Homegrown fintech startup, Rely, announced its partnership with ecommerce platform Qoo10 that allows shoppers to pay for their online purchases in instalments.

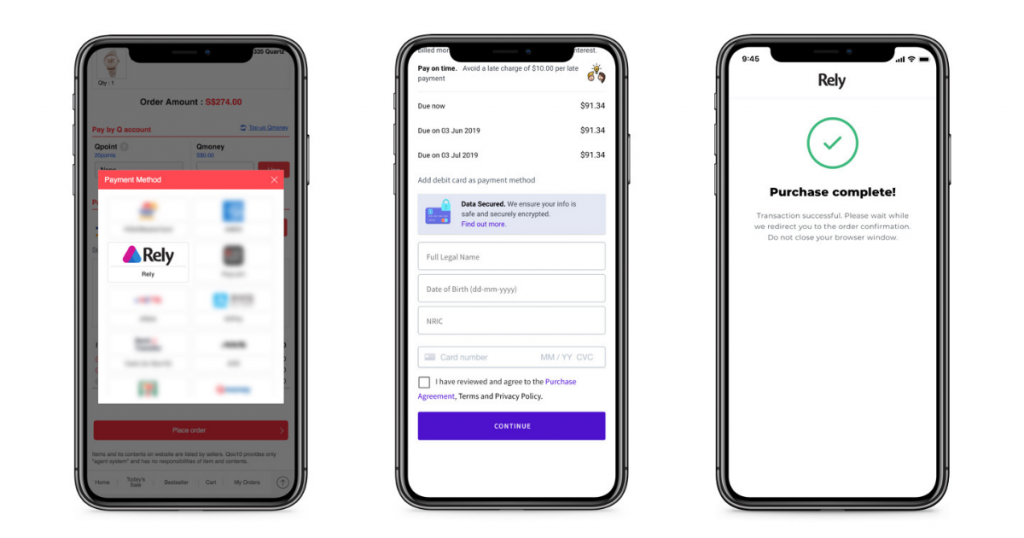

Dubbed as a ‘Buy Now Pay Later’ service, Qoo10 shoppers who check out with Rely by linking their Visa or Mastercard debit or credit card to their account will have their purchases split into three equal monthly payments.

The service is effective immediately and initial payment is collected at checkout while the remaining sum is collected over the next two months.

On top of that, to mark the partnership, the first 500 Qoo10 shoppers who choose to use the ‘Buy Now Pay Later’ service at checkout are entitled to a $10 coupon that can be used with a minimum spending of $25.

Qoo10 will be rolling out more coupons over the month of May for users who check out with Rely.

The service, targeted to suit the needs and lifestyle of younger shoppers in Singapore, comes as the companies noticed that “millennials are set to dominate the consumer markets”.

Millennials are also identified to be one of the “major driving forces for growth” in the Southeast Asian ecommerce industry that’s set to exceed US$100 billion over the next few years.

The fintech firm is looking to partner with fashion and beauty retailers to expand its ‘Buy Now Pay Later’ service.

Rely was a solution that came about in 2017 when co-founder and CEO Hizam Ismail was working on his startup, Onelyst, an online portal that lets people compare and apply for loans from different licensed moneylenders.

As described by the statement, Rely uses its proprietary decision engine that’s powered by artificial intelligence and machine learning, to help determine shoppers’ repayment capabilities for each transaction.

The technology can also determine spending limits for each consumer to foster responsible spending habits.

There are also safeguards in place to ensure shoppers repay on time and further purchases cannot be made if payments are not made on time.

Rely’s ‘Buy Now Pay Later’ service is similar to Grab Financial’s ‘Pay Later’ feature that was rolled out in March this year.

One of the ‘Pay Later’ functions is an instalment plan that lets GrabPay users make purchases first and then repay over two to 12 months at 0% interest.

When the feature is available, online and offline merchants on GrabPay can offer it to their patrons.

However, it’s worth noting that both payment options are targeted at different demographics, as Rely works well on a community level, while Grab’s Pay Later wants to be accessible to everyone.

Featured Image Credit: Rely Singapore