also no longer to conduct meet-ups to make cash payments.

According to Carousell, the flow of pay-ins and pay-outs is powered by Stripe Connect, Stripe’s solution for multi-sided marketplaces and platforms.

CarouPay is currently available for Carousell users in Singapore on both iOS and Android mobile devices. The desktop version will only be rolled out next month.

Buyers Can Transact With A Greater Peace Of Mind

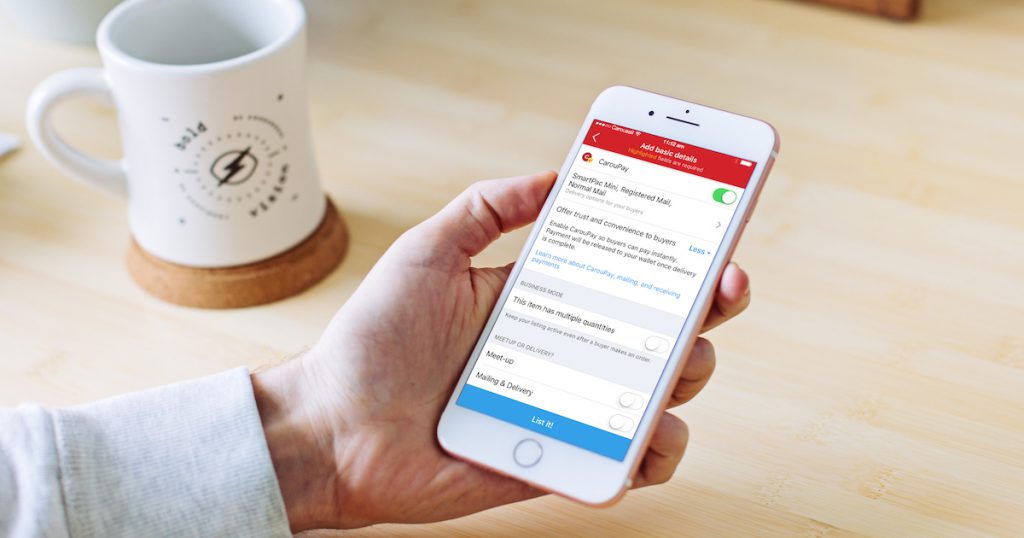

Sellers can enable CarouPay as a payment option when listing their items, reaching more buyers who prefer to transact online.

When a buyer makes a purchase via CarouPay, Carousell holds the payment and first verifies the transaction before cashing out to sellers. This gives assurance to both seller and buyer in case of dispute.

Once verified, sellers will be able to receive their payments from Carousell directly into their bank accounts, or immediately on their Visa debit cards using Stripe’s Instant Payouts feature.

As an additional layer of protection, users who do not receive their item as described, or do not receive their tracked mail can raise an issue with the seller, or escalate it to the Carousell administrators.

Funds will be held by Carousell until a resolution is met.

For orders fulfilled via SingPost’s SmartPacs and registered mail, a live delivery status will also be available and updated in-app on Carousell so both parties can track where the item is.

…But You Have To Pay A Fee For A Successful Transaction

“With the support of our industry-leading payment and tech partners, we are offering a long-awaited feature to improve our users’ buying and selling experience, making it easier and safer to make a purchase for those who can’t find time to meet up,” said Jia Jih Chai, Senior Vice President, Business Division, Carousell.

“Everyone has unused or underused items that can benefit others. Carousell was built to allow people to ‘snap, list, sell’ these items easily. With the help from our partners, CarouPay allows the Carousell community to sell their underused items even faster and safer with cashless convenience.”

So far, over 70,000 listings have been enabled with CarouPay.

If CarouPay is successful, it will become an additional source of revenue for the firm as it takes a nominal fee of 4.98% + S$0.50 (US$0.37) for all successful transactions.

It is still unknown whether the buyer or seller will bear this transaction charge.

But while this feature is indeed convenient for buyers, these charges might hinder users from adopting this payment method and they might end up sticking to the traditional options of bank transfer or meet-ups instead.

In line with this launch, Carousell users can enjoy greater savings when using CarouPay with this promo code: use “TAKE5LAH” to receive a $5 discount off to receive a $5 discount on your first CarouPay purchase via DBS PayLah! when you spend a minimum of $20 by July 19.

For DBS and POSB cardholders and DBS PayLah! users, payment fees will be waived.

Featured Image Credit: Carousell

Also Read: Carousell Users Can Soon Make In-App Payments Thanks To DBS-Backed Mobile Wallet CarouPay