Payments and cash solutions provider SOCASH is raising funds to drive further expansion in Southeast Asia amid the digitalisation push in the region.

In an interview with Vulcan Post, CEO and Founder of SOCASH Hari Sivan revealed the company’s growth plans.

“As we expand our footprint in ASEAN, we are continuing to raise capital from investors…Our next phase of growth will be driven by demand from virtual banks and embedded finance products that require efficient delivery platforms for their products and services,” Hari said.

The next generation of networks will be retailers who deliver banking products & services, just like how they provide their infrastructure for e-commerce delivery and collections, Hari explained, and SOCASH can provide the technology platform that connects banks and consumers to these retailers. “This drives banking services at the counter, avoiding the need for onerous cashier training.”

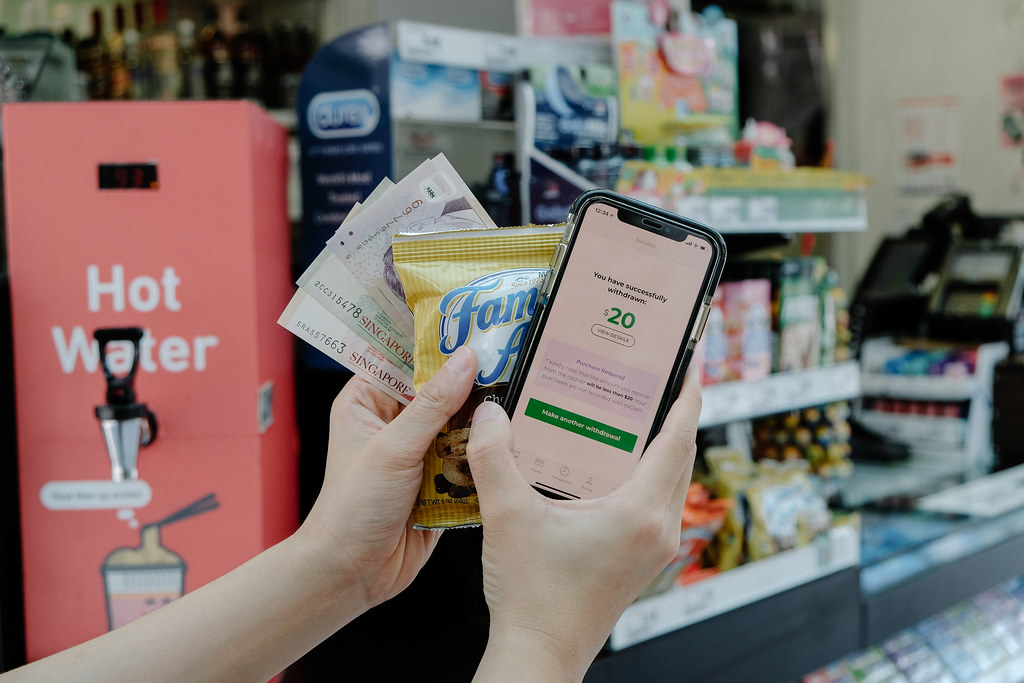

SOCASH is like the symbiotic bridge between cash and cashless services. It provides cash withdrawals as well as cashless payments. This two-way service helps it fulfill both the cash and cashless needs of people in Southeast Asia.

Founded in 2015 by Hari and his wife, Rekha, SOCASH converts shops into digital banking channels and links up thousands of retailers to process digital payments and deliver banking services. SOCASH operates in Singapore, Indonesia and Malaysia.

The company has raised US$12.5 Million from investors so far, including Vertex Ventures, Standard Chartered Ventures and GLORY, to fuel expansion plans in Southeast Asia.

Hawkers, micro SMEs still prefer cash payments

In Singapore, cash is “still king”. Data from the Monetary Authority of Singapore showed that currency in circulation increased from the previous year by 9.5 per cent. That’s as ATM withdrawals decreased by 16 per cent in the same period.

Food merchants still prefer cash payments, despite the official endorsement of digital payments.

Nearly half of all 18,000 Singaporean hawkers accepted cashless payments under the Hawkers Go Digital programme to incentivise digital solutions, but the digital push has not brought a general adoption from the hawkers still. Some problems vendors face are the tech difficulties and the fear of mistakes made when making e-payments.

“We do foresee a mixed landscape where consumers and retailers will continue to use a mix of payment options for different consumption needs – ranging from cash at food courts (and hawkers), credit cards for overseas travel, and BNPL for consumer electronics,” said Hari.

The uneven terrain also means that there’s opportunity for a payments solution service like SOCASH, as micro vendors gradually adopt the cashless move. The company provides digital payment functions including QR code payments, and contactless credit and debit card payments.

“In Singapore, our digital payment business is growing 20-30 per cent month-on-month. With the rapid rise of digital banks in Asia, there is a huge demand for capital efficient network and distribution for banking products and services,” he said.

SOCASH is getting its retailers onboard to accept digital payments – including payment methods such as DBS PayLah! and PayNow. “Our payment solutions include processing of QR payments at the retailer counter, which reduces frauds and seamlessly integrates to their point of sales systems,” he explained.

The fintech provider spans over 16,500 shops across Singapore, Indonesia and Malaysia. That includes mom-and-pop shops, cafes, retail giants like 7-11 and supermarket chains like Sheng Siong.

“Our business is fundamentally focused on delivering efficient payment solutions & banking services…The growth in digital payments will only accelerate with the right innovations and our payments business is seeing the tailwinds of this revolution,” he said.

Cash withdrawals slow

One of the banking services is cash re-circulation – which involves enabling retailers to deposit the cash that they collect into their bank account efficiently and allowing consumers to get the cash that they need from these retailers, instead of queuing up at ATMs.

But work-from-home has changed consumption behaviours to digital, reducing the need for cash re-circulation, said Hari.

An international study done by the Bank for International Settlements (BIS) agrees that the “unprecedented public concerns about viral transmission via cash” has led to drops in cash usage in some countries.

BIS said, “If cash is not generally accepted as a means of payment, this could open a ‘payments divide’ between those with access to digital payments and those without. This in turn could have an especially severe impact on unbanked and older consumers.”

“In Asia, given the lack of debt-driven consumption, cash is the dominant payment system with market shares ranging from 60-99 per cent, and there are efficiencies that we bring to this large market from ATM withdrawals to moneychangers,” he said.

When asked if the company would consider changing the name to “SOCASHLESS” as Covid-19 has radically changed the way most people handle money, Hari joked and said that he’s still a fan of 6 letter names.

“That’s funny! But I will definitely keep that in mind,” he said.

Startup feature stories is a key content pillar for Vulcan Post. You can follow our coverage on startups here.

From 1 July 2021, Vulcan Post’s premium articles will be hidden behind a paywall. Subscribers will be able to enjoy exclusive articles with a deeper level of coverage and insight on verticals that include government technology, electric vehicles, cryptocurrency and e-commerce. You can check out our premium articles here and subscribe to us here.

Featured Image Credit: TypicalBen