Last Friday (28 Jun), Senior Minister and Monetary Authority of Singapore (MAS) Chairman Tharman Shanmugaratnam announced at the 46th annual dinner of The Association of Banks in Singapore that it will now let non-bank fintech firms set up and operate digital-only banks.

This announcement comes after “a few months of studying its viability”.

Just like digital-only telcos we’re familiar with (like Circles.Life and the newest Grid Mobile) these digital-only banks will fulfill all their transactions and banking-related services online without any physical branches.

The MAS will be issuing up to five new digital bank licenses, and out of the five, two of them will allow licensees to serve retail customers through a wide range of financial services.

These firms will also be able to take deposits from customers.

However, only companies headquartered in Singapore and managed by Singaporeans can apply for these ‘digital full bank licenses’.

Foreign firms interested in a license will only be able to apply if they partner a local firm to set up a joint venture.

The remaining three licenses will be set aside for digital wholesale bank licences, which will enable licensees to serve SMEs and other non-retail segments.

This digital bank license will be introduced as a pilot, and MAS will observe to see if it’s feasible to offer more of them in the future.

Firms can begin applying “as soon as” August, with more details on eligibility and admission criteria to be provided later.

Razer, Singtel, Grab Express Their Interest

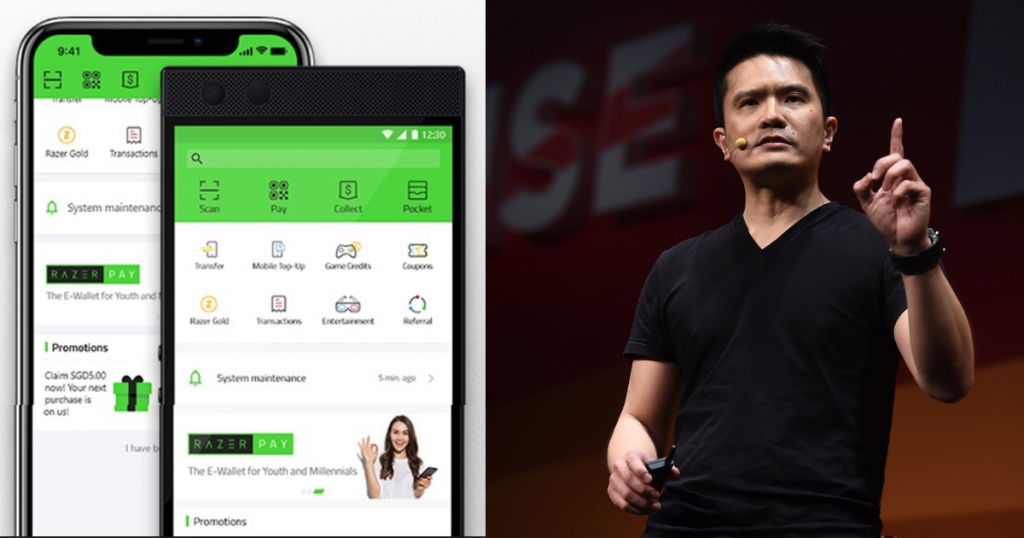

Following the announcement, Razer has applauded MAS “for being so forward-looking in liberalising the Singapore banking industry” and also expressed their interest in applying for a license.

Said Limeng Lee, Chief Strategy Officer at Razer: “This announcement is timely as Razer has been growing our fintech business rapidly in the SE Asia region. We already process billions of dollars in digital payments and our Razer Pay e-wallet is already one of the largest in Malaysia with the Singapore app coming soon.”

Just last week, Razer announced a new partnership with Visa which will see the firms working together to develop a virtual Visa prepaid solution via a ‘mini-app’ which will be embedded in the Razer Pay e-wallet.

With the partnership, Razer Pay users will be able to make payments at 54 million merchants worldwide that accept Visa.

“Our Singapore headquarters has the largest headcount of our 18 global offices. We will definitely consider applying for the digital bank license and are keen to help spur innovation in Singapore’s financial sector,” added Lee.

Another party that we might see applying for the license is (unsurprisingly) Grab, which has also been on a fundraising streak recently.

A few days back, the ride-hailing giant announced that it had received an additional investment of US$300 million from Invesco Ltd., effectively putting it on track to meet its aim to raise US$6.5 billion in funding between June 2018 and the end of this year.

On the new digital bank license, Mr Reuben Lai, senior managing director of Grab Financial Group said: “We will study the digibank licensing requirements closely, and are keeping an open mind as we assess how best to pursue this, including whether to work with suitable partners.”

According to an article on The Straits Times, a spokesperson from Singtel also revealed that they “are open to exploring the feasibility of such an opportunity and will be reviewing the licensing conditions”.

It is uncertain if more firms will soon come forward to express their interest, but watch this space for updates.