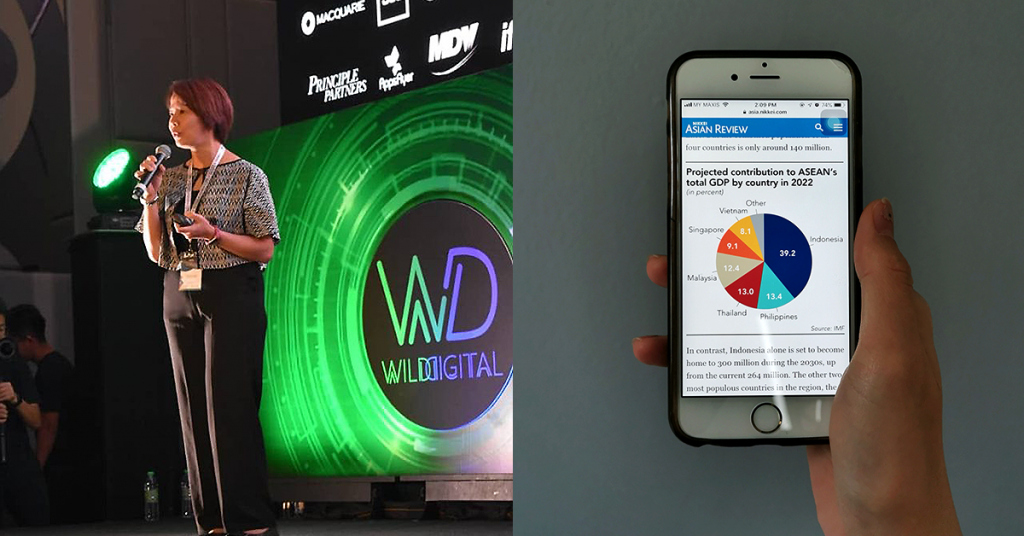

Last week, Carmen Yuen stood on the stage of Wild Digital SEA 2019 and shared her insights as a partner under Vertex Ventures.

In her information-packed speech, she talked about what target group of people businesses should be focusing their efforts on.

“Our GDP dipping below 5% is not an indication of gloomy days ahead,” Carmen reassured us.

She advised us to take stock of ASEAN as a region and explore the strengths we have and the potential waiting to be discovered.

ASEAN is its own goldmine

“We are the sixth largest economy in the world and we are likely to overtake some of the larger economies in the world over the next 10 years or so,” she said.

She then displayed a slide showing a McKinsey study on the purchasing power of ASEAN consumer households.

“When we have better purchasing power, we have aspirations.”

According to Carmen, these aspirations are geared towards education and the pursuit of knowledge, lifestyle choices like travel and better healthcare, and finding opportunities that will make us more employable.

“ASEAN is the third most populous region in the world,” Carmen shared, “We have an extremely young population.”

Over 50% of us are under 30 years old and we have a fertility rate of 2.3 which is higher than that of China’s.

“Within the next 5 years, ASEAN will still have more babies than China and parents do not spare monies when it comes to spending on their children, so therein lies opportunities,” Carmen pointed out.

“We have Indonesia, Malaysia, Thailand and Phillippines, 4 big countries with 4 big populations where people are spending more than 4 hours a day on their internet devices thereby making these countries the top 10 most technically or most digitally-involved countries in the world.”

“And there you go, another opportunity where we can reach people via social media,” she supplied.

Understanding Millennial Culture

With millennials making up a huge demographic of ASEAN, we need to look at some of their characteristics to better understand their lifestyle decisions.

Carmen pointed out that millennials are unable to survive without internet connectivity nowadays.

They are also spenders who live for the now, for the experiences and for causes that speak to them.

“They are willing to spend to support these causes. They don’t really believe in savings, at least not yet,” Carmen commented.

So, what do they spend on?

They spend on entertainment, fashion and gadgets, according to Carmen.

“Next, they depend a lot on what other people say. They feel strongly for influencers who share the same perspectives, value and truths as them. Influencers speak more to them than brands or celebrities do.”

“Transparency is also of great importance to this group of people who are strong spenders potentially.”

“So, when we look at opportunities, we should bear in mind these characteristics.”

Fear = Opportunity

“Next, we look at companies that support organisations that provide goods and services to our millennials and to us,” Carmen continued.

“Who are the partners who will support your companies going forward?” she posed the question.

“We know fears spell opportunities. We have many SMEs that form the backbone of our economies. They hire many people but yet there are things that keep us or CEOs of SMEs awake at night.”

“In this digital journey, what are some of the key things that worry them?”

Worries can also be translated into opportunities, Carmen shared.

In PwC’s Annual Global CEO Survey, CEOs on a global level were asked about some of their biggest worries or fears pertaining to their businesses.

The top 3 answers were trade conflicts, protectionism, and availability of talent.

Carmen said that SMEs in ASEAN reported similar worries with the addition of digitalisation, financing and the issue of collecting monies as cash flow is key.

“When we’re able to better manage cash flow, we can see a 4x bump-up in terms of revenue,” she stated.

A separate survey of CEOs on internal issues that they worry about brought about answers of talent and succession planning along with business model innovation.

“What are some of the business models that corporates should consider and where do you then categorise business models?” Carmen asked.

Sectors Of Interest

Look at it from visible aspects, she said. Lifestyle, food, mobility and co-living.

The pursuit of knowledge is only natural. All of us desire to have more knowledge. It’s the path of progress.

“Popular used to be a household brand for those of us in this region, where they were known for one thing only: accessing books.”

“They had so many of us through 2 to 3 generations of people who were consumers,” Carmen said.

But they failed to exploit our data and failed to have insights on their consumer base and thus have been de-listed from the stock markets.

“And guess who has taken over this pursuit of knowledge?” Carmen paused, then continued, “New internet players.”

One of those new internet players is VIPKid, an online teaching and educational company.

“They’re not doing anything very new, they’re merely exploiting what technology has for them by linking the latest features to children, by providing them to links to better their spoken English.”

“When Popular stopped innovating, they stepped back from the game. Will they be around for the next 10, 20 years? I’m not sure.”

She pointed out that as human beings, we’re social creatures. We need relationships to function. We have friends who we can trust and enjoy spending time with.

“Previously, my cornershop people will know what I like, how can we bring that into the digital world where millennials are having so many conversations?”

Carmen then talked about a company called The Asian Parent that has 25 million parents on its platform with a strong community of about 2 million parents who constantly check in with each other.

Parents who pose a question will get responses from other parents with suggestions.

Upon receiving responses, these parents will be keen to try the suggestions out so therefore there are high levels of trust, Carmen said.

“Now, if this conversation were to shift into doing commerce, you can imagine the potential that lies in this conversation.”

On F&B, Carmen advised, “Try not to invest into any more companies that are looking at food delivery.” Focus instead on cloud kitchen spaces and central kitchen spaces as those are where the opportunity lies, according to her.

We all know of the salted egg yolk hype; it was in everything and it remains pervasive in food you least expect it in. For example, 7-Eleven just came out with its salted egg yolk ice cream.

“But we are getting a little bit jaded and tired of salted egg yolks. What then is the next big thing that’s likely to hit the market?”

“AI Palette has discovered that there is a trend coming up and that is that there’s going to be an interest in beetroot and taro,” Carmen said.

Food automation is also slowly rising in popularity with F&B enterprises and can be another area of opportunity for investments.

“Talent is going to be scarce and the people are unlikely to want to work in hot kitchens doing the same thing over and over again.”

Carmen’s stance on co-living spaces is that Airbnb actually broke out of the norm and that everything else that came after it was kind of incremental.

“From Airbnb to co-living, it speaks again to the millennials of having short-term employment in different places and of having new discoveries.”

Mobility presents another area of investment that corporates should focus on, Carmen said.

You Know You’ve Made It When…

“Regulators start to regulate you. That’s when you know you’ve become a maverick.”

Carmen used Grab as a case study example and David versus Goliath as comparison for their situation. How did this local startup go up against established local taxi companies and emerge as a giant itself?

“They found inefficiencies,” she simply answered.

Grab found inefficiencies within local taxi operations and took it upon themselves to address them, therefore coming up with an improved business model that propelled Grab to its unicorn status.

There are definitely opportunities in this region, given that our GDP is growing, Carmen said.

“When GDP improves, that means that we have got propensity to spend. Our region is comprised primarily of young people with a very different way of consuming and a very different way of engagement, and they are prepared to spend for what they believe in.”

She then addressed SMEs and corporates, “What are some of the inefficiencies within the organisations, within the business network that seek transformation or disruption?”

“All these spell opportunities for billion-dollar cases but if worst comes to worst, continue to develop whatever you are developing, [but] just make sure you are smart enough to build a pathway on the billion-dollar companies,” Carmen imparted some final advice to the crowd.

-//-

Editor’s Update: Parts of this article have been edited after publishing, to correct or clarify certain points.

Also Read: We Spat Into A Tube 5 Weeks Ago, Here Are The Results

Featured Image Credit: Wild Digital