The number of mobile banking apps has risen over the years and more often than not, they land in a buggy mess with missing features or even worse, missing transactions and money.

In my opinion, I think one of the main reasons for the increase is due to the demand for convenience from bank users.

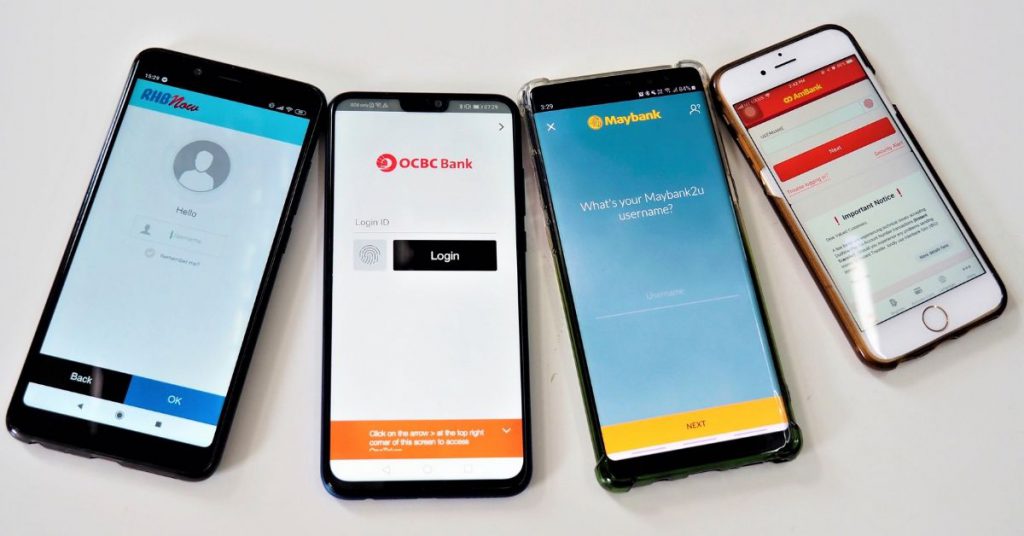

So, I’ve decided to compile a list of features that these 6 bank apps provide for your ease of banking. Maybe this could even convince you to switch banks.

These apps were reviewed based on my access to them, and they’re listed in alphabetical order. You can also see a table of features at the end of the article.

AmOnline (AmBank)

The first mobile banking app we’ll be looking at is AmBank’s. Its user interface (UI) pretty much takes its design from the website.

While it’s one of the more simple-looking ones, it gets the job done, and action tabs are clearly defined through icons and labels.

Users who have a newer phone like the HUAWEI P30 or a Samsung Galaxy S7 can enable biometric log-in, allowing them to log into the app with just face recognition or fingerprint scanning.

One major advantage this app has over the others is its ability to search for transactions by keywords, dates or amount on the app.

This came as a pleasant surprise as I’m sure we’ve all had moments where a friend insisted we had yet to pay them back when we already did. With this feature, you could easily prove them wrong.

Hong Leong Connect (Hong Leong)

The Hong Leong mobile banking app is a unique one as instead of using the traditional tabs to navigate the app, you’re presented with a chat-esque interface.

To go into certain tabs, all you have to do is type what you’re looking for. For example, if you want to access your “favourites” list, all you have to do is type in the name of the person and they’ll pop up.

Clicking on the name will then lead you to different actions that you can do with the contact.

If your phone is new enough, you can also enable logging into the app using your biometrics for a faster and hassle-free experience.

However, you’ll still need to key-in your password or PIN to perform transactions.

Maybank App (Maybank)

Maybank is one of the slickest apps on this list, if not the slickest. The menus are intuitive and you have access to most of what you need at first glance.

However, being the slickest doesn’t mean it is without disadvantages. For example, the app doesn’t allow you to see more information regarding your past transactions.

In the screenshot above, you can see a transaction of RM2.50 that was made on the 18th of July is simply titled “Sale Debit”.

It’s the same on Maybank’s desktop site as well so I guess I’ll just never know what I spent it on. (Though I do believe it was spent on an ice-cream cone.)

Maybank was one of the first banks to introduce a mobile banking app and in doing so, the bank showed that it isn’t one to shy away when it comes to trying new things.

QRPay is currently one of its newest developments, and while QR codes technically aren’t new, not many banks in Malaysia utilise the system yet.

OCBC Malaysia Mobile Banking (OCBC)

OCBC is one of the longest-running banks in Singapore as it was formed way back in 1932 and according to OCBC, they currently have over 600 branches and offices in 18 countries.

Most of the time, people use mobile banking apps for convenience but OCBC prioritises security over convenience and only allows you to transfer funds to other accounts that you have added as favourites.

This means that if you wish to pay a new recipient through the app, you’ll have to add them as “favourites” on the website before being able to do so on the app.

While a little more time-consuming, the added security is good, since it might make it harder for funds to be funnelled out through the app in the case of your phone getting lost or stolen.

OCBC also has a nifty feature on its app called “Money In$ights”. It charts your expenditure for reference and you can even check how other OCBC users spend their money.

PBengage (Public Bank)

Public Bank is currently the 3rd largest bank in Malaysia with over RM419 billion in assets and it’s been in operation since 1966.

Its app UI is one of the most old-fashioned ones among the bunch (I mean, just look at the screenshots above and try to tell me otherwise).

Unlike the other banks on the list, Public Bank only offers biometric log-in on the app by fingerprint, since they have yet to add face recognition.

It does, however, offer quick transactions, which can be performed in just a few clicks by selecting a contact from the “favourites” list.

You can also utilise DuitNow to send money to others, but it requires them to have paired their mobile number or NRIC to a bank account first.

RHB Mobile Banking (RHB)

Similar to Public Bank, RHB also allows you to log into the app with your fingerprint but doesn’t offer an option for face recognition at the moment.

A bone I have to pick with the app is with its promotional page. Most of the other apps have this hidden in a menu for you to access and check out if you want to.

The RHB app instead shows it off right at the bottom of the main menu, taking up half the screen and to make matters worse, it’s not removable.

When transferring money, it requires you to key in a recipient reference which is normal.

However, the app then also requires you to at least click on the “Optional” details before you can proceed. It’s optional, so why do I have to expend energy on an extra click?

Some closing thoughts

From the table above, AmBank’s app would be the clear cut winner simply based on the number of features it offers for mobile banking convenience.

The only feature missing when compared to a few of the other apps is a QR payment option, which is one of the fastest ways to perform a transaction.

While I do acknowledge AmBank’s win, I’m biased and would still side with Maybank because I’m more attuned to the ins and outs of its app. User experience is subjective, after all.

However, I will say that they should address the issue of users being unable to view further details of their transactions, and also consider implementing a feature similar to AmBank’s past transactions search as it’s quite useful.

All in all, it’s undeniable that banking apps have come a long way from what they were in the early days and have improved in terms of usability.

- Read more app reviews here.