It was 2020, and Chuan Wei Zhang was attending a Zoom lecture for his Master’s at the hospital’s delivery ward. As his professor droned away, he was innately cheering on his wife who was delivering their firstborn.

Beyond the changing of diapers, group project meetings, sleepless nights and piles of assignments, Wei Zhang was also lecturing at a polytechnic and above it all, he relaunched his startup, Lendor, in September 2020.

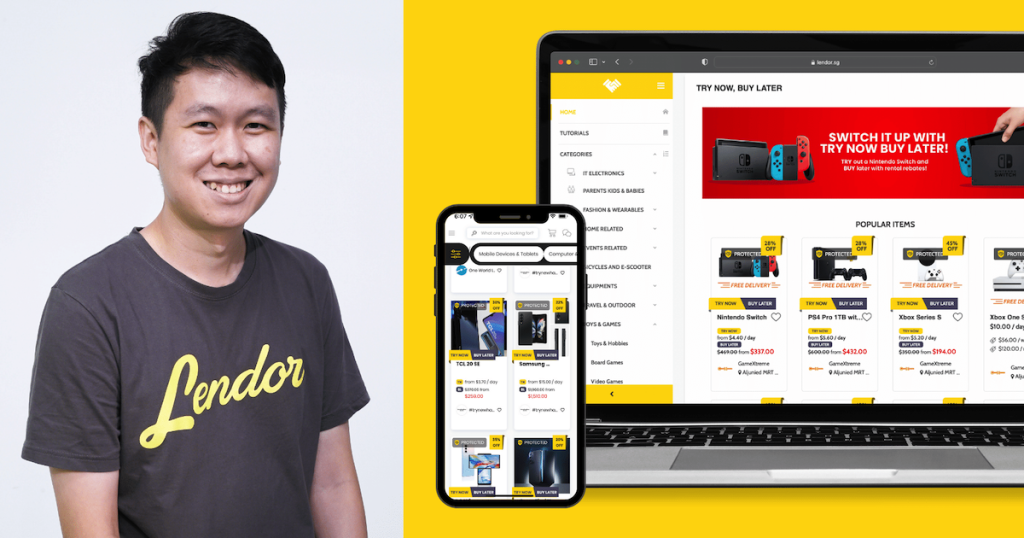

First founded in 2017, Lendor is an online item rental marketplace, allowing users to rent tech items like game consoles, vacuum cleaners and laptops. While it was first focused on allowing individuals to rent out their items, it has since shifted towards allowing businesses to rent out their items instead.

According to the 36-year-old, 2020 was a “challenging phase” of his life, yet it was something that he felt was necessary.

Today, Lendor has facilitated S$100,000 worth of transactions on its platform, with 50 merchants renting more than 3,000 items. And to top it all off, Lendor averaged a 40 per cent month-over-month growth in 2021, and is on track to see 10 times growth this year.

Challenges with Lendor 1.0

We launched Lendor app in late 2017 as a community project for consumers to lend items to other consumers through a sharing app. After Vulcan Post featured us in 2017, we garnered more than 3,000 shares that propelled us to be the top downloaded app that week… We were very heartened to see many Singaporeans interested to share their unused items at home.

– Chuan Wei Zhang, co-founder and CEO of Lendor

Despite the rise in popularity in 2017, Wei Zhang and his team faced various hurdles in keeping Lendor afloat.

For one, it did not have a clear monetisation route or business model to turn the free app into a sustainable business.

“We also faced operational challenges. When we first launched, we were all over the place trying to cover so many product verticals,” said Wei Zhang.

Aside from the range of product verticals, having to manage individuals’ different expectations and disputes was a time-consuming challenge.

For example, individuals may value their items differently, resulting in disputes in compensation when there is damage involved.

“An item had been damaged after being rented out, so we decided to compensate the owner. However, when determining the valuation of the item, the individual quoted its sentimental value,” Wei Zhang shared.

Pivoting towards business renters

Despite multiple challenges, Wei Zhang and his team at Lendor did not want to throw the towel early on as they believed that the rental marketplace idea was worth pursuing.

Then, a ‘eureka’ moment came.

Sometime in the middle of 2019, we decided to rebuild the technology from scratch after seeing large business presence on our platform to cater for B2C/B2B rather than C2C.

It is a different experience managing 1,000 consumers listing one product each versus two companies listing 500 products each.

– Chuan Wei Zhang, co-founder and CEO of Lendor

Now, businesses can rent their items on the platform, though they are also needed to fulfil handle requirements, such as sanitisation and servicing.

Charging a commission of between 15 and 20 per cent, Lendor supports these businesses through strategic partnerships with third-party insurance firms that protect accidental damages of up to 95 per cent of the repair costs, as well as delivery firms that provide same-day delivery, shared Wei Zhang.

Having struggled with handling too many product verticals early on, Lendor also decided to focus on consumer tech such as laptops and video game consoles, as well as rent out its own inventory of items.

They also onboarded another co-founder, Jason Heng, to helm its operations. Jason has previous experience at a third-party logistics firm and was the former Vice President at Lazada.

This rehash paid off — Lendor was given a new lease of life and saw profits since the first day of its relaunch. Additionally, disputes have become a rare occurrence as customer experience improved drastically.

Try Now, Buy Later

As momentum started to pick up for Lendor, it started receiving enquiries from customers who enjoyed the products they rented and wished to purchase them.

“This led us to believe that a large use case of our platform was for consumers to try out products through rentals before purchasing,” said Wei Zhang.

Inspired by their customers, it introduced ‘Try Now, Buy Later’ (TNBL), which allows users to try a range of products before deciding to make a purchase.

If users purchase products through Lendor, they would be able to get their rental money back. If not, they can simply return the item and rent something else.

“The TNBL model also sits very well with our merchants and today we have brands like Xiaomi, Lenovo and GameXtreme piloting the model,” said Wei Zhang.

Since launching its TNBL model at the end of 2021, Lendor has seen “a handful of transactions per month”, he added.

“However, we have evidence of customers simply choosing to buy from other platforms after trying on our platform. This year would be for us to close the loop and incentivise our customers to buy from our platform instead.”

An uphill battle that continues to pay off

For Wei Zhang, entrepreneurship is a “privilege” in Singapore as it is easy to start a business, and being able to use that privilege to make an impact is a huge motivation for him to keep growing Lendor.

When he first spoke to Vulcan Post in 2017, he shared that Lendor was to help foster the ‘kampung’ spirit and reduce the modern alienation between neighbours. That has not changed despite the company’s shift towards B2C and B2B.

The fundamental vision has not changed, which is to encourage a more circular way of consumption and ‘kampung’ spirit is part of this. We sometimes forget companies are made of people too and the B2C model allows businesses to build different sharing communities with us that is more professional and secure.

– Chuan Wei Zhang, co-founder and CEO of Lendor

Now armed with his Masters in Technopreneurship and Innovation, Wei Zhang has big plans for 2022.

One of which is to offer long-term rentals between three and 18 months while offering a higher proportion of the latest tech gadgets. This would benefit smaller businesses and startups, helping them “better manage their cashflow by being reducing capital expenditure”, he shared.

“Our goal is to create a more sustainable way of consumption through circularity. We want to do that (by) putting ourselves in the middle of every customer purchase decision. Do you want to pay with cash, credit card, BNPL or perhaps just rent?”

Featured Image Credit: Lendor