GXS Bank (GXS) launched today (August 31) Singapore’s first digital bank for consumers and businesses, which is backed by a consortium consisting of Southeast Asia’s superapp Grab, and Singtel.

The Monetary Authority of Singapore (MAS) previously awarded the wholesale banking license to the Grab-Singtel consortium in December 2020.

GXS aims to redefine banking services and improve financial inclusion in Singapore for individuals and small businesses who have unmet financial needs.

Its game plan is to address the banking gaps that financially underserved customers face today. These improvements will also raise banking standards that benefit everyone.

The bank also aims to improve financial inclusion and to drive financial revolution for its customers through the secure and ethical use of technology and data.

GXS is also the first digital bank in Singapore to be awarded the Data Protection Trustmark by the Infocomm Media Development Authority (IMDA), which is a testament to its data protection practices to keep customers’ personal data safe and secure.

“GXS is a homegrown bank on a mission to support the needs of the entrepreneurs, gig economy workers, and early-jobbers in our community. To start, we are challenging the notion of what a basic savings account could do to support their goals and dreams,” said Charles Wong, Singapore CEO of GXS.

“Over the coming months, we will also tackle other obstacles that hinder consumers and small businesses from reaching their goals sooner, such as growing their wealth or accessing credit.”

The GXS’ digital bank app will be made available on Apple’s App Store and the Google Play Store from next Monday (September 5). The bank’s services will be rolled out progressively to consumers thereafter, starting with selected employees and underbanked customers within the GXS, Grab and Singtel ecosystem.

Different pockets of funds for different goals

GXS’ first financial product is the GXS Savings Account, which is designed to address the gaps that hinder consumers such as those who are gig economy workers, self-employed entrepreneurs, and early-jobbers from reaching their saving goals.

For example, given that cashflow is important for this group of individuals, the GXS Savings Account enables them to earn interest daily at 0.08 per cent per annum. Interest is accrued daily (up to five decimal places), and will be credited to the GXS Savings Account with every S$0.01 earned.

At launch, customers can deposit up to S$5,000 into their GXS Savings Account.

GXS Savings Account-holders also do not need to worry about being penalised with fees should they need to withdraw their savings as there is no minimum balance requirement.

The GXS Savings Account is also designed to encourage customers to stay disciplined with their savings without the hassle and stress that may be associated with this activity.

Understanding that consumers in Singapore have the habit of allocating different pockets of funds for different goals, GXS has an intuitive feature within its Savings Account known as Saving Pockets that enables customers to do just that.

Users can create up to eight pockets at a time, and funds can be transferred anytime from the Main Account to individual pockets. Each pocket earns 1.58 per cent interest per annum accrued daily.

In designing Pockets, GXS incorporated techniques such as visualisation and smart nudges to help its customers develop and sustain a habit of saving.

For example, saving is no longer just setting money aside in an account with a string of numbers. Instead, GXS customers can customise their Pockets to make saving for their dreams personable.

In addition to naming their Pockets, customers can choose to tag their Pockets to any photo which resonates with their goals.

To help them stay on track with their saving habit, GXS also sends timely nudges to customers, such as encouraging them to top up their Pockets when they’re close to their goals or cheering them on the progress they have made.

“A Gen Z bank”: what does it mean?

A digital native, GXS, is built to stay nimble and agile alongside customers as their needs change over time and their expectations are continually shaped by technology.

For example, GXS has built a data infrastructure that enables the bank to analyse data swiftly in order to generate extensive and meaningful insights.

GXS uses these insights to develop, refine and iterate new features, services and conversations that matter to its customers.

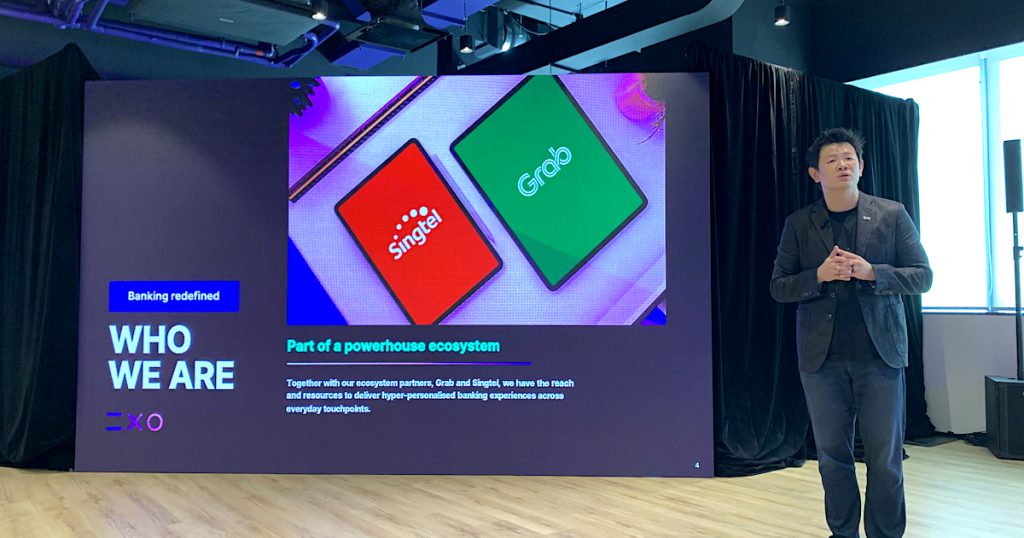

“GXS is uniquely positioned to learn and to refine the banking experience so that it is extremely personalised and relevant to customers because we are part of a powerhouse ecosystem that includes Grab and Singtel. Their platforms are used daily by more than three million Singaporeans,” said Wong.

“The frequent interactions between consumers and the platforms within our ecosystem provide us with deeper and sharper insights on what our customers need and how we can serve them seamlessly across all touchpoints within our ecosystem.”

In the coming months, GXS said it is looking to leverage its ecosystem, consisting of GXS, Grab and Singtel, to provide banking services to selected customers seamlessly across multiple platforms.

The meaningful insights harnessed from customers’ interactions within the ecosystem will enable them to understand, refine, and converse with them in their preferred manner.

As customers continue to make transactions and interact within the ecosystem, GXS is able to understand their banking needs more deeply and offer them hyper-personalised support.

Featured Image Credit: Vulcan Post