I’m still relatively new to investing, so when I was tasked to review the Everest Gold app — a gold trading platform — I felt pretty nervous.

I didn’t want to end up burning my fingers, but research has shown that gold is a great asset to invest in now.

The value of gold has an inverse relationship with the economy, with its value going up during bad times. This means that the Covid-19 pandemic is a great opportunity to make a killing.

Traditionally, banks charge high premiums for gold trading. However, Everest Gold doesn’t require any additional transaction fees, which allows you to get more bang for your buck.

This is another reason why I was inclined to give gold investment a shot and start exploring the Everest Gold app.

Signing Up Is A Breeze

The sign-up process to create a new account on Everest Gold is so easy.

It only requires my email or phone number, which is verified via a one-time password. Alternatively, I can also opt to use the biometric authentication.

As I proceeded with the sign-up process, the app served me a series of graphics detailing Everest Gold’s auditing process, license issued by the Ministry of Law (Singapore) and other proofs of credibility.

This gave me reassurance that the company was legally verified and that I can be guaranteed a safe transaction dealing on their app.

I was then prompted to provide personal information, including my personal security number. To be honest, I was a little paranoid about sharing my personal information with third-party apps so I skipped this optional step.

After doing some digging however, I found out that Everest Gold uses industry-standard encryption, which should make the provision of personal information relatively safe.

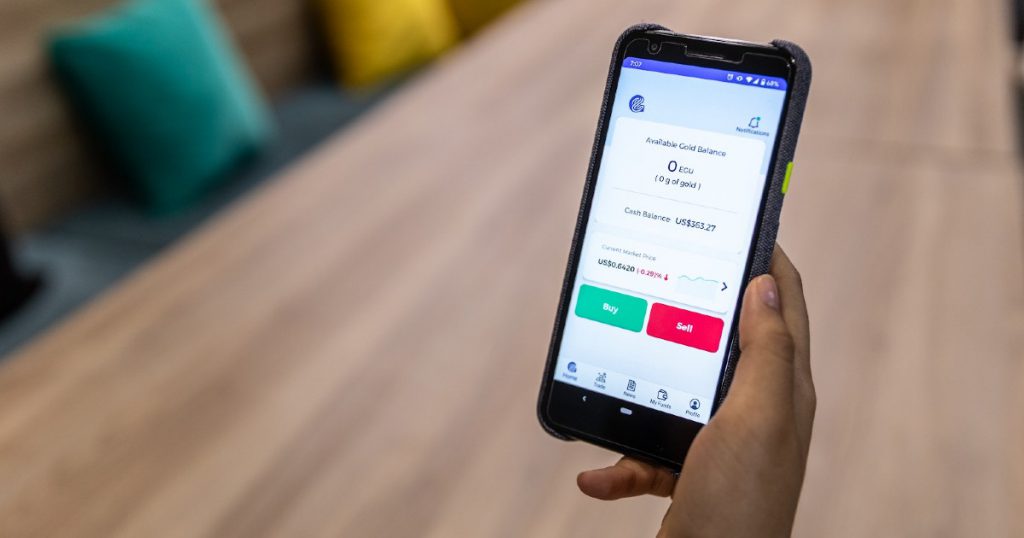

On the home screen, the Everest Gold app had several different pages for me to explore, including a trade, news, funds and profile page, where I easily linked my bank account to the app.

It took less than a day for my account to be verified after keying in my bank account information. To transfer funds from my bank into the in-app wallet, I had to do it from my Internet banking app, which required me to exit the app.

It’s not a huge gripe, but it would be better if I can perform the funds transfer in-app to make the investing process more seamless.

Intuitive Trading For Noob Investors

What’s great is that Everest Gold doesn’t have a minimum starting amount to start trading in gold. You can invest as low as S$50 into the app, or S$100 if you’re more comfortable.

For me, I chose to invest S$500 because I wanted higher returns, though it also meant higher risks.

Despite being a beginner investor, I found trading on Everest Gold to be simple and intuitive. On its home screen, a chart showing real-time market prices reflects the going rate for 0.01 grams of gold, or one Everest Gold Unit (1EGU).

There’s also a huge “buy” and “sell” button that is difficult to miss.

After clicking either “buy” or “sell”, I can select the number of EGUs or capital I want to trade. I had the option to sell aggregate percentages of my funds, but I opted to go for 100 per cent since I wanted to make returns off a low capital.

The chart turned out to be extremely useful for gauging when I ought to buy or sell my gold assets. Although gold prices fluctuate quite a bit, it doesn’t warrant a need for me to check in on the market every few minutes.

During the time that I was on the app, gold prices showed a definite upward trend, increasing from US$0.63 to US$0.64 per EGU.

You can also file a claim to collect the physical gold you’ve bought in-app — this is an upcoming feature of Everest Gold that I’m definitely looking forward to.

There’s also gold subscription events that happen every now and then, which allow you to purchase gold at spot price and earn more on the side. The sale of gold at spot price (US$0.61) in July helped me turn profit, reselling it at higher values later.

It also keeps you engaged with the app and gamifies the whole process — making trading fun, not stressful.

With my S$500 investment, I managed to earn about S$20 in just two days. This equates to an earning of about S$10 in a single day, which could easily cover two meal expenses.

This is quite a significant profit, considering that if I had left that same amount of money in my DBS Multiplier bank account, it would have taken a year to garner S$20, based on a 3.8 per cent per annum interest rate.

The Verdict: How Much Did I Earn?

Playing about with trading on Everest Gold has eventually become an activity that has settled into the background hum of my life.

Over the next two weeks of trading, I managed to make about S$7 at the end of it all, losing quite a bit of money here and there due to my own personal poor trading decisions.

For example, I bought when prices of gold were at an all-time high, thinking that they’d keep increasing despite a plateau in price for the past day. That led to me selling gold at low prices, resulting in a net loss.

Regardless, I was quite pleased with how the app performed. Suitable for first-time investors, the app allows users to trade modest sums so practically anyone can get started anytime.

Buying and selling gold also doesn’t require a whole host of brainpower and analytical know-how, just a reminder to check in on market prices every once in a while.

The low-commitment high return model is quite effective, though that depends on gold market fluctuations.

One minor drawback of the app however, is that it lacks a live chat function to help newcomers navigate the ins and outs of digital trading. Although the key mechanism — gold trade — was easy to use, the add-ons like OTC trading and reward claims remained oblique.

Additionally, I feel that more endorsements from banks and other governmental corporations would help generate greater trust among the app’s users.

Overall, Everest Gold is a great app that would benefit both first-time and more seasoned investors.

At this point, I’ve gotten so used to playing around with the app that I’ll probably leave it on my phone even after this review is over. After all, it lets my money work for me even while I sleep.

In line with this year’s National Day celebrations, Everest Gold will be giving 400,000 reward points (worth S$55) for every new-sign up upon successful account verification. Reward points can be converted to gold during Gold Subscription Events.

Enter referral code “WALQA” when you register your Everest Gold account. This promotion is valid until 31 August, and is only applicable for users residing in Singapore.

This article was written in collaboration with Everest Gold

Featured Image Credit: Vulcan Post

Also Read: Gold Rush: This S’pore Firm Launched An App That Lets You Trade Gold With A Small Budget