A currency is defined by three criteria. It must serve as a store of value, a unit of account, and a medium of exchange.

When Bitcoin was created back in 2008, the third criteria seemed to be its main focus. Distrust in banks was growing following the Great Recession, and there was a desire to reduce consumer dependence on such third parties.

Through Bitcoin, people would be able to exchange value with one another without the need for an intermediary.

On this day in 2008: Bitcoin white paper released by Satoshi Nakamoto pic.twitter.com/3fsPKqCYdY

— Jon Erlichman (@JonErlichman) October 31, 2018

In the years since, this primary focus seems to have shifted. For most people, crypto derives appeal not for its function of exchange, but its use as a store of value — or more aptly, as a speculative investment.

To put things into perspective, compare it with a fiat currency. Although the Singapore Dollar is treated as an investment in forex markets — primarily by institutional investors — its primary use is to facilitate everyday transactions.

The opposite seems to be true for most crypto coins. As it stands, a majority of investors seem to approach crypto like they would equity instruments, not fiat currencies.

In a survey conducted by Bakkt in 2021, it was found that the most common reason for owning crypto — as chosen by 60 percent of respondents — was as a long-term investment. Less than a quarter of respondents registered an interest to use crypto for online purchases.

Perhaps, this is due for a change though.

Coming full circle

In Singapore, more and more merchants have begun accepting crypto payments. From luxury fashion brands like Gucci to cocktail bars such as Maison Ikkoku, accepting crypto seems to be a way to prepare for the future.

Digital Treasures Center, a Singaporean company which provides crypto payment services, has seen an influx of clients this year.

In recent months, we have seen and engaged a wider range of merchants, from medical to education, which demonstrates the interest surrounding crypto payments in various industries.

– El Lee, co-Founder and Chief Operating Officer at DTC

In addition to facilitating a new payment option for consumers, a crypto payment gateway can be directly beneficial for merchants as well. The transaction fees are far lower than those of card payments, there are no losses incurred due to chargeback claims, and money is received within seconds of transfer.

“Given the clear benefits, more merchants will start to enable crypto payment,” Lee speculates. “As the number of avenues to spend crypto increases, consumers will be able to select an easier mode of payment over traditional rails. Crypto adoption will take time, but it is inevitable.”

Novelty or norm?

In 2021, the Bank of Singapore issued a research stating that privately-issued cryptocurrencies had the potential to displace safe haven assets such as gold, but it was highly unlikely that they would replace fiat currencies.

The volatility of cryptocurrencies makes them an inefficient unit of exchange. Their limited supply makes them unable to facilitate growing economic activity, and governments are not likely to tolerate direct challenges to monetary sovereignty.

– Mansoor Mohi-uddin, Chief Economist at Bank of Singapore

As merchants adopt crypto payments in Singapore, this statement is proving to be true. For one, they aren’t able to price their products and services in crypto units. This is because of both price volatility and regulatory restrictions.

Crypto doesn’t fulfil the second function of a currency when it comes to valuing real-world goods. Because of this, it’s tough to picture cryptocurrencies driving out traditional payments altogether.

“We do not think other modes of payment will become obsolete, just as cash remains useful in many societies. However, crypto payment will result in margin compression for traditional payment modes. Incumbent players would be forced to adapt crypto payment or be faced with being priced out,” says Lee.

He further notes that this would only happen in jurisdictions where crypto isn’t outlawed altogether.

The decentralised economy

Crypto might not be the first choice for real-world transactions, but it is leading the charge in the decentralised sphere.

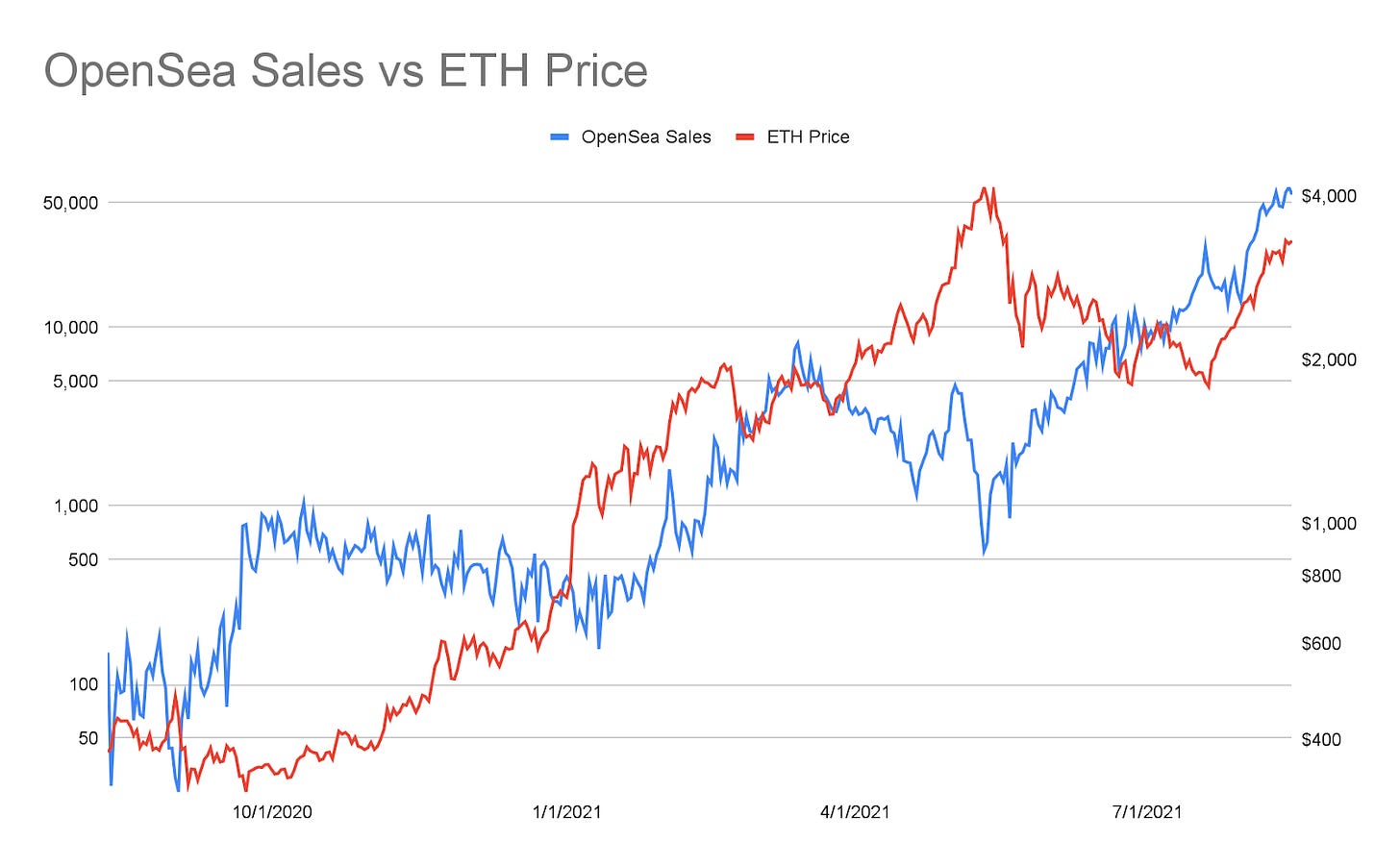

Most notably, with the emergence of NFTs, we see products which are valued and traded almost exclusively using crypto.

The prices of popular NFT collections often remain unchanged, regardless of how their underlying cryptocurrency is performing. This goes to show that the market doesn’t always take into account the fiat value of NFTs when making trades.

We also see the gaming industry embracing crypto for in-game transactions rather than fiat currency. Crypto provides utility as a fundraising mechanism for indie developers, and facilitates play-to-earn incentives for gamers. By doing so, it proves to be a lot more versatile than fiat currency.

As metaverse concepts continue to emerge and virtual assets establish credibility, crypto adoption is being spurred on for reasons beyond speculative investing. Crypto is emerging as the currency of choice in the digital world.

Featured Image Credit: Blockbuild.Africa