If there’s one thing that sets Singapore apart from all countries in the world, it’s the way it is financed. No other nation has achieved quite so much, having so little.

The tiny city-state is known for its low-tax and business-friendly environment, but few people ask the question of how exactly it is possible.

The common idea espoused by the zealots of the free markets is that a friendly tax environment spurs business activity and provides increased inflows to the national budget even at lower tax rates, but it is only partly true in this case.

Indeed, businesses do very well in Singapore, but the country is surprisingly generous to its public too. It subsidises every important area of human life: housing, healthcare, education, public transport, while boasting an advanced military at the same time.

The only reason it is able to afford so much is its decades-long prudent policy of not spending beyond its means and setting aside budgetary surpluses into national reserves which are continuously invested.

Today, half of the projected long-term returns on these reserves can be funnelled back into the budget annually.

Introduced in 2008, Net Investment Returns Contribution (NIRC) has now grown so much that it is the single largest source of revenue for the budget in 2021.

It constitutes a whopping 20 per cent of all inflows — or S$19.56 billion — out of S$96.16 billion available to the government this year.

In other words, it is larger than any single tax source.

If the NIRC didn’t exist, the government would have to more than double the corporate tax rates, or triple the personal income tax rates, or triple the GST rate to 20 per cent or more — that is assuming that nobody would try to dodge these elevated obligations (which is likely when taxes get too high).

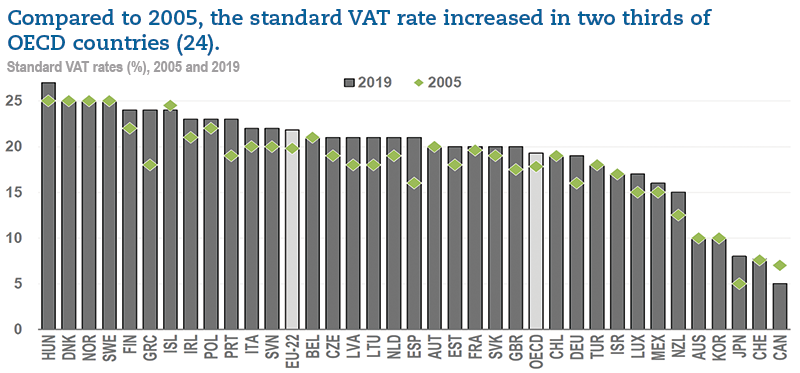

Thanks to its sound financial management, Singapore doesn’t have to contemplate raising its GST to 20 per cent, which would be similar to VAT rates in Europe.

Instead, it is raising it to only a modest nine per cent, from the current seven per cent.

But Why Does The Gov’t Even Have To Raise GST In The First Place?

Singapore may be governed very well, but it is not immune to changing demographics.

Its society is ageing and the proportion of the elderly is only going to grow, raising the pressure on provision of healthcare services and financial aid in their retirement.

There are also significant infrastructural investment requirements in the coming decades such as new MRT lines, continuing harbour expansion, Changi Airport, development of new housing estates and redevelopment of ageing HDB towns — all while the working age population is gradually shrinking in the 21st century.

For Singapore to remain as wealthy as it is, it needs to find more money. It can do so either by raising taxes or dipping into reserves. The latter, however, is far more costly.

The Covid-19 pandemic has only accelerated this necessity, ripping about a S$50 billion hole in the reserves, which now has to be patched up.

This is because a significant decrease would hurt future NIRC returns, losing the country billions of dollars in annual revenues in the already uncertain future.

Let’s put things in perspective. The increase in GST from seven to nine per cent is expected to initially provide additional S$3.2 billion to the budget.

If Singapore chose to draw more from its reserves (as some have proposed) instead of raising the tax, it would gradually eat away the base of its future investment returns.

We know that GIC is reporting approximately 5.5 per cent annual return over a 20-year period, which means it nearly triples the money under its management every two decades.

Using this as a baseline, we can calculate that every S$3.2 billion removed from reserves to stave off a GST increase could cost the country nearly S$10 billion after 20 years, and S$16 billion after 30 years. That is for every single year.

* $3.2bn invested at an annual rate of 5.5% becomes $9.33bn and $15.98bn after 20 and 30 years respectively

Cumulatively, the loss to reserves after 30 years could reach close to S$400 billion if we factor in the economic growth. This is how much lower the national reserves would be by 2050 if GST is not increased (such is the impact of the compound interest on investments of Singapore’s reserves).

For reference, the construction of a single MRT line costs approximately S$20 billion to S$25 billion.

Isn’t GST Regressive And Hurting The Poor More?

At this point, some people may raise a frequently-mentioned issue: GST is regressive in nature. This means that the rich pay a proportionately smaller portion of their incomes than the poor.

This is true, but it is also very misleading as most of the money would still be paid by the wealthy, who spend far more than any single average individual.

Yes, in proportion to their incomes, the percentage would be smaller. However, this is not a tax on income, but consumption.

Each time they buy a new car, luxury handbag or book a suite in a five-star hotel, they are providing thousands of dollars into the budget with a single purchase — more than any single average resident over the course of a year.

At the same time, the government has the means to provide tax rebates for the needy, in the form of GST vouchers, which reduce the burden on the poorest in a targeted way.

Paying Less Today To Avoid Paying More In The Future

Nobody likes taxes going up, but in the exceptional case of Singapore, the increase of the sales tax should actually enjoy broad public support.

There are two reasons for it:

- It’s still quite small compared to rates around the world.

- The sooner it is raised, the faster the country’s reserves can grow (or recover in the post-Covid reality), protecting everyone from a much larger increase in taxation later. There’s a reason VAT rates in Europe and most of OECD are around or above 20 per cent (and have kept growing in recent years), and I don’t think anybody in Singapore would want to find themselves in a similar position.

The priority is to protect and even grow the reserves, as the NIRC should keep providing an increasing portion of the revenues to the national budget.

As long as that pace is retained, taxation should remain stable well into the future, even if the society keeps growing older.

This is quite unlike in any other country in the world, where taxes are typically raised in desperate attempts to plug holes caused by fiscal deficits and are used to finance current spending.

In Singapore, higher GST helps protect the national reserves, allowing for their faster accumulation and profitable investment over the long term so they can keep delivering progressively greater returns — and the country continues to enjoy its low-tax environment regardless of demographic changes and future economic and political challenges.

Featured Image Credit: Paul Wan & Co.