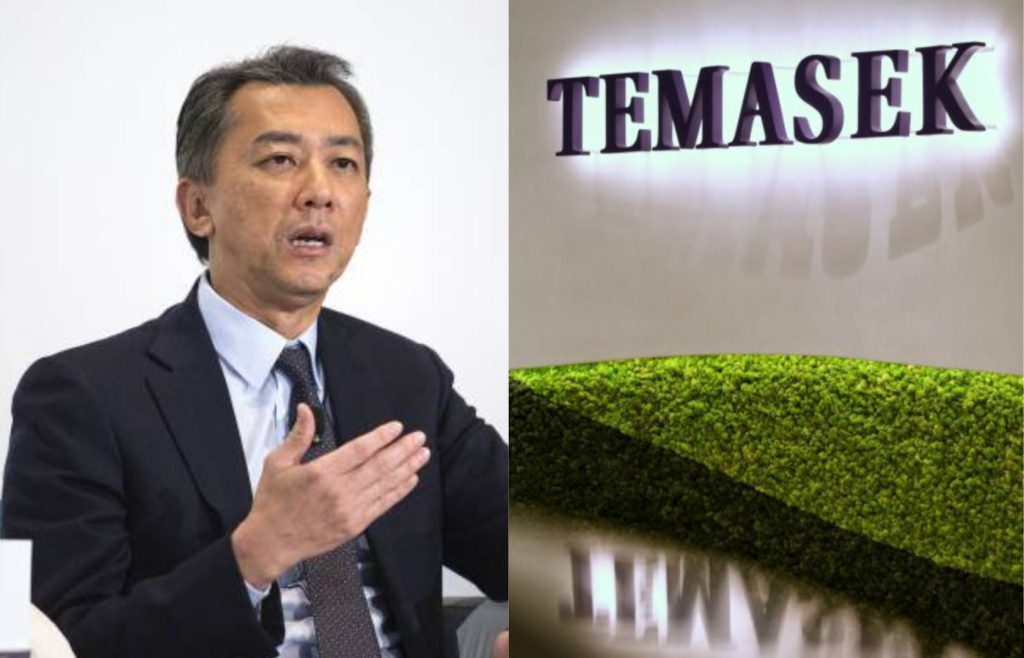

At a panel ‘Shaping our Digital Future’ at the Singapore FinTech Festival, Chia Song Hwee, deputy CEO at Temasek International touched on a topic that is not commonly spoken about – the area of ethics and governance towards innovation.

He talked about it as he shared Temasek’s views on technology and digitalisation trends. This is as technology-enabled inflections are disrupting industries faster than ever before – accelerated by Covid-19 – and governance and innovation are often at the crossroads in this fast-paced changing environment.

“As you know with the use of technology that is decentralised and autonomous, if not careful, it can create a lot of problems (if unregulated),” Chia said.

“So the knee jerk reaction to that is, well, let’s regulate. I’m more a believer of – regulation is appropriate, but we should not over regulate tech. As this will stifle innovation. It is a balance. I think if a company does more to build trust, then we self-govern. But if we do not behave, then we deserve to be regulated more,” said Chia.

Chia added that he “personally believes” there’s no need to have more new laws to cope with the effects of technology evolution. “Some of the implementation and application of the laws and the rules, should be refreshed and updated instead because for example, antitrust issues 20 years ago are quite different from antitrust issues today. But the principles don’t change…The spirit is the same.”

“But I stress that we also need to be careful as we develop solutions and services. It is our responsibility to make sure that it’s safe, that we are protecting the assets of others,” he added.

“Tremendous opportunity” with Web 3.0 and digitalisation

At the panel, Chia dived in on how digitalisation is a very important part of Temasek’s investment direction while acknowledging its disruptive aspects. “We believe that the technology brought about by digitalisation has a very pervasive impact across sectors, countries, and geographies.”

“On the one hand, it can provide a lot of investment opportunities. but on the other hand, it could disrupt a lot of existing businesses, which we own today. So it is therefore very important for Temasek to take this seriously in terms of where we want to deploy our capital going forward, and to also help our portfolio companies navigate the change,” he said.

“Web 3.0, we believe, is a very important element of digitalisation,” said Chia. “The Web 3.0 evolution is a very powerful one. Compared to the Internet 2.0, it is smarter, more autonomous, and open.”

“We believe that these elements are very hard to stop by nature and also by design. Therefore it is a very fertile ground for innovation to take place, for new businesses, and value to be created. So I think the opportunity there is tremendous.”

Do not be afraid of change, be afraid of being irrelevant

Staying in the comfort zone and not embracing new things is something that doesn’t seem to sit well at Temasek, according to Chia.

Chia said that adapting to change is “something that we talk about a lot internally in Temasek”.

“What we fear is we stop changing, we stop embracing new things. Because we believe that if we do that and be complacent, then we will be irrelevant going forward.”

“So change is difficult for anyone, but we must learn how to deal with change, because it will come at you even if you try to avoid it. So what we try to do is to make small changes in steps, experiment, create pilots, and slowly build confidence.”

One thing that keeps Temasek’s senior management like Chia awake at night is ensuring “that our portfolio continues to be relevant going forward and that it is future proof. So, over the past decade, we have been reshaping our portfolio.”

Chia notes that Temasek’s portfolio has gone through significant shifts in its underlying assets.

For example, he noted that the firm’s financial services sector portfolio was 34 per cent of portfolio value at the end of its last financial year. “10 years ago, over 90 per cent of our assets were banks, traditional banks. Today, more than half are into FinTech and payments companies. It is very, very different.”

“As for our technology, media, and telecom segment: 10 years ago, 90 per cent of the portfolio consisted of telcos. Today, more than half are in digital-heavy technology-enabled businesses, such as e-commerce, social commerce, and so on. The underlying line portfolios have transformed a lot, and it actually follows how the economy has evolved to be more digital.”

Digitalisation is one of the major trends identified by Temasek as a guidance to its investment approach. The other three major trends identified by the firm are longer lifespans, sustainable living, and the future of consumption.

Getting hands dirty

Back in 2018, Temasek created two portfolios – AI and blockchain. The tasks include building capabilities on the talent front, like engineers.

Chia shared that Temasek had found out that horizontal technologies, like AI and blockchain are so powerful and so pervasive that no single market or sector can cover them, and that reshaped the way they worked.

“Because it’s horizontal and going by how we are structured, we believe that we will miss a lot of opportunities. We also believe that the value of investing in enablers of this technology will be far less than those opportunities where technologies are applied to business situations,” Chia explained.

“Because of those two understanding or hypothesis, we felt that we must learn the technology ourselves. We must get our hands dirty,” he said.

“With these capabilities (building a talent base) we can work on use cases with our portfolio companies or partners to unlock value or create value. They also have the mandate to build new businesses through venture building and also build a network or ecosystem to enable early stage investments so that we know what’s happening around the world.”

The reshaping of the strategy has helped Temasek build capabilities and adopt an “agile methodology” way of working, a term that the tech world is very familiar with.

“It’s been two plus years, but really many things have actually just taken place in the past in the past one and a half years,” said Chia.

Under the area of AI, Temasek has formed a venture called Aicadium. Chia mentioned the latest national AI programme, project NovA!, and said that Acadium, together with local banks are working on creating a utility platform that will address challenges in the financial services sector. This could create solutions, like tools to track loans that banks have exposure in.

Another endeavour Partior, a venture Temasek has with DBS and JPMorgan, is building a network for cross-border digital payment settlements. It’s currently in the process of onboarding other banks, and has plans to facilitate digital funds transfers or settlements, going forward.

“All these I wouldn’t call them success, but they are early signs of early results. and they have been quite encouraging,” he said.

Skills and jobs mismatch, other issues caused by tech disruption

The pandemic has driven the need for internet services, and it seems almost unthinkable now to imagine a world without food delivery and e-commerce.

“Without online. without e-commerce, without getting our food delivered to us with a press of a button, how could we have survived the pandemic or during the lockdown. Therefore, we can all understand the importance and the impact that technology can bring to us. But like I said, tech can also create a lot of disruption,” said Chia.

“According to a number of reports, including that from the World Economic Forum, over 85 million jobs are going to be displaced, between now and 2025. So, it’s a big problem. However, more than 100 million jobs will be created. So that’s exciting,” he said.

“The problem is, there’s going to be a mismatch of skill sets and needs. So it’s really upon all of us, individuals, businesses, and the public sector to address this skill gap issue in terms of reskilling and retraining our existing resources.”

Chia was heartened that within Temasek’s portfolio companies, there are those who are already on the digital digitalisation journey and are addressing the changes. For example, he mentioned traditional banks, whereby many are shutting down their branches but are deploying their tellers into newer parts of the business.

“So, this can be done with planning, with deliberate efforts. With support from the government. We can manage this transition a lot better,” he said.

Another issue brought about by this digitalisation shift are cybersecurity threats. He said cyber attacks have gone up six-fold during the pandemic compared to pre-Covid-19 times.

“Individual companies cannot possibly address the threat. It is moving too fast, it is highly complex, and no one single company can handle it. So a smarter approach that can bear better results is collaboration, how we all can come together and work on defending ourselves.”

No magic wand to climate change

As for the hot button topic of climate change, Chia said that a collective effort is required. “Governments, companies, and individuals have to do our part. No single country or company can do it alone. Only collectively we can make an impact.”

“In Temasek we are committed to our net zero goal by 2025 and we will half the footprint of our portfolio by 2030. This is a very challenging goal for us in itself, but we believe that we will be able to execute that. Because many of our portfolio companies have also made the same commitment to do so.”

“We could have gotten to our goal of net zero sooner if we decided to sell off our stake in the pollutive assets that we own today. But we don’t believe in passing the buck to another owner, we believe in working with our existing portfolio companies and helping them get greener,” Chia said.

The deputy CEO shared three ways on how Temasek will keep to its green targets.

“First, whenever we are investing now going forward, it has to be aligned to our climate goals so that we can continue to lower our portfolio emissions. Second, we need to invest in businesses that will create a positive impact on carbon emission, for example, natural based solutions, carbon capture, or carbon storage. These are the new technologies that we want to get into and invest in them, so that we can bring this to the market.”

“We also need to contribute to how the overall system works in terms of carbon tax, and carbon trading especially for cross-border. As a country we may not be producing carbon, but we may be buying things for our benefit and another country is bearing the consequences.”

“If we don’t work together, then there’s a lot of things we cannot achieve – such as the potential Industry 4.0, Web 3.0, and the climate change agenda. If we don’t work together, we will fall way short of what all these can deliver to us.”

Featured Image Credit: Getty Images, Reuters