Author’s Blurb: I’ve never properly budgeted for anything in my life. My way of saving is just to not spend, and I suppose I have rather good discipline over my financial habits. Even during the MCO, I haven’t been tempted to spend on wants to keep myself happy, I just indulge in free stuff like YouTube and a game I already own.

The basic advice for saving money would be to have a practical budget and track your expenses, and this would still apply whether during the MCO or not.

Many of us already know these general tips, but are still unsure on how to actually do these things. We want specific examples from people who practice these themselves, as proof that these steps actually work.

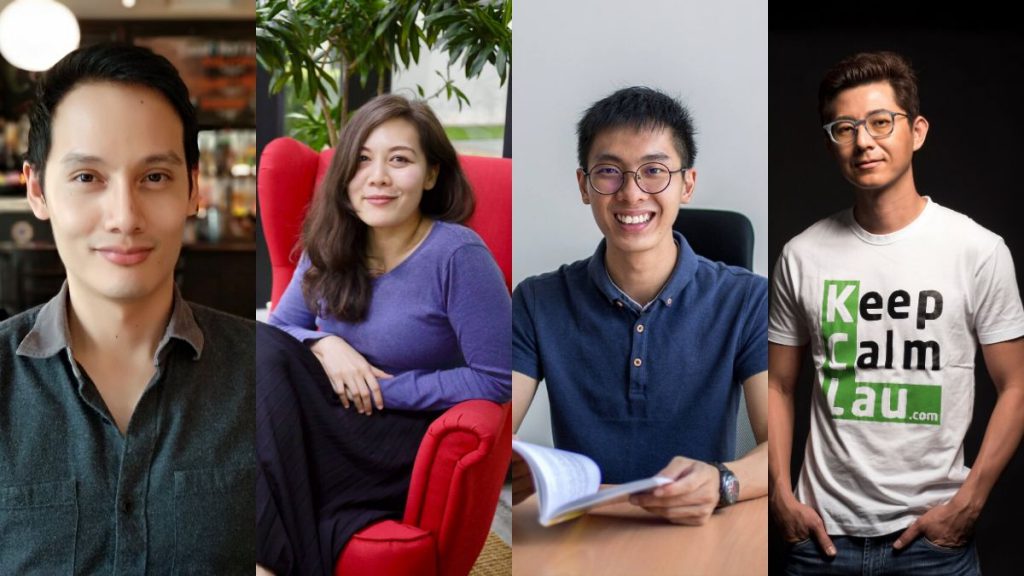

Based on the experiences of some Malaysian personal finance bloggers, here’s what we’ve gathered.

1. Examine Past Expenses

There’s no way to save money on everything, as you’d still have to spend to survive. However, KC Lau of KCLau.com gave some guidance on how you can at least identify what you can cut down on.

This is especially helpful if you’ve had your salary cut during the MCO. These are his steps:

- Examine your expenses for the past 12 months,

- Identify the items that are the top 10 most significant expenses,

- Find out the top 10 recurring costs,

- Scrutinise what’s necessary to keep this period (out of the top 10s),

- Cut down or renegotiate the recurring bills for each item.

By doing this, you get a better overview of what costs you can forego paying and which ones are integral to keep.

2. Saving Money On Necessities

There isn’t much that you can compromise on necessities without affecting your quality of life, but there are still ways to save incrementally.

One thing you can do is price comparisons of groceries and household items in physical stores and across online sites for the best deal.

Additionally, Marcus Keong told Vulcan Post, “If you found toothpaste, milk powder, or Milo on discounted sale on online shops such as Shopee, buy them in bulk since you’ll be using them often anyway.”

Sivasathish of Money Inspirations by Sivasathish advised, “It is also a good time to eliminate bad habits by quitting smoking, alcohol addiction and gambling habits.”

Other things you can do include finding cheaper alternatives for necessities (like downgrading from RON97 to RON95, or getting cheaper mobile phone and internet plans) and saving on your utilities bills by keeping the aircond off during the rainy season/cooler days, for example.

Helmi of Balkoni Hijau pitched in with recommending learning how to cook, and possibly incorporating more vegetarian dishes in your diet, as meat is one of the most expensive grocery items.

3. Set Aside Money For Your Wants

It’s completely okay to save a portion of your monthly income just for indulgences. Aaron of Mr-stingy calls this “play money”, which you can use for a cool gadget or even something as trivial as some good coffee or ice cream.

One way of setting aside money for this could be by using the 50-30-20 budget—setting aside 50% of your income for needs (rent and groceries), 30% for wants (“play money”), and 20% for savings and investments.

If you want to be even more conservative during the MCO, setting aside 5-10% for this purpose would be good enough, KC Lau shared.

4. Check Your Subscriptions

For the longest time, I remained subscribed to Spotify even though I was only using it once every few months, so I was definitely not getting my money’s worth.

“To save more money, my suggestion is to really cut on non-essential subscriptions (Netflix, Spotify),” Yi Xuan of No Money Lah advised. One can always re-subscribe when your financial status is more secure.

5. Use Promo Codes & Cashback

If you’re already buying stuff online and using online payment solutions, you should take advantage of any promo codes and cashback offered to you, Yi Xuan said.

However, this doesn’t mean that you should excessively spend just because there are promos and cashback offers. When used correctly, these could help you reduce expenses.

6. Avoid Emotional Spending

During the MCO, you may have experienced more negative moods and emotions. For some of us, coping consists of making indulgent purchases on a whim.

If this sounds like you and you’re not sure how to deal with emotional spending, here are a variety of proactive ways you can tackle this issue.

a) Make it tougher to access your money.

Aaron recommended automatically transferring any money in your bank account that doesn’t go to the “play money” pile to somewhere you can’t easily access.

“Or if you can’t control your credit card spending, pass your cards to your mother. Ask her to only let you spend if you can justify the expense,” he added.

b) Keep bank accounts unlinked to any platforms.

Suraya of Ringgit Oh Ringgit personally hasn’t linked any bank accounts to online shopping platforms and e-wallets.

“Each time I want to buy something, I have to manually key in the information. It’s mafan (troublesome), so the increase in buying friction helps to reduce (though not eliminate) my impulse buys.”

c) Get rid of notifications and newsletters.

Another thing that Suraya does is stop all app notifications (like Lazada and Shopee’s) and sign up her spam email address to receive marketing emails.

Yi Xuan also makes sure to unsubscribe from newsletters so he doesn’t get exposed to news of deals.

d) Use the 72-hour rule.

Marcus’ personal technique for buying something he wants is to note the item down and wait 72 hours. In those 72 hours, you can consider if you really need it, see if you have a similar item, or check if you can get it secondhand. If you still want it after 72 hours, get it.

Likewise, Helmi has a “Want List” tab in his personal finance spreadsheet to filter out impulse purchases, where he lets his wants marinate for at least a week. He’s learnt that he doesn’t end up buying most of these items after a few days.

e) Find other ways to release your emotions.

Take a look at your current possessions or “play with your existing toys”, as Sivasathish put it.

He’s been collecting mid-range Japanese watches for the last few years but has recently stopped to allocate the money for investments or his emergency fund.

If he gets emotional or has the urge to buy more, he will look at his current collection, touch and feel the watches and appreciate them for the reasons he bought them.

f) Use e-wallets.

Rather than link your credit card to e-commerce websites as the default payment, Helmi recommended linking an e-wallet.

“Only put in a certain amount of money (like RM200) into the e-wallet each month. If you’ve used up the month’s quota, that’s it. This is a psychological trick to add another step between you and that impulse purchase.”

g) Deliberately set up a system for bigger purchases.

For stricter control, KC Lau’s advice is to create a system like a purchase flow chart. You can personalise it, but some examples you can consider adding to it include:

- Am I going to use the item in the next 3 days? If not, forget it. If yes, then…

- Does the item cost more than RM100? If it’s less, I will buy it since I know it will not harm my finances. If it costs more, I will find alternatives to compare.

- I’ve identified which brand, model and size I want to get. Where can I get it at the lowest price? Check at least 3 other offers.

- Before making payment, check if I can get a discount, perhaps in the form of a coupon or promo code.

By fighting your impulse with a logical system, you can reduce the guilt that comes with making unnecessary purchases after the novelty wears off.

-//-

One thing Suraya shared I felt was important to add as an ending note was that we should adopt the mindset of being willing to experiment with different ways of saving money.

Most people already know what to do to save money, as the advice has been shared over and over again.

“The problem is prematurely thinking ‘Meh, that advice won’t work for me’, thus never actually giving the money-saving tip a fair trial run,” Suraya said.

“So, keep trying. You might surprise yourself by actually enjoying a specific money-saving tip that you thought you’d hate.”

What they’ve shared with us here will only increase in importance, seeing as Malaysia is still weathering an economic recession.

Editor’s Note 05/06/21: Information in this article has been updated to reflect current situations.

Bottom Line: One thing that I’d be interested to try is setting aside money for spending on things that I want. I usually hold back and dump all my money into savings, but perhaps an indulgent purchase every now and then really won’t hurt, so long as I have a system to keep myself in check.

- You can read more on what we’ve written about the MCO here.

Also Read: 5 Benefits Local Entrepreneurs Can Get From Alibaba Cloud

Featured Image Credit: Mr-stingy / Ringgit Oh Ringgit / No Money Lah / KCLau.com