[UPDATE] 15 August, 2pm:

Following the announcement of PayNow Corporate in June this year, this service finally went ‘live’ yesterday.

With this service, companies can pay and receive money in Singapore currency instantly from customers and other firms.

Consumers also enjoy greater convenience when they shop and pay — they can make purchases at retail shops and F&B outlets by scanning a QR code on their phones, or entering the establishment’s unique entity number to make a transfer.

In addition, this service gives them the option of hassle-free transactions when paying taxes, hospital fees and phone bills, et cetera.

Currently, this service is only available to businesses and corporate customers of seven participating banks, namely Citibank, DBS/POSB, HSBC, Maybank, OCBC, Standard Chartered Bank and UOB.

Two more banks — Bank of China, and the Industrial and Commercial Bank of China — will also come onboard to offer PayNow soon, according to the Association of Banks in Singapore (ABS).

In its media release, DBS said that it expects about 50,000 SMEs to register for this service by the end of 2019.

—

Companies and government agencies will soon be able to use funds transfer service PayNow, thanks to PayNow Corporate which will be rolled out on August 13 at 8am.

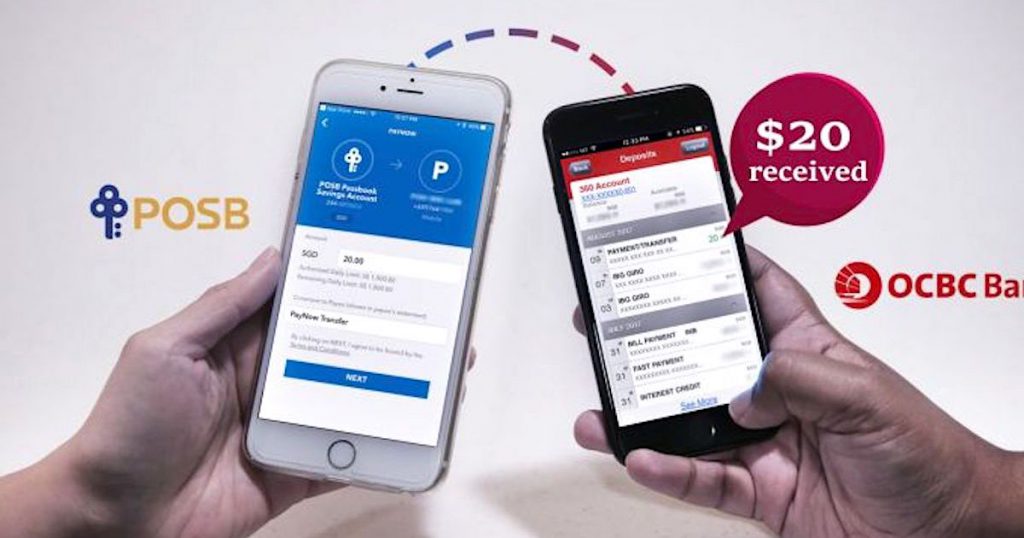

PayNow Corporate is basically an extension of the existing PayNow service – catered to businesses and government agencies who are the corporate customers of Citibank, DBS Bank/POSB, HSBC, Maybank, OCBC Bank, Standard Chartered Bank and United Overseas Bank – to conduct funds transfer “instantaneously” via their bank’s mobile app.

These seven participating banks will release a mobile app for its corporate customers on the same day so that it is more convenient for companies to make fund transfers via PayNow.

However, it is still unclear how much they will charge their corporate customers to utilise this new service.

How It Works

Organisations which sign up for PayNow Corporate will have their Unique Entity Number linked to their Singapore bank account.

This will let them receive payments without having to disclose details like the actual account numbers, which is especially useful for one-off payments like insurance claims and casual labour wages.

A QR code will also be generated for both individual and corporate users of PayNow when the new service rolls out.

Customers can scan the merchant or individual Quick Response (QR) codes to make transfers as PayNow Corporate will be included in the Singapore QR code system.

Additionally, businesses and organisations can also make mass disbursement to individuals through their mobile phone or identification numbers.

“There are various possible applications, such as salary crediting, insurance payouts, or giving out awards,” said Education Minister and Monetary Authority of Singapore board member Ong Ye Kung.

Earlier this year, the Ministry of Education actually disbursed Edusave Award funds to students via PayNow.

Ultimately, this new service helps to simplify bank transactions because it “takes away the need to know the bank account number,” said Association of Banks in Singapore (ABS) director Ong-Ang Ai Boon.

Reducing Cheques

In addition, this new service also helps to reduce the number of cheques companies have to collect, alleviating the hours spent on tallying cheques and cash payments against bank statements.

This is in line with the government’s vision to make Singapore cheque-free by 2025.

Kelvin Ngian, general manager of Siam Coconut, told Channel NewsAsia that with the roll-out of PayNow Corporate, they no longer have to spend on getting a merchant terminal for pop-up events.

Using the new PayNow system will enable them to collect cash much easier. Moreover, “cash is always hard to handle”, he added.

Featured Image Credit: Ministry of Communications and Information