Disclaimer: Opinions expressed below belong solely to the author.

I have to say that few things have driven me up the wall in recent weeks as the incessant whinging about the seemingly “overpriced” graphic processing units (GPUs) in the PC market.

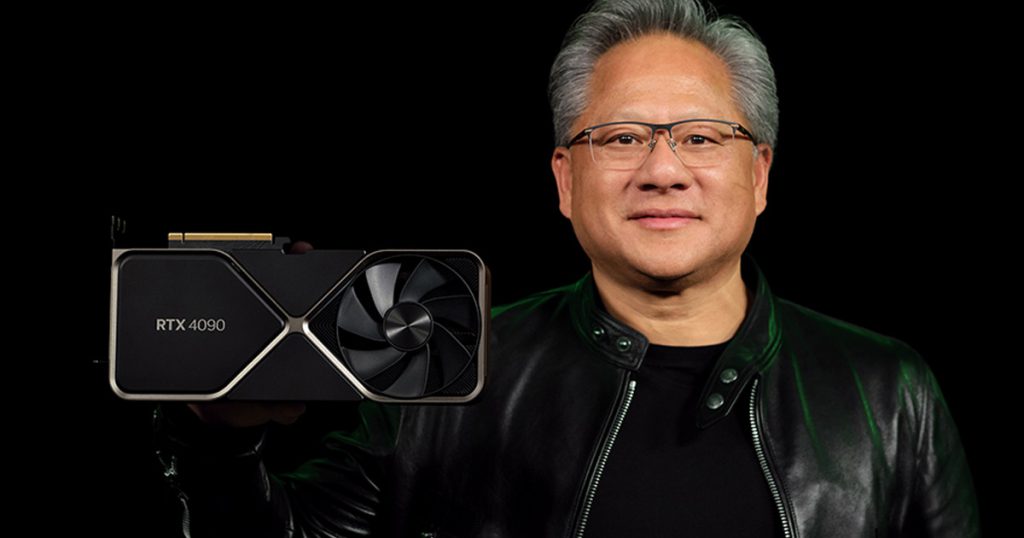

The main target of public scorn has been Nvidia, which has launched its 40-series cards in the fall, starting with the flagship RTX 4090, retailing in Singapore at an eye-watering S$2,700 (though many third-party models are around S$3,000).

And I get the disappointment — it’s expensive, it costs several times as much as a PlayStation 5 or Xbox, a good laptop, or an entire desktop PC (depending on the configuration).

But it’s also worth it, being the absolute cutting edge of graphics performance on PC, which absolutely blows out of the water all of the previous generation of cards. All of a sudden, a 3090 looks like a mid-tier product at best.

The flagship 4090 was followed by 4080, and recently launched 4070 Ti (originally named 4080 12G).

The same wave of global moaning about its pricing followed, despite the fact that Nvidia brought down its MSRP to US$799, from the original US$899 (in Singapore, the cards — available since yesterday — retail around S$1,300 to S$1,500).

Similar accusations of price gouging followed — “Nvidia is ripping customers off! The company is the scalper now! My 1070 Ti cost US$450 at launch!”

Matters aren’t made better by popular tech YouTubers like Linus Tech Tips, JayzTwoCents or GamersNexus (among many others, as they all sing to the same tune), going on rants about high prices of new cards, with LTT’s founder even swearing off putting a 4090 in his computer ever over its US$1,599 MSRP.

But as they spend hours talking about the prices, they somehow don’t ever wander into the difficult topic of economics of manufacturing of cutting edge electronics. They will show you 127 different performance charts, but not one showing just how expensive everything in the supply chain has gotten.

Inflation depends on what you buy

If you think average inflation of seven per cent is bad, how about learning that container shipping costs have spent over a year at around 10 times the pre-pandemic prices? That’s 1,000 per cent (or more in some cases).

And everything has to be shipped — not only the products themselves, but all of the raw materials needed to make them.

Semiconductor companies spend the past year trying to clear their backlogs of pandemic orders, but so did everybody else — and competition for shipping capacity created enormous (and very expensive) shortages.

Speaking of raw materials, they also took the world for a wild ride. Here are the prices of silicon:

Very nearly every other material used in some way in electronics manufacturing has gone up in price between 10 and 500 per cent across the last two years. It’s hard to expect it would not have any impact on the prices of finished products:

The world is so interconnected that people often forget that some event that may feel obscure to you can significantly impact the price of an apple in your basket.

In this case, the Russian invasion of Ukraine has not only sent energy prices up into the sky, together with many metals mined in both countries, but also prices of neon gas. Close to 90 per cent of the highest grade of neon gas comes from Ukraine, and neon is used in lasers performing precise cuts in semiconductor manufacturing processes.

On top of that, let’s not forget about the global talent crunch, together with inflation pushing prices of labour upward.

If your workforce is more expensive, if your materials have gone up in prices — sometimes by two or triple digit percentages — and if your transportation has at times cost 10-fold of what you paid in the past, will you not be forced to raise your prices? Come on.

Is Nvidia ripping us off?

By now, the answer should already be clear, but let’s take a look at the most telling chart of all — the company’s net margins:

Using the latest data, Nvidia’s net margin for the preceding year dropped to around 20 per cent in October, from the highs of up to 35 per cent. In either case, it is quite large for any business, but it isn’t so large to accommodate massive price drops of products on the shelves.

After all is said and done, Nvidia takes about 20 per cent home — but that’s on its sales to third-party manufacturers, not the shelf, retail price. Even if Nvidia sets MSRPs, they still have to include this.

Nvidia’s partners make about 10 per cent in gross margins (excluding expenses like marketing), so the company still has to sell the boards at some discount, before cooling solutions are applied, unique software integrated and so on.

This means Nvidia is taking 20 per cent on maybe 80 per cent of the retail price (excluding sales taxes in different countries), which equates to about 16 per cent of its stated MSRP, on average.

But it’s clear that the premium segment — i.e. 90-series cards and enterprise GPUS — have had higher margins, effectively subsidising mid and lower tier offering (a bit like business class passengers on a plane allow us to get a cheaper ride in the economy).

So, we’re currently looking at maybe 10 per cent margin on your mid-tier card like 4070 Ti, perhaps a bit more. That is all the company takes home. On a US$800 priced card, this is US$80 to US$100 at most.

As you can see, even if it cut its margin in half, it still wouldn’t translate into a meaningful drop in what you have to pay. Would US$50 really make a meaningful difference?

Will prices ever come down?

Most likely not.

First of all, there’s still considerable global turmoil as a result of Russian invasion of Ukraine. This will keep prices of energy as well as many raw resources high.

Transportation may begin to normalise, but it’s only one of many pricing factors.

Most importantly, however, labour is only going to get more expensive, since people typically do not agree to salary cuts, unless in the most dire circumstances (like impending bankruptcy of the business).

In fact, everything else that is not directly subject to highly fluctuating market prices (like commodities), is not going to become cheaper.

The only hope is that our earnings will catch up to the prices — as they, historically, always have. So, if you want to afford the latest GPU, your best bet is to fight for a raise or get a better paying job as those pricey cards are here to stay.

Featured Image Credit: Nvidia