Just last month, DBS Bank revealed its new tagline, “Live more, Bank less”.

By embedding banking in customers’ financial journey, they have launched consumer-focused products like “NAV – Your Financial GPS“, a digital financial advisor conveniently available in customers’ DBS/POSB iBanking and digibank apps.

More than just a log for expenses, the app also lets customers set budgets and goals – something that we found particularly useful for millennials working towards various life goals.

Over the past year, DBS also partnered with VICOM and Alpine Group to launch a car marketplace in Aug 2017; and Keppel Electric to launch an electricity marketplace in Mar 2018 in a bid to make browsing and financing for these items even more seamless.

DBS has officially launched yet another marketplace, this time, focused on something that I’m pretty sure most (if not all) Singaporeans have fretted over – property.

Southeast Asia’s Largest Bank-Led Property Marketplace

On Tuesday (24 Jul), DBS announced the launch of the DBS Property Marketplace, said to be Southeast Asia’s largest bank-led property marketplace.

DBS partnered with property listing platforms EdgeProp and Averspace to provide around 100,000 listings on the platform, and listings from SoReal will be included soon.

With the launch, DBS has effectively become the first bank in the region to launch an online property marketplace that offers listings from both agents and owners.

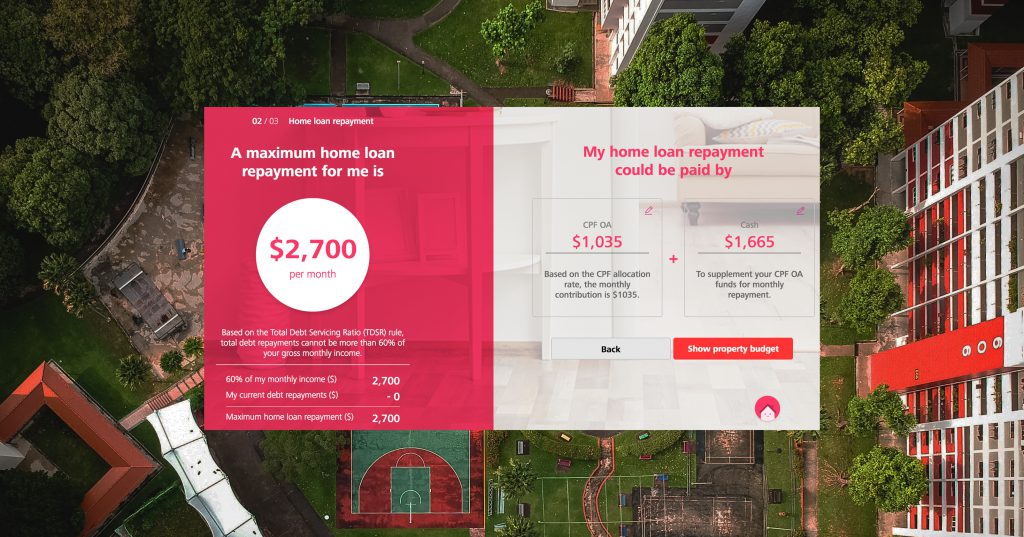

More than just a platform for listings, the marketplace also includes a “first home financial planner” that helps first-time home buyers determine their “affordability price range” based on their monthly cashflow, calculated from both their CPF and cash deposits.

The home marketplace will also be able to facilitate end-to-end paperless transactions, from cheque-free payments to digital documentation.

After making the purchase, the marketplace also aims to “provide all the essential services buyers need to settle into their new homes by partnering with service providers, including utilities; digital home solutions such as internet and TV services; renovation; cleaning and moving services”.

Currently, resale and new condos and landed properties make up 70% of the listings, while resale HDB flats make up the remaining 30%.

Said Jeremy Soo, Head of DBS Consumer Banking Group (Singapore), “While it is still early days, we believe this represents a paradigm shift for financial services in the future.”

“As the largest bank in Singapore for both consumers and SMEs, we can effectively work in each sector’s ecosystem to partner SMEs and build data-driven customer research and benchmarking tools. This allows us to provide one-stop solutions that effectively anticipate our customers’ needs across their purchase journey.”

Added Bernard Tong, CEO of EdgeProp, “EdgeProp’s goal is to help property seekers make informed property decisions by making information as widely accessible and as transparent as possible. We believe that great content, whether it is research, news, property listings or data, is meant to be shared.”

“Our ground-breaking partnership with DBS offers a new opportunity to collaborate with one of Singapore’s major institutions with similar values to ours in uplifting Singaporeans’ knowledge of property as a major asset class and creating shared value amongst all our business partners.”

Currently, the marketplace is more catered to first-time home buyers, but “other tools for upgraders, investors, and ‘silver-haired’ property buyers will be progressively available by end 2019”.

OCBC Bank Is Also Targeting The Property Market

DBS isn’t the first bank in Singapore to venture into the property market, though.

In January, OCBC Bank launched the OCBC OneAdvisor, an online advisory service that gives users access to property listings, policy details, rules and regulations, and also comprehensive affordability advice.

The OneAdvisor is said to have more than 135,000 property listings, and lets users compute their “maximum affordability […] including down-payment, stamp duty, minimum cash payment as well as legal and agent fees”.

Interestingly enough, the OneAdvisor also uses listings from EdgeProp.

Upcoming features of the OneAdvisor include home-related products and services (renovation, Home Insurance), and letting home buyers get better acquainted with OCBC’s Mortgage Specialists without the need to head down to an OCBC branch.

Services like the application for a renovation loan will also be added.

Which bank’s property platform are you using, or are planning to use? Let us know!

Featured Image Credit: Christian Chen on Unsplash