It is no exaggeration to say that 2020 has seen headwinds and challenges on multiple fronts.

For one, Covid-19 has dealt a blow to the different business sectors and businesses have been forced to innovate in order to survive. The startup scene was adversely impacted as well.

On the good side, it has also presented new opportunities for startup founders. The startup scene is poised for a rebound after the Covid-19 pandemic.

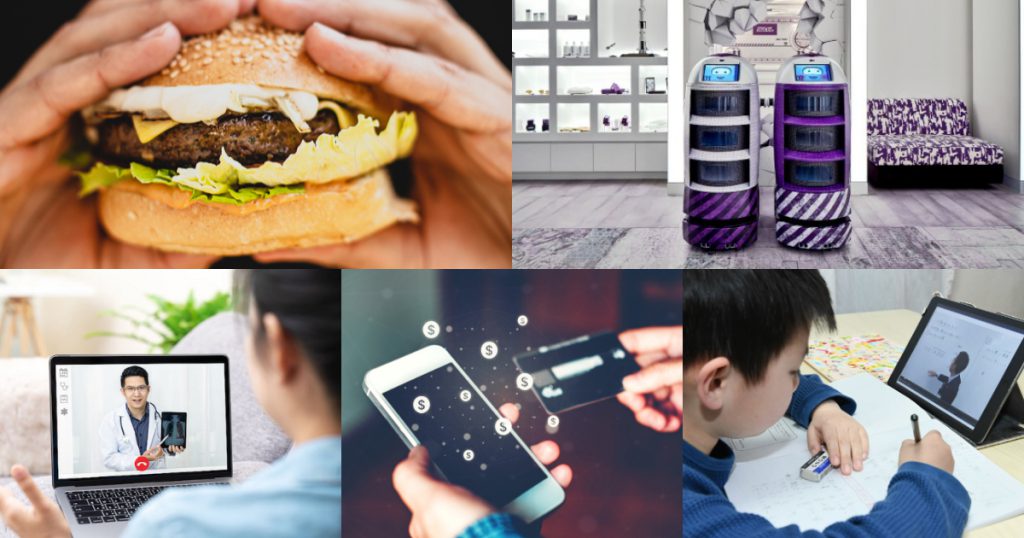

We take a look at the emerging trends for startups that will likely continue in 2021.

Foodtech

The year has seen the rise of foodtech startups such as cell-based clean meat company Shiok Meats and plant-based meat startup Next Gen in developing sustainable meats.

This will persist in 2021 as these startups are gearing up to launch their anticipated products.

For one, Shiok Meats raised US$12.6 million of Series A funding in September this year, to build the first-of-its-kind commercial

pilot plant from which they plan to launch their minced shrimp product in 2022.

Next Gen newly launched in Singapore in October, armed with a seed funding of US$2.2 million (S$3 million). They plan to build a global consumer brand.

Moreover, when Covid-19 first erupted in Singapore, we saw several bouts of panic buying, as Singaporeans flocked to supermarkets to stock up on essential items.

This emphasised the issue of food security in Singapore. With the renewed interest in food security, the nation has seen a rise in agriculture technology (agritech) and foodtech startups, as well as a wave of investor funding and government support in the area.

To combat food shortages, agritech companies are geared towards redesigning farming operations that no longer need to be constrained by space, climate, and manual labour.

With that, foodtech is a booming industry, with Forbes predicting that it is expected to exceed US$250 billion (S$342.8 billion) by 2022.

Robotic Delivery

Using robots has always been a thing but with Covid-19, the use of robots has increased to minimise human contact.

We saw a rise in kopi robots with Crown Coffee and recently, the RATIO robotic café and lounge. We also saw the increased usage of room service robots in hotels here such as YOTEL as they welcome staycations.

Grocery delivery robots, which are already underway in China with delivery apps like Meituan Dianping, have potential to reduce the need to be at a supermarket physically to get groceries.

Furthermore, some Covid-19 patients at Alexandra Hospital had robots delivering their meals and medication.

With these successful implementations, robotic delivery could see a higher take-up rate in 2021 and manual tasks could be overtaken by machines.

Telehealth and Home Medical Services

There is no doubt that there has been a rise of telehealth services such as Doctor Anywhere and White Doctor as Covid-19 forced us to stay home.

Telehealth focuses on providing remote telemedicine and teleconsultations through text messaging, web or mobile apps.

With Ministry of Health’s implementation of a new regulatory framework for telemedicine by come 2022, an accelerated development in this field is expected.

Even pre-Covid 19, telemedicine had already been gaining traction in Singapore. The acceleration in its use is expected to be one of the lasting changes to lifestyles as a result of the pandemic.

Another area that saw an increased adoption rate is on-demand house call services such as Homage due to Covid-19.

Beyond eldercare, home medical services can offer medical escorting to facility-based care in hospital wards.

With Covid-19, family members may think twice before sending a loved one to a nursing home or assisted living facility. Covid-19 exposed weaknesses in these communities as the virus entered and spread quickly.

As a result, telehealth and home care services could still take up an integral role in 2021.

E-commerce 2.0

E-commerce saw a huge boom during Covid-19 as people were forced to stay home.

“If the first wave of ecommerce brought consumers to online marketplaces, e-commerce 2.0 will reimagine the consumer experience on these marketplaces,” said Yinglan Tan of Insignia Ventures Partners.

We will see more e-commerce platforms tapping into new forms of distribution through localised supply chains, data-enabled financing options, contactless technology, and personalised content.

This aligns with greater adoption of digital payments, improvements in logistics infrastructure, and a larger internet consumer population in the region.

This means we can expect more marketplaces that are focused on a core set of products while expanding on adjacent services, instead of the other way around.

From a business perspective, this vertical approach to growth clears a path to profitability for marketplaces in a space that is known for high cash burn and low margins.

In Singapore, Carro reinvented the way people purchase cars amidst Covid-19 with the country’s first car subscription service and contactless car purchase service.

5G Connectivity

5G connectivity will be the backbone of Singapore’s digital economy as we push towards a Smart Nation.

5G will be a game-changer globally, creating jobs and revitalising economies. Around the world, it could create 22.3 million jobs and contribute US$13.2 trillion to the economy, according to an IHS Markit study.

Startups here have much to look forward to, as 5G capabilities will accelerate innovation in Deep Tech by supporting machine learning (ML) and the Internet of Things (IoT) at scale, and at the edge.

For one, M1 is partnering SGInnovate to bring the benefits of 5G to start-ups, especially in healthcare.

An example of such an application in healthcare would be electrocardiogram (ECG) rhythm monitoring devices.

With 5G, the device will be paired to a phone via Bluetooth, which will then send signals directly to a cloud server database allowing doctors to access patients’ information, form a diagnosis and create reports.

Blockchain solutions for supply chain management problems typically come hand-in-hand with IoT and big data. 5G will help these solutions overcome their scalability issues, thus paving the way for their wide-scale adoption.

There are a lot of possibilities of breakthroughs with 5G as Singapore aims to attain 5G coverage for half of the country by the end of 2022, and nationwide coverage by 2025.

Digital Banking

The rise of digital and challenger banks is fuelled by more Southeast Asian consumers demanding contactless and convenient platforms to handle their finances, said Yinglan Tan of Insignia Ventures Partners.

This has been accelerated by Covid-19 as we avoided going to the physical banks or ATMs in order to minimise human contact.

Last year in June, the Monetary Authority of Singapore (MAS) announced that it will issue up to five digital banking licenses.

A total of 21 applications were received and Grab-Singtel, Razer Fintech and Internet company Sea are some of the companies which have applied.

By 2021, we can expect to see more digital and challenger banks in Southeast Asia.

The digital banking races in Singapore and Malaysia that began this year will have concluded by then, and the winners will be hard at work launching their offerings.

This also coincides with incumbent and traditional players opening up their banking infrastructure for deeper partnerships with tech companies.

Online Education

Covid-19 has moved classroom teaching to video conferencing and online classes as Singapore schools closed during the circuit breaker.

The pandemic has also highlighted a gap — there is a lack of adoption of education technology solutions in schools.

According to then Education Minister Ong Ye Kung, he said that “there are certain strengths in online learning that actually, classroom learning does not have”.

Students can engage in self-directed learning outside the classroom. Many institutions have actually been recommended to complete a portion of their curriculum online even after everything returns to normal.

Moreover, the rise of edtech startups in 2020 such as Koobits and Doyobi has been evident.

According to Holon IQ, funding for edtech startups grew from US$500 million in 2010 to US$7 billion in 2019. Another US$87 billion is expected to be invested over the next 10 years.

More Trends To Emerge

From 5G related startups to telehealth, these areas have seen tremendous growth in 2020 — and will continue growing in 2021.

With startups forced to pivot, we have seen opportunities that arose as we embrace new needs. We may continue to see new trends emerging as industries and sectors reopen.

As companies gear back into business, they will adopt digitalisation and innovate their business processes for post-Covid 19.

2021 will be an exciting year for startups, especially off the back of a shaky year.

Featured Image Credit: Nikkei Asia / Green Queen / SSIVIX Lab / TripAdvisor / Industry Wired