Ever felt like you were stepping onto a minefield when it comes to managing your personal finance?

Well, you’re not alone. In fact, one in two adults in Singapore feel the same way. 55.2 per cent of adults consider themselves as financially illiterate, and this is most prominent among young adults aged between 18 and 24 years old.

You’re not to blame though. There are many pain points when it comes to managing finances — there’s too much guesswork when it comes to planning, and too many variables for the layman without knowledge in excel to plan ahead.

You could always turn to a financial advisor to plan out your personal finance and take things out of your hands, but you’ll never know if they have your best intentions at heart.

After all, personal finance is personal. There’s no one-size-fits-all solution.

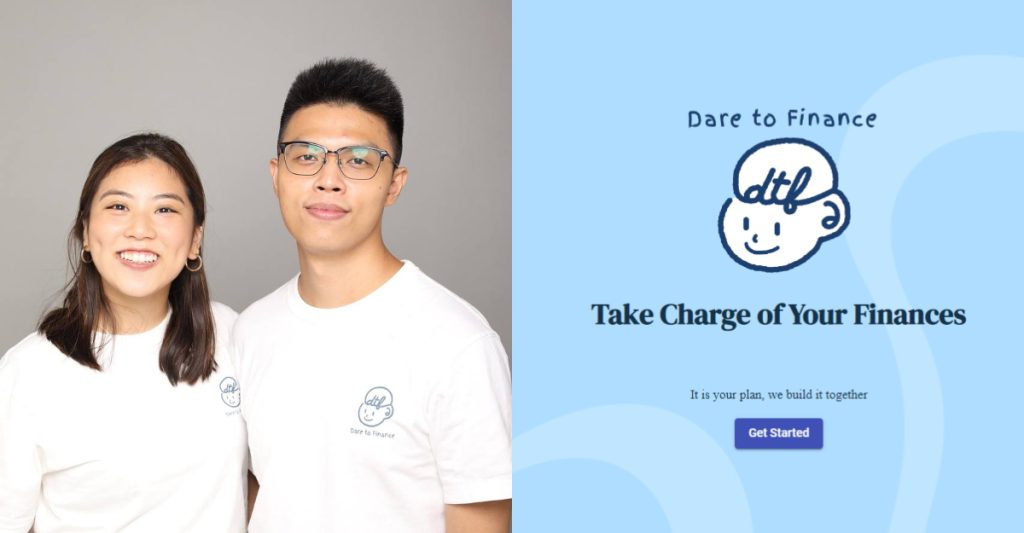

This was why Darren Lee Jian Wei founded personal finance platform Dare to Finance — to help Singaporeans to make informed decisions when it comes to personal finance.

Giving their “2 cents on personal finance”

When Darren was still studying at the National University of Singapore back in 2019, he landed a job as a financial consultant.

Darren had always felt strongly about managing personal finances, but taking up the job made him realise that the financial advisory landscape in Singapore was subpar, and left a lot to be desired.

Particularly unsatisfied with the sales-driven approach of financial advisors, he spearheaded the launch of Dare to Finance in 2020.

Initially starting out as a platform to share his perspective on personal finance on Instagram, Dare to Finance aimed to help individual to take charge of their finance and give its “2 cents on personal finance”, with financial education as its top priority.

This is why they came up with the tagline: “Just a platform to give our 2 cents on personal finance because the 98 cents is up to you!”

As Dare to Finance rose to popularity on Instagram, Darren was finding it hard to manage the platform alone. After all, he was still a full-time computing student and a part time financial advisor.

This was when he was joined by his former classmate from Ngee Ann Polytechnic, Sakura Seet, who is also passionate in personal finance matters.

She held on to her full-time job as a digital marketeer while managing Dare to Finance’s brand accounts and a year later, Sakura also became a financial advisor to help out with the platform’s advisory demand as well.

Fast forward to today, both Sakura and Darren have left their full-time jobs to fully focus on Dare to Finance’s growth.

Focusing on content, financial advisory and fintech

The personal finance platform now comprises three pillars: content, financial advisory and fintech.

Primarily, it produces finance and lifestyle content on Instagram and Medium. Both Sakura and Darren occasionally delegate a day or two to interact with followers on these platforms and answer their personal finance queries.

“We don’t earn anything from this, but it’s just a small action on our part that we feel will go a long way,” said Sakura.

Meanwhile, Dare to Finance’s financial advisory pillar, veers away from the typical sales and product-centric approach and is structured to take on an educational-first approach.

We want our advisory department to consist of advisors that assist beyond just products. All of our advisors go through mandatory finance training and are equipped with current financial news and knowledge.

– Sakura Seet, co-founder of Dare to Finance

Users can visit their website to schedule a free appointment with a financial advisor at their convenience.

Once you have an idea of what you need — whether it be investment, insurance, or retirement planning — the advisor team will review any relevant documents you have and provide you with an overview of your current commitments and any terms and conditions that may have been missed by previous advisors.

The team will also answer any questions you have about your current plans and, if necessary, recommend suitable insurance products to fill any gaps in your plan.

Sakura emphasised that Dare to Finance has mandated that there would be no sales during the financial consultation. “This is to prevent any impulse purchases from the client’s side, and to give them ample time to think about the team’s recommendation.”

Currently, Dare to Finance is prioritising the growth of its fintech pillar, which aims to utilise technology in order to make financial planning fun and hassle-free.

When the company first started out, Darren helped his pool of clients create a personalised 32-page financial “guidebook”, meant to provide clarity and help its them set their financial priorities on the right direction.

Although the guidebook received positive reviews, it was extremely time-consuming and not scalable. To address this, Darren decided to use his coding skills to automate the process. “And that’s how our tech arm started,” said Sakura.

Subsequently, Darren devoted most of his time towards developing their own software, called the Financial Pathway. Sakura described it as a “calculator that puts together different aspects of one’s finances and projects it into the future.”

They eventually tested out the personalised financial planning tool with over 200 of its followers, which received positive feedback and became a mainstay of the platform. They are currently building the ready-to-launch version of the Financial Pathway, which is expected to roll out by April 2023.

Over 10,000 followers in two years

Starting off as a mere Instagram page, the company has made it quite far — it has amassed over 10,200 followers on Instagram and has over 1,000 subscribers on Telegram.

In 2022, Dare to Finance decided to scale it into a fintech company, which led it to be incubated under Singapore Management University (SMU)’s Institute of Innovation and Entrepreneurship.

Their involvement in the SMU Incubator Program has led to the improvement of their services and streamlining of offerings. The company received regular feedback from investors through the program, which helped them to refine their offerings.

Partnering with the likes of CPF, StashAway, Syfe, and moomoo to work on branded content on its platform, the company has successfully achieved profitability for its content arm. The revenue from this is used to finance its fintech development.

However, not everything is as rosy as it seems. A key challenge the business is facing today is to keep up Singaporeans’ interest in managing finances.

“We all know the importance of good financial habits, but unfortunately, not everyone cares as much as they should,” commented Sakura.

Many individuals in Singapore are still spending more than they can afford to upkeep a lifestyle they can’t maintain — and it is these people that need more help with their finances.

Although COVID-19 and inflation has propelled the interest of Singaporeans in personal finance, many have yet to take the initiative to sort their finances. “If you look at the OCBC financial wellness index, you’ll still see that we’re still far from ideal.”

To tackle this problem, Dare to Finance plans to embed lifestyle and gamification into its tools, and leverage its financial advisors to reach out to these individuals.

Growing the business with more funds, AI integration

In Singapore, aside from payments, tech in the personal finance space has not seen much growth.

The vast majority of tech in this space are mostly revolved around expense tracking, which help users keep to a budget that they have set out for themselves.

While these apps may be useful, Sakura explained that coming up with a budget tailored to your short term and long term goals is not easy. “Many resort to an excel sheet in the end to manage their finances which is not necessarily friendly to everyone.”

Hence, Dare to Finance aims to revolutionise the personal finance space and build an ecosystem that enables Singaporeans to work towards and achieve their financial goals. In order to do this, the company plans to incorporate artificial intelligence (AI) into its offerings to give users insights and guide them through their personalised financial journey.

To further bolster their progress in the personal finance industry, it also plans to start seeking funding from venture capitals and build a recognisable local brand synonymous with Singapore.

Featured Image Credit: Dare to Finance