Funding Societies and Razer Fintech announced today (29 September) a partnership to offer short-term business financing to merchants under Razer Merchant Services (RMS), Razer’s B2B platform.

The first beneficiaries will be Malaysian micro, small and medium enterprises (MSMEs), including retailers, F&B vendors and online sellers.

More than 20,000 of these MSMEs will be connected to the Funding Societies’ financing solutions via RMS.

According to a joint media statement, MSMEs have been the most undeserved but hardest hit by the pandemic and short-term business financing is expected to propel growth for these businesses.

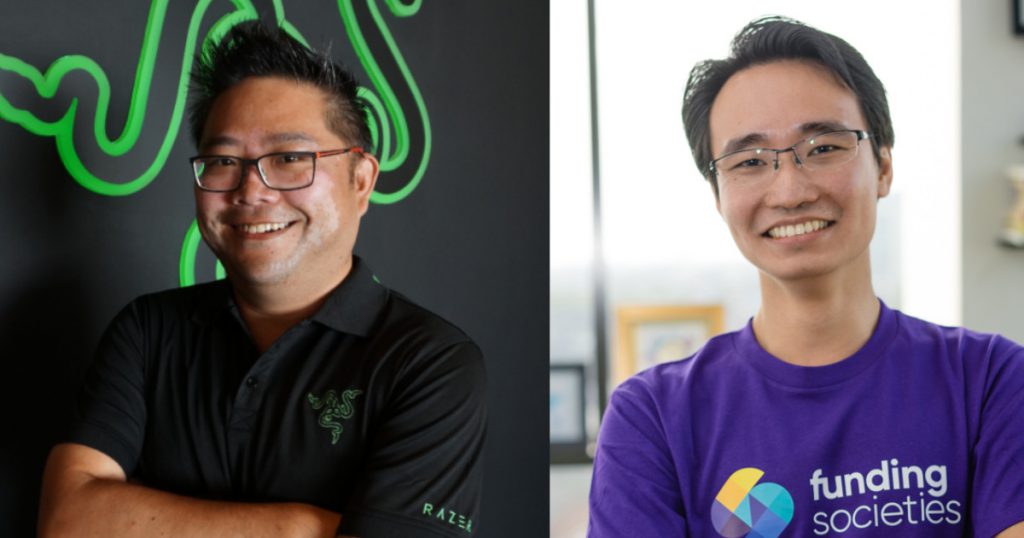

“Having worked very closely with our merchants via our RMS network, we understand the challenges MSMEs face, especially so during these pandemic times,” said Lee Li Meng, CEO at Razer Fintech.

“With the combined ambition to supporting the needs of the underserved MSMEs, we look forward to growing together with Funding Societies in our bid for our respective digital banking licenses.”

Short-Term Loans To Relieve COVID-19 Burden On SMEs

The partnership will potentially be rolled out across Southeast Asia to empower enterprises in their post-COVID recovery.

Eligible merchants will gain access to short-term financing to help them meet common operational costs.

Benefits of the loans include waivers of retention sums, fast disbursements between three to five working days, flexible tenures between six to 18 months, no collateral requirement and minimal documentation.

According to an Ernst & Young survey, over half of the 670 surveyed SMEs called for loan reliefs to cope with operational costs, while 84 per cent expressed difficulty sustaining online connectivity with customers and suppliers.

Financial relief and technology solutions were also touted as crucial areas of intervention to help companies survive, a gap that Razer and Funding Societies will be attempting to fill.

Synergising Digital Capabilities

To date, Funding Societies is the largest digital financing platform in Southeast Asia, specialising in peer-to-peer lending and short-term funding for SMEs.

In the past five years, the platform has financed over 2.8 million business loans with over S$1.6 billion in funding, and is recognised by IDC as among the five fastest-growing fintechs in Singapore.

Similarly, Razer Fintech was established in 2018 as the fintech arm of Razer, which is now one of the largest offline-to-online digital payment networks in emerging markets, processing billions of dollars in total payment value.

RMS is the B2B solution vertical of Razer Fintech, comprising of RMS Online, a card processing gateway, and RMS Offline, SEA’s largest offline payment network.

“As applicants of different digital bank licenses in Singapore, we share the conviction for digital banking and see synergies working together, for the arduous but meaningful mission of financially enabling SMEs,” said Kelvin Teo, co-founder and Group CEO of Funding Societies.

Featured Image Credit: Mothership / Digital News Asia