- StashAway, the intelligent management wealth platform that is designed to build and protect wealth has just made their services officially available in Malaysia.

- StashAway is rolling out their platform in batches to over 5000 people who have registered on the waitlist and customers will receive an email when they are “next in line”.

StashAway, the robo-advisor that we previously covered, has just made their services officially available in Malaysia. As one of the lucky 5,000 people who joined their waitlist, I was able to start investing on the platform. Fret not for those who missed out, StashAway will be rolling out to the public by early November.

For those who are not aware of StashAway, it’s an intelligent, data-driven asset allocation investment strategy that has no minimum balance, no sales charge and users will only be charged management fees of around 0.2% to 0.8%.

StashAway is the first company in Malaysia to be awarded a Capital Market Services License and carry out fund management activities as set out by the Digital Investment License framework. StashAway will serve both retail and accredited investors.

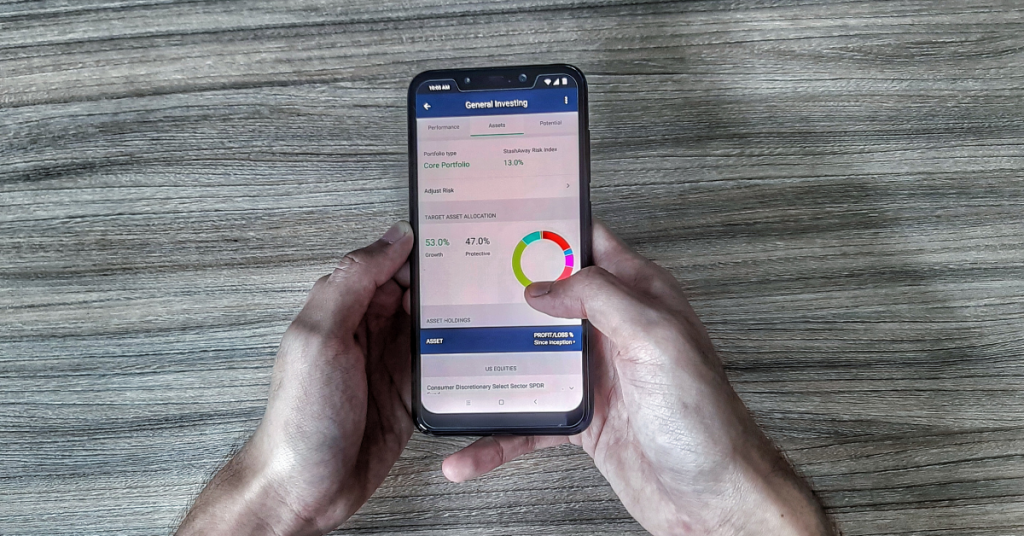

StashAway personalises financial advice and portfolio management with its propriety investment framework, ERAA (Economic Regime-based Asset Allocation). ERAA combines a risk management strategy with a macroeconomic data-driven asset allocation strategy. StashAway does not invest in single securities (e.g stocks), but rather focuses on indices (e.g. ETFs) that track the entire market.

Dictionary Time: An ETF, or an exchange-traded fund, is an index-tracking investment vehicle listed on a major exchange. Indices are composed of asset classes, such as stocks or bonds, in a particular segment of the market, such as technology, energy, or real estate.

With risk management at the very heart of the investment strategy, ERAA is designed to navigate the ups and downs of economic cycles. In-depth back-testing indicates that ERAA would have outperformed in risk-adjusted terms during the 2008 Financial Crisis.

Getting Ready To Invest

On Malaysia’s readiness for a robo-advisor available to investors of all net worths, StashAway Malaysia Country Manager, Wong Wai Ken shared, “We’ve seen what’s been happening in the investment space in countries around the world, and by now, we expect these low-cost, convenient, transparent, and sophisticated investment options to be available to us.”

“Over-priced, inconvenient and one-size-fits-all Unit Trusts and Investment Linked Policies don’t cut it anymore. Malaysia’s population is growing and life expectancy is increasing; we need investment solutions that enable us to manage our growing wealth better,” he added.

The co-founder and Group CEO, Michele Ferrario also mentioned that 43% of gross financial assets in Malaysia are in bank deposits.

“It’s clear that current investment options aren’t doing their jobs of enabling Malaysians to build their long-term wealth through intelligent investing. This huge amount of wealth sitting in cash proves that the financial services industry has failed thus far to equip Malaysians with the right investment tools,” said Michele.

Trying It Out

As one of the lucky few who had early access, I wanted to have a go at letting a robo-advisor help me to invest. Personally I believe that A.I. is the way to go, for investing at least. StashAway is both available on the web and on iOS and Android smartphones.

Disclaimer: I have no experience in finance or anything to do with investing, so I’m still learning. Furthermore, this is my first real investment.

Firstly, I was shown an introductory video of what StashAway is and then I was taken through the steps of registration on the platform. I was then presented the choice of choosing to invest for a goal or just for general investment.

I chose the general investment section as I’m not currently targeting anything yet. I was then shown two choices of portfolios; one is a balanced portfolio growth which are designed and managed to provide reliable, long-term wealth.

The other portfolio that is available has a little more risk and is geared towards growth-focused portfolios aimed at achieving higher returns. There are likely to be more short-term ups and downs in these portfolios than the standard ones.

After choosing the balanced portfolio, I was then shown an example of how much returns I could be getting if I invested a certain amount. You can adjust the initial deposit and monthly deposit amount to test it out.

After answering some questions about myself and my finances, I was then brought to the real investing part where I had to choose my deposit amount and monthly deposits. Do take your time to think about it as this is real money we’re talking about. You can change your monthly deposit amounts anytime.

I had chosen an initial deposit amount of RM500 and a monthly RM100 planned transfer. From the prediction, it states that if I continue with the set amount, I’ll probably be getting around an estimation of RM152,661 at the year 2048 (do note it’s not a guaranteed amount).

By then I would have invested RM36,500 (including my one-time deposit)—that is if I don’t increase or decrease my monthly deposits. So I can say figuratively that StashAway might be able to quadruple my investments in 30 years time. I’m not too sure if it’s good or bad, but it’s better than just sitting in my bank account.

After choosing my plan, I then proceeded to pay the set amount and set up the monthly installments. I had to wait around one business day or two for it to show up in my profile, and then they will start investing.

For someone who has no knowledge of investments, I can say that the process was simple enough and you’re not bombarded with technical terms. Personally, I think StashAway is a great platform for people who are new to investments and can’t be bothered to learn about it, because it’s better than letting your cash sit in the bank.

I might increase my investments in StashAway over time depending on how well it does, I’ll write an update piece in maybe a few months or so to let you guys know the progress of my investment.

Please do remember that investing always comes with a risk. Remember that many seasoned investors pass out this piece of advice, “Only invest money you can afford to lose”.

- If you would like to know more about StashAway and sign up on the waitlist, click here.

- You can also download the StashAway app on both iOS and Android.