OCBC Bank announced today (June 23) its partnership with seven medical groups — Singapore Medical Group, StarMed Specialist Centre, Thomson Medical, Faith Medical Group, OneCare Medical Group, Etern Medical and True Medical — to launch a new mobile app.

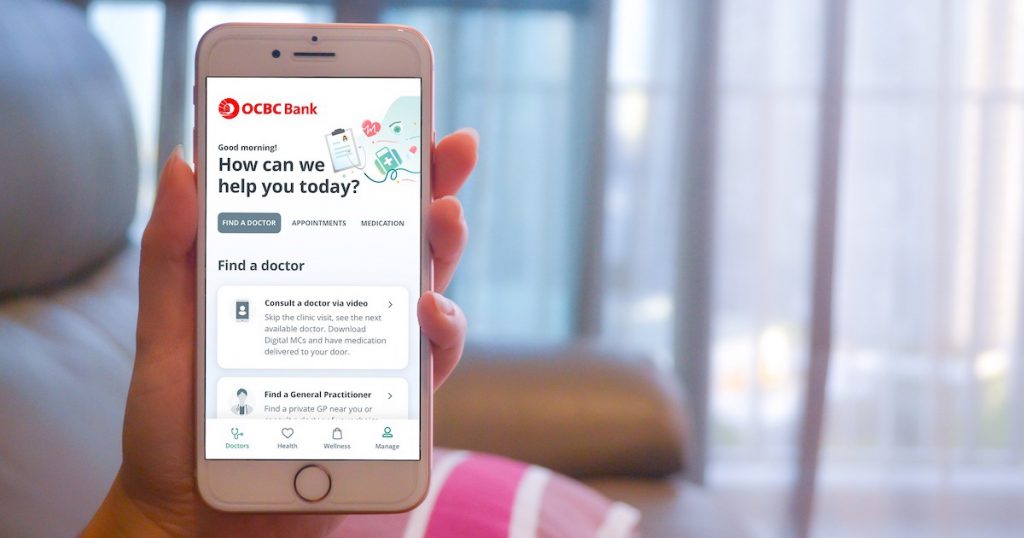

Called HealthPass by OCBC, it provides access to over 100 general practitioners (GPs) and specialists to address the healthcare needs of Singapore residents, including non-OCBC Bank customers.

Video consultations with both GPs and specialist doctors can be booked and administered through the app, with medication delivered to the patient’s doorstep.

According to OCBC, the consultation fee is kept flat at S$20 for each telehealth and in-clinic visit to a GP during normal operating hours.

Patients pay a flat fee of S$100 for the first telehealth or in-clinic consultation with any of the 63 specialist doctors from 21 specialties including gynaecology, paediatrics, cardiology, dermatology and oncology, which are among the top fields of specialist medicine Singaporeans often seek medical advice for.

These flat consultation fees especially benefit individuals or families without existing private coverage for outpatient clinic visits, and individuals with longer-term medical needs.

Meanwhile, medication and diagnostic procedures are charged separately based on current practices.

App Makes It Convenient For Patients

HealthPass by OCBC integrates directly with the healthcare partner’s clinic management systems, and information is only accessible by users and their doctors, which provides personal data privacy and security.

Patients can also access digital Medical Certificates (MC), clinic invoices and laboratory results from the clinics visited securely through the app.

This makes it convenient for patients, especially those with on-going medical needs, to easily retrieve past records for doctor consultations without the hassle of retrieving hard copies and maintaining a physical file.

The wellness shop in the HealthPass app also gives users access to more than 100 merchant offers for wellness products and services.

Users will be able to purchase preventive health services, such as health screenings, directly via the app. Other services available for purchase in the store include Traditional Chinese Medicine, dental and pain management services.

Spike In Tele-Consultations Since COVID-19

The multi-ministry taskforce has recommended individuals to continue minimising physical medical visits whenever possible.

On that note, Singapore Medical Group estimates that there has been a 60% surge in specialist tele-consults since COVID-19 began.

Consulting a doctor through telehealth safeguards individuals more susceptible to the effects of the virus, such as the elderly, those with underlying conditions and expecting mums, allowing them to seek timely medical help with relative safety.

It also helps doctors to conduct follow-up consultations with patients, especially those with chronic ailments, as they do not need to go to the clinic physically to consult the doctor or get a new prescription for their medications.

For patients that require a physical assessment, the app enables users to pre-book an appointment to visit a GP or specialist clinic. Visits by appointment enable clinics to better manage patient traffic, minimising waiting times and ensuring physical safe distancing is practiced.

“As the maxim goes, ‘health is wealth’. To complement our wealth management solutions, we are bringing various partners together to provide our customers with a solution for managing their fundamental wealth – their health,” said Pranav Seth, OCBC Bank’s Head of Digital and Innovation.

“HealthPass by OCBC is the result of bringing together key corporate customer relationships in the medical and healthcare space on one digital platform. COVID-19 will eventually pass, but its impact on the community will be long felt, and widespread access to telehealth will provide a big boost to help manage Singapore’s healthcare needs.”

He also noted that in-clinic visits are still necessary for certain medical treatments. As a result, OCBC will work on on-boarding more clinics and healthcare providers on the app to ensure at least one clinic in the proximity of everyone’s home and workplace.

Featured Image Credit: OCBC Bank