[This is a sponsored post with CIMB.]

It’s not surprising that Malaysia is seeing a widespread adoption of digital payments.

The volume of cashless transactions in Malaysia is estimated to have doubled in 2020 compared to the year before, according to the International Data Corporation (IDC). Fueled by the pandemic, high-contact physical payments that require cash have become less favourable and the country is moving towards cashless options such as contactless and e-wallet payments.

No matter the scale of your business, you probably already know that it’s crucial to digitalise. However, investing in a new Point Of Sale (POS) equipment and system comes at a price that can range from hundreds to thousands of ringgit, especially if you have no initial hardware to start with.

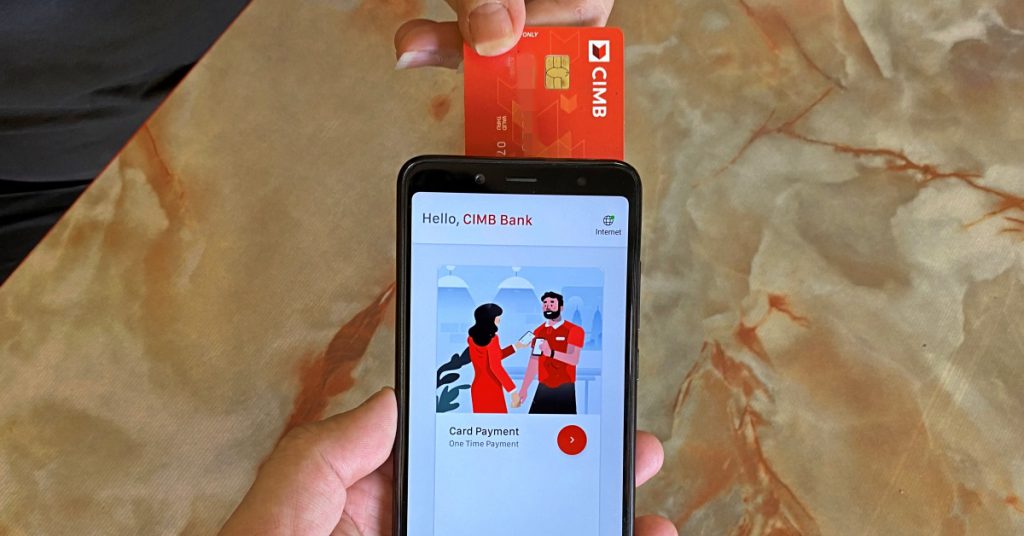

With this in mind, CIMB Tap n Pay enables merchants to accept cashless payments using what is already in hand, or in your pocket—an NFC-enabled Android smartphone.

For an affordable monthly subscription fee, merchants can have a convenient and portable POS terminal, no additional hardware required.

Quick facts about CIMB Tap n Pay:

- Accepts contactless payments via debit and credit card transactions supported by MyDebit, Visa and Mastercard

- Accepts QR Payments via DuitNow QR, CIMB QR Pay, Touch ‘n Go, and AliPay e-Wallets

- Merchants need to sign up for or use an existing CIMB Current Account

- E-receipt sent by SMS/email

- Maximum transaction amount: RM250 (transactions above RM250 with PIN capability in development)

- No minimum transaction amount

Combining Mobility, Security, And Accessibility

Since CIMB Tap n Pay transforms your mobile phone into a POS terminal, this means that you can just pick it up and carry with you to wherever your customers are.

It’s designed to match the needs of micro-businesses like F&B such as restaurants, cafes, food courts, food trucks or retail stores such as hair/beauty salons, book stores, pharmacies, education/learning centres, etc. If you don’t have a permanent store location, there’s nothing much to set up or pack down, saving on time and energy. The app can also be used by on-the-go sellers like insurance agents and delivery services.

When it comes to payments, data security is paramount. Customers’ cardholder and PIN information is kept safe thanks to secure end-to-end encryption. This innovative platform fulfils similar certification to traditional electronic data capture (EDC) terminals.

But one other important thing comes to mind: what about access to the funds for an efficient cash flow?

According to the CIMB team and website, the settlement amount will be in the user’s authorised bank account on the next business day and can be used immediately. The maximum limit that you can transfer out is also dependent on your sales volume.

Setting up the CIMB Tap n Pay app on your phone is very simple. After your application is approved, you’ll receive your Tap n Pay User ID and PIN via email. Use these to log into the Tap n Pay app, which you can download from the Google Play store.

After that, you’re ready to provide your customers with a contactless yet simple payment method, without needing to spend more on additional hardware.

As a small business, making it easier for your customers to pay you digitally could be one of the key deciding factors that leads to close or lose a sale. So having an affordable and straightforward point of entry would greatly ease this process of adoption for you.

CIMB is currently running a RM20,000 cash rebate campaign that is open to all their new Tap n Pay users who sign up for the service from now until the 31st of March 2021.

If your business conducts a minimum of 8 successful transactions through CIMB Tap n Pay on or before the 30th of May 2021, you can get a RM188 cash rebate. There is no minimum value for the successful transactions. You can see the full T&Cs for the cash rebate campaign here.

*The details of the cash rebate campaign have been updated since publishing.

- Download the CIMB Tap n Pay app from the Google Play store here.

- Get in touch with CIMB here to find out more.

- See the FAQs here, or learn more about the product here. You can also check out the full list of compatible devices.