Following good news for Singaporeans, the $1.1 billion Bicentennial Bonus handout, Mr Heng announced that the Government will introduce a 50% personal income tax rebate for FY2019, subject to a cap of $200.

The cap is set at $200 so that middle-income earners will stand to benefit more.

Personal income tax in Singapore for taxpayers is progressive, so that means the more you earn, the more tax you have to pay.

Those with an annual income under $22,000 won’t need to pay taxes.

Last year, the speech addressed the enhancement and extension of the Corporate Income Tax (CIT) rebate to YA2019 which would cost the Government $475 million in two years.

For the YA2018, CIT rebate was raised to 40% of tax payable, capped at $15,000. For the YA2019, CIT rebate is at a rate of 20% of tax payable, capped at $10,000.

The CIT rebates should benefit all tax-paying companies, especially smaller ones, according to last year’s budget.

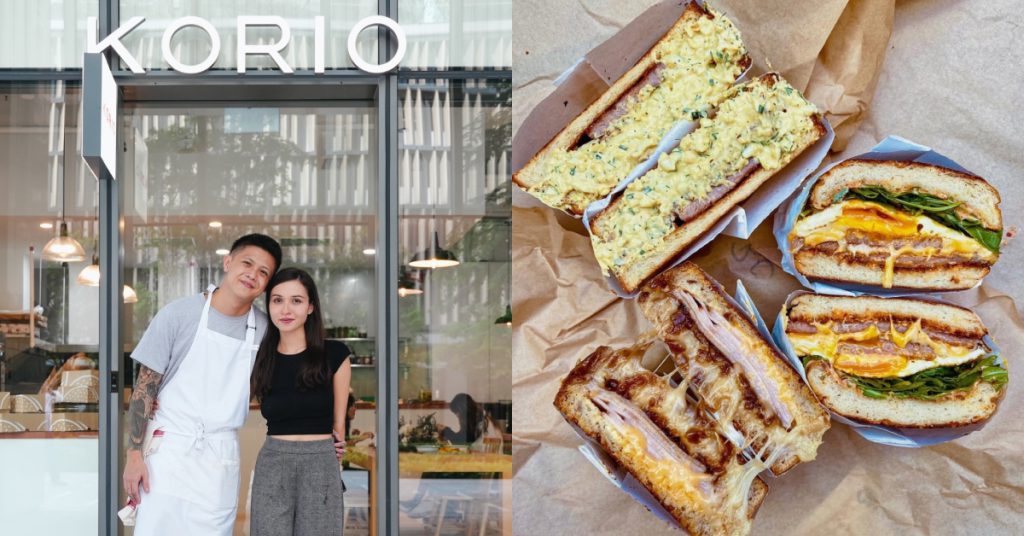

Featured Image Credit: Contemporary Nomad