Earlier last week, Singapore’s largest bank DBS, announced its latest earnings. It reported a 72 per cent increase in net profit for the three months ending March 2021.

The bank also recorded a net profit of S$2 billion dollars for the same period, compared to S$1.17 billion dollars the year before.

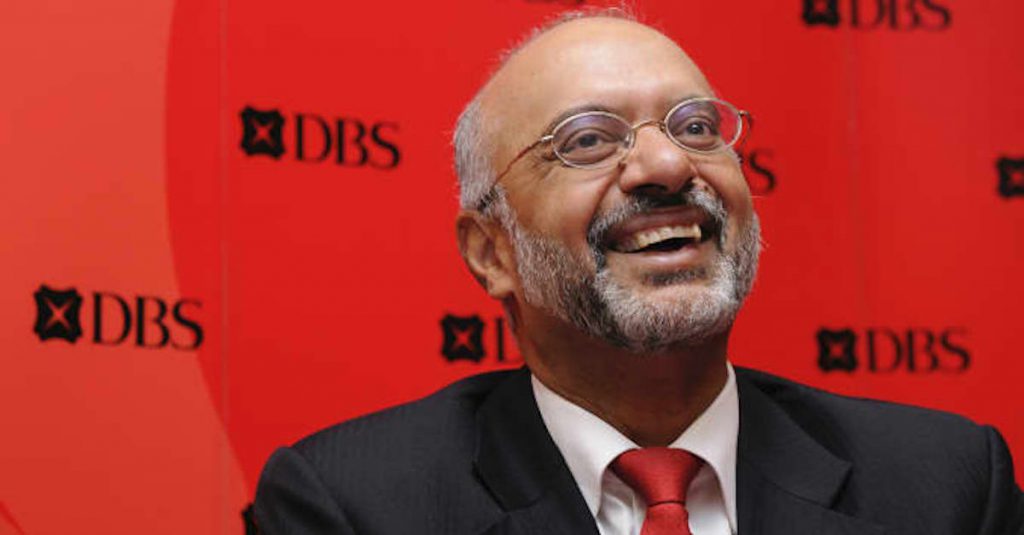

Beyond just highlighting the recovery of the bank’s business post COVID-19, CEO Piyush Gupta also shared insights into its cryptocurrency digital exchange which was launched last year.

S$30 – S$40 Million dollar daily trading volume

According to DBS, the digital exchange, which is only open for accredited investors for now, has a daily trading volume between S$30-S$40 million dollars. It currently has 120 investors onboard.

DBS shared that they have “hundreds of more, probably thousands of clients who are waiting in the queue” to become an investor.

“We are being slightly thoughtful about how we bring them on board, similarly on the asset side,” shared CEO Piyush Gupta.

In comparison, Binance, the world’s largest cryptocurrency exchange, has a daily trading volume of US$46 billion. The second largest exchange, Coinbase, has a daily trading volume of US$6 billion.

DBS sees high interest in cryptocurrency trading and digital custody capability

When asked about the potential growth of the digital exchange, CEO Piyush shared an optimistic view of the future of cryptocurrency.

I do think given the amount of interest in all the four cryptos that we trade now, that interest is quite high. And therefore, I do think it will pick up. But whether it picks up to tens of millions, or hundreds of millions of income over the next few years, it’s hard to say. So my thinking is, we should get in there, figure it out and grow and then we’ll get a better sense for how big this could be in time.

Piyush Gupta, DBS CEO

Beyond just the trading of cryptocurrency, interest on whether the bank will allow custody of digital currency is high as well.

“On the digital custody, we are getting a lot of approaches now from other exchanges who want to use us for the digital custody capability, because it’s obviously superior,” said Piyush.

CEO Piyush: Blockchain is a game-changer for currency settlement

As DBS seeks to retain and gain more market share in the financial space, the bank has been actively exploring new revenue opportunities.

Other than the digital exchange which it launched last December, DBS has also announced a partnership with Temasek and J.P Morgan last week to set up a new blockchain based global payment platform.

Called Partior, it aims to disrupt the traditional cross-border payments ‘hub and spoke’ model, resulting in a more efficient clearing and settlement for payments.

“What the blockchain lets you do is take it and democratize it at scale for any counterparty in the world. I’m not going to limit it to places as set up in an arrangement. And, therefore, anybody on this platform can effectively pay in real-time instantly. And so your settlement of security, settlement of FX, settlement of active payment you do in real-time. I think that’s the game changer and it’s much better than the current expat infrastructure including the Swift infrastructure,” CEO Piyush added.

Cryptocurrency and blockchain technology is a key content pillar for Vulcan Post, and we will be continuing to cover the development in this space. You can follow our coverage here.

Featured Image Credit: CNBC