Disclaimer: Opinions expressed below belong solely to the author.

It’s not the best of periods for the crypto world with the wipeout of Terra Luna and a market-wide drop in cryptocurrencies, with BTC falling below US$30,000 for the first time since December 2020.

All of it is rather overshadowed, however, by the collapse of the NFT market since its autumn peaks.

Wall Street Journal reported drops of up to 92 per cent in the average number of sales between extreme days (i.e. the peak in September and the lowest days in April) and, on the whole, the market is down by 75.1 per cent in monthly averages in May — after a brief recovery from around -82 per cent last month.

The drop in active market wallets is a tad smaller, with 60 per cent gone from a maximum of little over a million last year — but still substantial, particularly for a novel industry that was expecting (and briefly experiencing) explosive growth.

Is this just a transitional decrease, or is the interest in NFTs waning across the board?

The “Bitcoinisation” of NFT

Careful observers will point out that while the number of transactions has gone down, the actual value saw a surge this month, not far from the figures it registered last year.

These observations are entirely accurate as the market received a boost earlier this May with the launch of metaverse NFTs by the company behind Bored Ape Yacht Club (BAYC), Yuga Labs.

The Otherside, as it is called, is promised to be a 3D MMORPG in the BAYC universe and the Otherdeed NFTs that the company launched are effectively unique properties that participants can buy in it.

The launch that broke Ethereum

When Otherdeed dropped on May 1, the interest was so high that it effectively broke the entire Ethereum blockchain, leading not only to a slowdown in transaction processing across the entire network, but also skyrocketing gas fees, which reached as high as US$44,000 just for the right to mint the NFT purchased.

Many were even more unlucky, with thousands of dollars lost to failed transactions that Yuga took on itself to refund later.

The collection sold out nearly instantly, netting Yuga over US$300 million. In total, close to US$900 million has been transacted for Otherdeed in the past two weeks, contributing to a spike in total sales figures, with one virtual plot fetching over US$1.6 million.

MYSTERY POTION SALE » Otherdeed 59906 That Features A 1/1 Mystery Potion Artifact Was Purchased By @nobody_vault For 625 ETH Or $1,635,000 USD

— The Bored Ape Gazette? (@BoredApeGazette) May 8, 2022

Full story coming soon: pic.twitter.com/qfb9mFXJwi

But, while some may consider it a positive sign that interest in NFTs is still high, I would rather suggest it’s a process similar to the one that is visible among cryptocurrencies — centralisation of activity around a single, or a few, top performer(s). Among currencies, it’s BTC and in the NFT market, it’s BAYC.

Therefore, as you can observe in the chart above, while the sales report occasional surges whenever popular collections make their debut, the overall number of sellers has gone down by 60 per cent — from over 500,000 in the autumn, to a little over 200,000 today.

The promise that NFTs could liberate the creatives, enabling them to make money off their work through its sale to supporters and subsequent trade appears to be in retreat.

The truth is, as ever, that most projects are destined to fail and the handful of top performers will rake in most of the money. Yes, there are examples of smaller contributors also achieving a degree of success, but they are rather an exception than the rule.

The NFT paradox

They say that “there’s no such thing as bad publicity”, but it seems to me that this old adage is being proven wrong in the NFT world (and a few other places).

While publicity generated by the most successful projects is getting eyeballs and contributes to the surge in interest among some, it is actually discouraging everybody else.

Despite the fact that the idea behind NFTs is sound and practical, giving digital creators almost infinite ways of cultivating communities and monetising benefits from participation in them, most people are likely unaware of these promises.

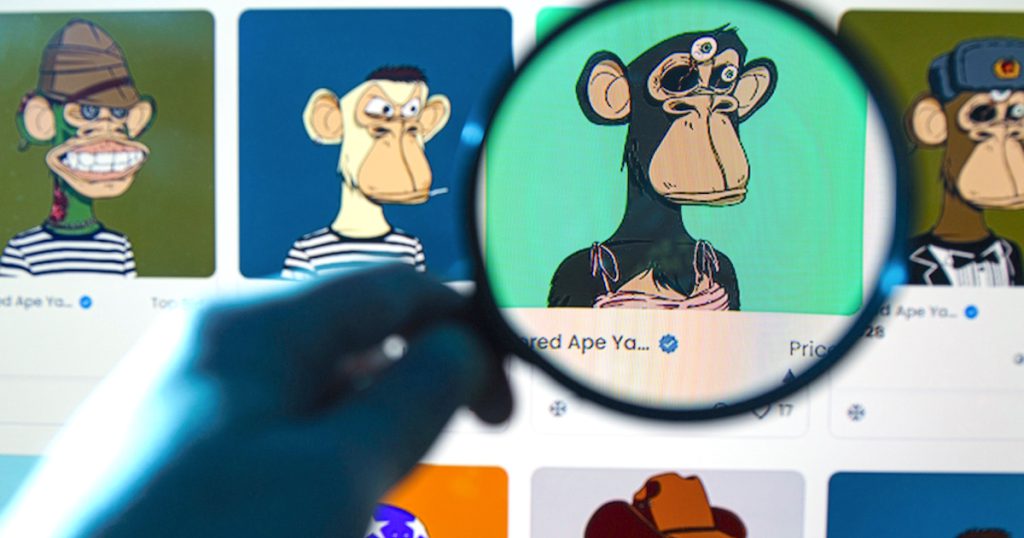

What they are aware of, however, is the incessant bombardment of headlines reporting on yet another collection of thousands of JPG avatars of monkeys, birds or some pixelated cartoons which sell for obscene amounts of money.

Some hail it as the next big thing and another way of getting rich quickly on the internet, but regular users smell a scam and stay away because it’s too outrageous and too unbelievable.

As a result, the market turns inward. Instead of attracting more people with simple, useful services, it becomes cult-like, while everybody else is trying to keep their distance.

It’s a shame, of course, because the technology itself could — when deployed properly — transform the ways we interact online and how entire communities become self-sustainable economically (without the need for third-party middlemen), rewarding their owners and participants alike.

Alas, it has become a victim of its own success, or at least success of the few who attract most of the attention (not always for the best reasons).

So, answering the question from the title: is this collapse in activity by both buyers and creators a sign that NFTs are just a fading fad or is the industry growing more mature? In my view, it’s the former but hopefully preceding the latter.

The interest is clearly waning among both the users and creators, but it may actually help the industry in the long run. The hype never lasts, so what matters is what is left after the dust settles.

It’s not BAYC that we should look at, but smaller communities of people who know what they’re doing and support work done by people they admire. NFTs will hit the mainstream when they’re no longer seen as a get-rich-quick scheme. The question is, however, whether they are able to shake off this label with time.

Featured Image Credit: Stewarts Law

Also Read: Forget about decentralisation: Singapore wants to become a hub for centralised crypto