Many Singapore tech startups have gone public or are intending to do so in the next few months. That’s because the pandemic has accelerated the need for tech-related services.

Superapp Grab is set to go public in the US via a special purpose acquisition company (SPAC) deal worth S$54 billion (US$40 billion) in the fourth quarter of this year, while proptech startup PropertyGuru is going public in a US$1.8 billion SPAC deal.

Other startups that are eyeing or considering a public listing include Carousell, Ninja Van, Carro, and Ryde.

The pandemic has helped accelerate digitalisation in Singapore and Southeast Asia. It has transformed the way we live and work – from going online to shop for groceries to banking needs. Over a third of the region’s consumers are new to digital platforms and more have gone online to cater to an assortment of needs, like gaming entertainment to even buying properties.

We take a look at some growth startups that may be under the radar and working on initial public offering (IPO) game plans to expand and tap on the region’s growth spurt.

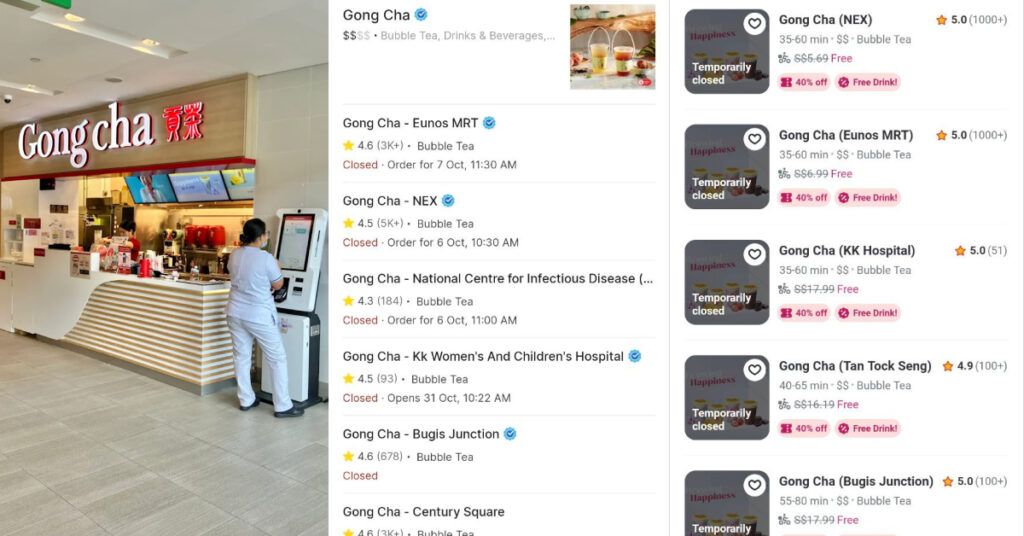

ShopBack

The cashback rewards platform ShopBack is said to be working on raising capital in its Series E round from new and existing investors. It was founded in 2014 by Henry Chan, Joel Leong, and Shanru Lai.

The Singapore startup has presence in Singapore, Malaysia, Indonesia, the Philippines, Thailand, Taiwan, and Australia, serving over 19 million users.

In December last year, it raised US$75 million in an extended funding round led by Temasek, with participation from existing investors like Rakuten and EDBI. Total publicly known funding is at US$113 million since its inception.

The company said last year the extended funding would be used to enhance its technology infrastructure, expand data capabilities, and drive growth in existing markets.

In 2019, ShopBack saw a 250 per cent year-on-year growth in sales and orders, powered over 16 million monthly orders, and delivered more than US$2 billion worth of sales for over 2,500 merchant partners.

In an interview with Yahoo in 2020, the firm had not ruled out the idea of an IPO in the near term, but CEO Henry had said that it remains focused on creating value for users and merchants in this period.

To deal with the pandemic, ShopBack has been extra-focused on optimising the business and rationalising its cost structure to operate more effectively with limited resources. The goal is to keep expenses as low as possible without significantly slowing business growth, while also innovating on new features.

99.co

Property listings platform 99.co has been slowly moving up the ranks and building its place in Singapore and Southeast Asia. It has a presence in the Republic and Indonesia.

The startup has raised US$33.1 million of funding in total. The most recent was in 2019, where it gained US$8 million in investment from REA Group, through the acquisition of the group’s consumer brands iProperty in Singapore and Rumah123 in Indonesia.

The last funding round was also in 2019, where it raised US$15.2 million in its Series B round. The funds were used to extend its reach in Singapore, Indonesia, and other markets.

It counts East Ventures, Sequoia Capital, 500 startups, and Facebook co-founder Eduardo Saverin as its investors.

In February this year, it reported a 66 per cent increase in revenue for 2020, at US$5.5 million. The firm attributed the strong results to an increase in subscriptions, partnerships, and package offerings.

The startup has been slowly acquiring companies as it expands its regional and local presence. In 2018 it was UrbanIndo, followed by iProperty in 2019, and SRX Property in 2020.

The site registers around 14 million visits per month, statistics from analytics site Similarweb showed. Around 70 per cent of the traffic comes from Indonesia, while traffic from Singapore is at 24 per cent.

As part of Covid-19 cost-cutting measures, 99.co employees took voluntary pay cuts and opted for a pay swap version of the classified employee stock ownership plan, where a dollar of their pay was exchanged for US$2 worth of stock. Meanwhile, CEO and co-founder Darius Chueng forwent his remuneration for roughly nine months.

Given the right conditions, and if the startup continues to reflect positive figures, it might eye a public listing in 12 to 18 months.

The funding can be used to grow its market share in both Indonesia and Singapore, as well as develop a better user interface and app experience to stand out in the competitive proptech sector.

The firm can also work on exploring indirect verticals of the property listing business, like insurance, lending, and mortgage options.

Love Bonito

This company’s founders may have previously voiced their uncertainty about going public. But the funding gains and conditions may be ripe now for it to consider doing so.

To date, Love Bonito has raised US$13 million in funding, according to publicly available records, with investors like Kakaku and Openspace Ventures.

The site registers close to 600,000 visits every month, according to data from Similarweb. Most of the traffic to Love Bonito comes from Singapore at 48.18 per cent, followed by the United States at 22.96 per cent, and Hong Kong at 9.68 per cent.

Love Bonito also has customers from Malaysia and the Philippines, making it suitable for it to eye further regional expansion as there’s demand.

The ecommerce site indicates that it has five retail stores across Singapore, including Jem, 313@Somerset, and Funan. Beyond Singapore, it has six stores in Malaysia, six stores or department store sections in Indonesia, and two stores in Cambodia.

On its website, it also indicated a Hong Kong pop-up store in the works. In total, that’s 20 stores in Asia.

To serve the demands of its international customers, its online store ships to 20 markets. This includes the United States, Australia, Middle East, and other Asian regions.

In a 2017 interview with High Net Worth, when asked if the firm would want to be acquired or have a public listing, co-founder Rachel Lim had said that she welcomes a good partnership that will propel the brand further, but the focus is on building a long-term brand.

With such a strong presence in Southeast Asia, it would be sound for the company to look for funds to further expand into the region, and build its credibility with Asia’s rising middle class.

According to the World Economic Forum, an estimated two billion Asians belonged to the middle-class last year, and that number is set to increase to 3.5 billion people by 2030.

With that comes higher spending power. The Asian Development Bank stated in a report that reduced poverty and rapid economic growth have hugely expanded markets for consumer goods in recent years, including fashion.

Secret Lab

Secretlab’s success is not a secret anymore. Ever since its co-founder Ian Ang came into the spotlight with reports of him buying a multi-million dollar good class bungalow and luxury condominium penthouse.

In a March report, the company was said to have exceeded S$350 million in sales for the latest financial year. Earlier filings had revealed how Covid-19 contributed to the business’ growth, as more people bought its chairs due to work from home arrangements.

The company has seen “meteoric growth” with sales increasing many folds over the years. In 2019, news reports showed that Secretlab sold over 200,000 chairs. By the time it was 2020, the business was said to produce at least 500,000 gaming chairs a year.

Around 60 per cent of Secretlab’s sales are reported to come from North America and Europe. Singapore accounts for just five per cent.

The company in 2019 entered into an investment deal with Temasek-owned Heliconia Capital Management where the fund took a minority stake in the consumer tech startup.

The seven-year-old startup has been seeing a surge in investor interest and is said to have appointed an external advisor to manage the discussions.

The cash-flow positive company may consider a public offering if it wants to tap on more funds to bring the brand to an even higher international status. The funds can be used to create other product verticals too, like gaming essentials. Loyal customers can also get a chance to participate in the business by being an investor. The storyline might follow consumer tech firm Razer’s, which has a strong gaming fan following.

With the esports market set to reach US$2.2 billion in revenue by 2023, the tech firm is set to post stellar growth in the road ahead, as its products reach out to more in the international gaming community and the mass market. In June last year, game developer Riot Games appointed Secretlab as the official chair partner of the League of Legends European Championship.

Southeast Asia’s burgeoning internet economy

The region’s internet economy is set to grow by three times to reach US$309 billion by 2025, from US$105 billion in 2020, according to a report by Google, Singapore state investor Temasek Holdings, and business consultants Bain & Co. Regional nations include Indonesia, Malaysia, Vietnam, the Philippines, and Singapore.

Last year, 40 million new internet users were added, bringing the region’s total internet users to 400 million. There’s still room to grow, as only 70 per cent of the population is online.

The ecommerce segment grew 63 per cent to reach US$62 billion in 2020. With an 11 per cent increase in online users, Southeast Asia is one of the world’s fastest-growing internet markets.

Growth is expected to come from sectors like gaming, video streaming, ecommerce, and financial services.

These tech developments are set to accelerate growth for multiple industry verticals, as well as provide jobs for Singaporeans.

Startup feature stories is a key content pillar for Vulcan Post. You can follow our coverage on startups here.

From 1 July 2021, Vulcan Post’s premium articles will be hidden behind a paywall. Subscribers will be able to enjoy exclusive articles with a deeper level of coverage and insight on verticals that include government technology, electric vehicles, cryptocurrency and e-commerce. You can check out our premium articles here and subscribe to us here.

Featured Image Credit: Secretlab, Love Bonito, ShopBack, 99.co