“Our revenue grew at an average rate of 20 per cent for the first few years, but when Covid-19 struck, it went south,” says Alan Lee, founder of homegrown gift brand Klosh.

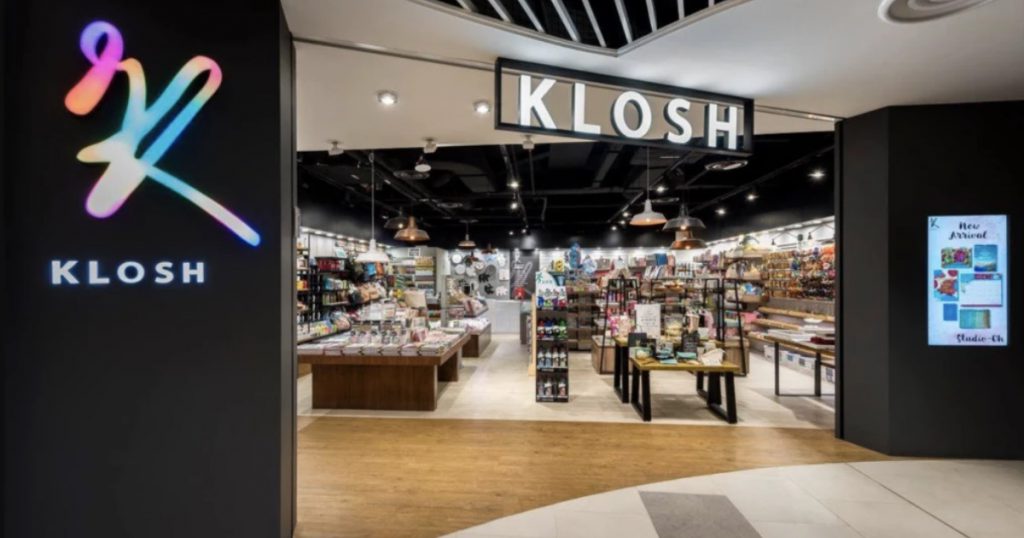

Launched in 2016, Klosh is a multi-label gift store created to provide a “total lifestyle experience.” It offers a broad range of products that give gifting an added ‘oomph’.

“My co-founder Shermaine Wee and I wanted to create a brand…where there is a story that is woven through everything that we offer.”

Klosh has a department specialising in personalised items, and sells everything from customised LED Neon lights to “handwritten” cards created by a KLOSH Robot.

The brand employs a lean team, and works with local designers to create original products.

In one of the most expensive cities in the world, Klosh was able to open six outlets in just four years.

The franchise gained traction among younger demographics, and was approached by overseas retailers with opportunities for expansion.

“(But) these countries are now in dire situations due to Covid-19 and landlords are not responsive enough in these trying times,” remarks Alan.

Retail Brands Are Biting The Dust

It’s common knowledge that retail has been in a slump — even prior to Covid-19.

International brands like Forever 21 and Barneys New York filed for bankruptcy and closed hundreds of stores, heralding fears of a “Retail Apocalypse”.

Singaporean multi-label retailer Naiise have pulled out of commitments such as the Design Orchard showcase to recoup their losses.

The brand has reportedly been late on payments to its vendors, and shut three outlets since January 2020.

Covid-19 catalysed the decline. In Singapore, retail sales, which had been declining for over 16 months hit a record-high low in May.

The drop in revenue continued well into the second phase of Singapore’s reopening.

All sectors continued to register declines in revenue in June, according to data from Singapore’s Department of Statistics.

Discretionary goods were hit the hardest, and the recreational goods sector experienced a 40.7 per cent plunge.

Integrating Retail and E-Commerce

While it seems like retail is dying, it isn’t. In fact, it is changing.

Businesses can bring wet markets onto e-commerce platforms, and even automate kopi brewing.

However, the jury’s still out on the extent to which digitisation can replace the experience of shopping in-store.

Online-based brands are creating physical stores to appeal to consumers. That includes brands like Nike and Zalora, which run-pop up stores to engage its customers and “reinvigorate” physical retail.

Businesses are learning that having both an online and offline presence is optimal. “We want KLOSH to do well in both (spaces),” says Alan.

The key is to integrate the two while providing audiences with innovative retail experiences. That includes upgrading the store, implementing technology in the form of integrated marketing channels and providing new digital payment options.

Cutting Retail Losses

Instead of a retail death, what’s happening looks more like a massive retail cutback.

The Covid-19 pandemic spelled a record-high vacancy rate of 8.0 to 9.6 per cent as tenants withdraw from major malls.

Covid-19 has made it almost compulsory for any business to have an online presence if it is to survive the retail drought. Still, it takes time for retail-based businesses to make the jump.

Currently, Klosh’s main revenue stream continues to be derived from its brick and mortar outlets.

At the same time, it’s accelerating its pivot towards omnichannel marketing strategies, through platforms such as Shopify.

Like most businesses adapting to Covid-19, Klosh has turned to e-commerce. The brand expanded its digital presence, training its employees in digital marketing strategies.

During the initial outbreak of the pandemic, sales at outlets dropped by 80 per cent and Klosh’s outlets now number just three stores. However, the brand managed to exit upon lease expiry to cut their losses.

“Covid-19 is a wake-up call to me,” says Alan. “With God’s blessing, we adapted well to the pandemic.”

Tenants Tussle With Landlords During Covid-19

“Our experiences with the landlords during this pandemic prompted me to reflect on our retail strategy of having more stores in Singapore,” remarks Alan.

Prior to Covid-19, Alan stated that he faced “ever-increasing rent” from landlords. Malls reportedly asked for rent increments of up to 40 per cent when it was time for a contract renewal.

Covid-19 didn’t incentivise landlords to drop rental prices. The Singapore Tenants United For Fairness group and Restaurant Association of Singapore were among the groups issuing their displeasure over landlords’ “foot-dragging” for rental relief in early 2020.

In February, the Singapore government issued a S$4 billion budget that gave landlords a 15 per cent property tax rebate. The hope was that the rebate would translate into lower rents for business — but that did not work out.

In April, the government later waived up to 100 per cent off property taxes for eligible properties, and a new law was passed to compel landlords to pass on the rebates to their tenants.

However, landlords dragged their feet, and social media was rife with complaints from tenants over the delay in rental relief.

A Long-Standing Battle

Observers have commented that the tussle between landlords and tenants aren’t specific to a Covid-19 economy.

The asymmetrical power dynamics have long been in the making. Inherently, landlords tend to hold more power over tenants. Practices like Real Estate Investment Trusts (REITS) incentivise landlords to focus on rental extraction rather than tenant welfare.

“Aggressive rent-seeking behaviour” is understandable in malls that invest heavily into the maintenance and upgrade of their properties. But the behaviour has been picked up by other landlords.

Retailers pay exorbitant sums under popular Gross Turnover Rent models, which extract a percentage of store sales.

This went up to S$36,000 in rent, for a store along Orchard Road. Over one-fifth of the commentator’s total sales went to his landlord in 2018, up from 15 per cent in 2015.

The overall power imbalance between landlords and tenants extends to everything from the terms and conditions in contract, to asymmetrical access to information over mall profits relative to tenant rents, according to a CNA article.

Rallying against their landlords, the newly-formed Fair Tenancy Framework Industry Committee (FTFIC) published a 64-page paper to the government on 21 May, laying out 15 recommendations for fair tenancy laws.

In late June, the Rental Relief Framework was set up to provide SMEs with assistance. Eligible SMEs can receive up to four months’ waiver of base rent for qualifying commercial properties.

What’s The Plight Of Retail?

Digitising tends to be used as a blanket statement, touted as the answer to retail woes in a pandemic-stricken economy.

But the answer isn’t so clear-cut.

If retail remains critical to businesses, it’s not feasible to suggest wholesale adoption of ‘digitisation’ as a salve for all our troubles.

“In my opinion, it is still important to upkeep a brick and mortar retail presence,” says Alan.

“(But) I believe when the dust settles, the retail landscape will change drastically and irreversibly, customer behaviour will alter and there will a whole new world. I am preparing myself for that.”

Featured Image Credit: Klosh