Recently, I’ve been coming across quite a few personal finance accounts on Instagram. These accounts publicly share their net worth, income, spending habits, and investment portfolios all on the internet.

As someone who admittedly doesn’t track her finances, I found this fascinating. I’ve always felt like financial journaling was daunting, but the way they did it seemed empowering and digestible. So, I reached out to them to learn more about their journey. They are:

- Colette of Colette’s Finance Journey;

- Yahya of My Ringgit Book;

- FIRE Dude of FIRE Dude Malaysia;

- Dr Sulekha Sivapatham of Budget With Sue

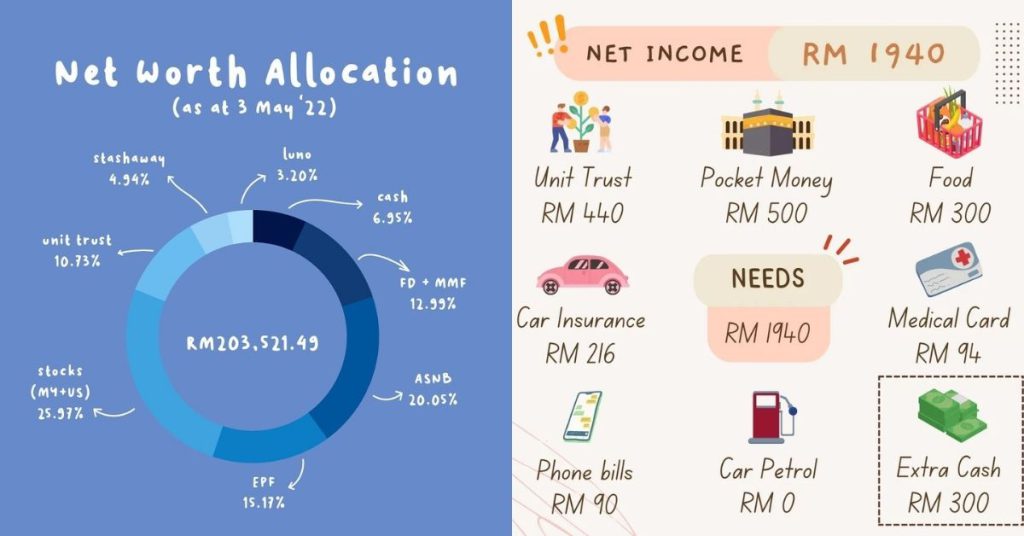

These accounts have differing approaches to their sharing. For instance, My Ringgit Book, which has a sizable following of 7K accounts, uses lots of illustrations in its post.

The person behind it, Yahya, is a project engineer in the oil and gas industry. He believes people are interested in following his journey because of three things. First, his content is simple and approachable for youngsters who lack financial literacy.

The second reason is because of his struggles’ relatability. The final reason is because of his graphic design, which is admittedly what drew my attention too.

Colette, a 25-year-old decision scientist, typically makes informational postings with the bulk of her explanations in the caption.

Dr Sulekha, a medical officer, posts updates on her journey while directing viewers to her YouTube channel where she talks in depth about her financial stories.

FIRE Dude, an engineer in oil and gas like Yahya, creates straightforward Excel sheet-like posts at the end of each month.

Despite their different formats, though, they actually share similarities in their motivations and intentions.

Inspired to inspire

The idea to start sharing their finances didn’t just come out of nowhere. All four of the creators were inspired by others who came before them.

Colette began her financial journey in January 2021 amid the MCO. Whilst surfing YouTube, she came across Malaysian personal finance YouTubers such as SuyinOng and Mr Money TV.

For FIRE Dude, who started his account in 2019, it was Leigh from Dividend Magic and Aaron Tang of Mr-Stingy, a familiar name at Vulcan Post, who sparked his journey.

“These two characters exposed me to a whole other world, i.e. the FIRE movement,” FIRE Dude explained. “The idea of being financially free and living out my days doing less stressful work enticed me.”

Did you know: FIRE stands for Financial Independence, Retire Early. As the phrase suggests, it’s a financial movement that encourages people to gain financial freedom at a younger age to retire sooner.

Created on January 22, 2022, My Ringgit Book was inspired by retirement specialist Balqis and My Wealth Book on Instagram.

Out of the four, the newest account is Budget With Sue. Dr Sulekha started her account in March 2022 after years of watching budgeting content on YouTube.

Keeping count for accountability and more

For Colette, accountability is a key reason why she documents her finances online. More importantly, though, she wants to raise awareness about personal finance.

“Personal finance isn’t a part of our education syllabus and its importance is understated,” Colette explained. “Friends that know I am passionate about personal finance often ask me to help guide them navigate the options available for the finances.”

Yahya also sees his account as a way to keep himself disciplined. Furthermore, it gives him a healthy amount of pressure that pushes him to be more serious about his dreams.

Other than awareness and accountability, another reason for journaling their finances is to keep a public record of their journey. As Dr Sulekha puts it, her account has become a time capsule that shows her growth as a personal finance enthusiast and a person in general.

FIRE Dude agrees with this sentiment. He said posting his journey online gives him a sense of accountability that keeps him on track to reach his financial goals as well as reflect his journey.

“The monthly incremental steps seem small to me in the short term. But similar to looking back at the trodden path from the peak of a mountain, it always hits me just how much I’ve achieved,” he shared.

Public sharing, with some privacy measures

Colette is actually a pseudonym, as the decision scientist wants to make sure her privacy is protected. While she does share some personal details such as her job, she doesn’t reveal critical information such as where she works or what she looks like.

On the other hand, Dr Sulekha does show her face on her account and on YouTube. But she makes sure to blank out her salary and bill details. The net worth she reveals is also more generic, and she doesn’t share her assets and liabilities in detail.

“Anytime I choose to share new information online, I would poll my friends and family to see if anyone has any concerns about it, and then make an informed decision from there,” she shared.

The oldest account, FIRE Dude, doesn’t really worry over this. He believes his finances are nothing more than just numbers, as he only posts the current value of his investments and loans.

Besides, FIRE Dude is a strong proponent of pay transparency, even before the rise of popular Instagram account and pay transparency advocates, Malaysian Pay Gap.

He even added that his friends’ openness on their compensation packages allowed him to negotiate a 45% higher basic salary for his new contract in Qatar.

“I firmly believe that having a secretive attitude towards your salary only serves to benefit the employer, so I could definitely get behind a movement to break that social taboo,” he said.

Comparison within the community

Given the public nature of these accounts, it may lead to feelings of envy or dissatisfaction when one person sees someone else making more money than them.

“I think that is part of the life we have now, with the influence social media has on us,” Dr Sulekha admitted. “I’m definitely not immune to comparison within the community, especially with other Malaysians from similar backgrounds as me.”

However, she tries to focus on the good. This includes being excited for others’ achievements and her own personal progress.

Colette also said that it’s in our human nature to compare. However, she said it’s important to note that everyone’s journey is different.

“It’s important to remember that it’s called ‘personal finance’ for a reason,” she said. “Everyone has a different background, income, monthly commitments, mindset and habits.”

Similarly, she said that no two people have the same risk tolerance. Some might be stock investors, some property investors, others only keep their money in the bank.

“As I find my way in this community, I learn that none of us are perfect,” she said. “I am more focused on my own journey but am happy to celebrate others’ money wins!”

Yahya shared an analogy he turns to when he compares himself to others.

Imagine you are in your Perodua Kelisa, cruising along on a 50 kilometre per hour lane. And you are at the stoplight. You look beside you and you see a red-hot Ferrari. And the moment that light turns green, that Ferrari speeds right ahead and it seems like they are light years away. Until a couple of minutes later, you are at the next stoplight, guess what? You look beside you and the same hot Ferrari is beside you, again.

Yahya of My Ringgit Book

What he means to convey is that no matter how fast or slow you think you are going, at the end of the day, you are going to get to the destination that you need to get to.

“Every time you find yourself comparing your progress to others, always just put your head down and focus on your own stuff,” he advises.

“When you are too busy shoulder-checking to see what everyone else is up to, you are not going to be able to focus and put your energy towards the road ahead.”

On the other hand, FIRE Dude doesn’t see comparison as all bad.

“Let’s be real here, there’ll always be that feeling of envy. But the trick is to not let it overpower me. In fact, when harnessed effectively, envy can be a powerful motivator,” he pointed out.

As an example, he said that his peer, Rock Bottom, unknowingly motivated him to migrate overseas.

Of course, that isn’t to say he never struggled with unhealthy comparisons. Instead, he has come to understand that each person’s situation is unique with its own privileges and hurdles.

Now is the right time

If you’re thinking of starting a financial account yourself, here’s what these creators have to say.

“Do it!” Colette encouraged. “The personal finance community is a big one. Start following a few and you’ll start getting a lot more suggested profiles. It’s a space to share your wins for others to celebrate with you or a place to ask for advice.”

Colette has also gotten positive messages from people who say she has impacted them to start their own page, which she sees a big win.

“My advice is to use whatever that you have right now to gain as many skills and knowledge as possible,” Yahya added. “Always be humble to learn from people no matter their age or backgrounds.”

Dr Sulekha’s advice is: “Go for it. If you wait for the ‘right time’ to start, you will always have a reason why now is not the ‘right time’. Start slow, start small, and you will definitely grow, be it your savings or an account of your own.”

- Read other articles we’ve written about personal finance here.

Featured Image Credit: Colette’s Finance Journey / My Ringgit Book