Disclaimer: Opinions expressed in this story belong solely to the author, unless stated otherwise.

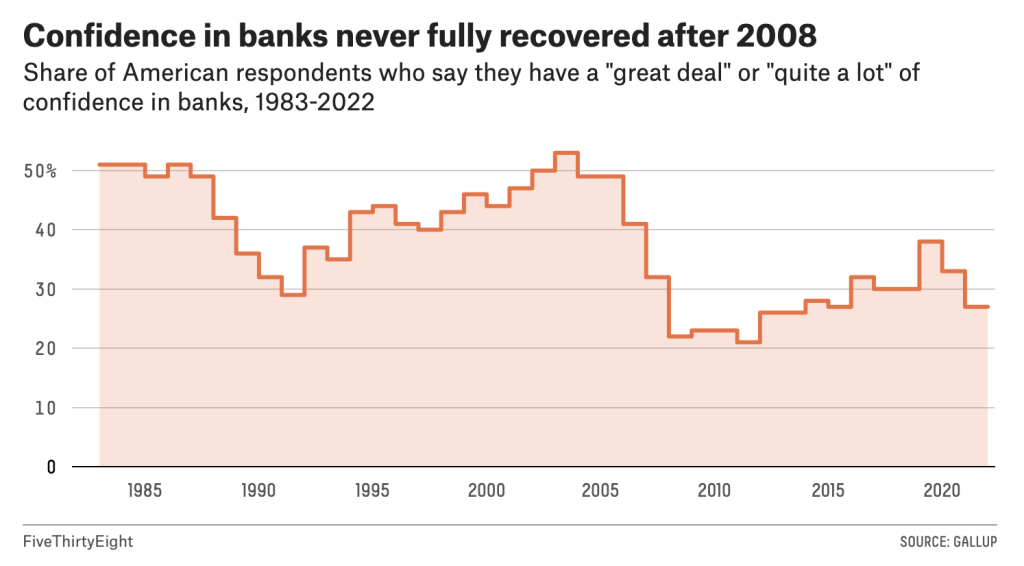

Bitcoin was created as a response to the 2008 Financial Crisis, when trust in the American banking industry reached unprecedented lows. Over a decade since then, these trust levels have continued to falter, remaining well off the highs seen in the late 90s and early 2000s.

In countries where the banking system is perceived to be unreliable or inaccessible, the Bitcoin vision holds stronger footing. It can be argued that there’s a demand for this transaction system, which is free from third-party involvement.

However, what does Bitcoin offer a country like Singapore? As per a survey published by the Association of Banks in Singapore (ABS), 74 per cent of respondents reported high levels of trust in the country’s banks. In contrast, this figure was only 27 per cent for a similar survey conducted by Gallup in the US.

Singaporeans have placed more trust in banks in recent years, while their confidence in crypto has fallen after last year’s market crash.

It’d seem there’s not much use for privately-issued money in the city-state. DBS CEO Piyush Gupta believed so at Singapore Fintech Festival 2022, where he argued that private money wouldn’t replace public money.

He added that digital currencies would offer little in terms of retail use, since services such as PayLah and GrabPay are already very efficient means of transacting.

With that in mind, Bitcoin is unlikely to ever overthrow the Singapore Dollar. However, there are other utilities — from stablecoins to tokenised carbon credits — which could help propel crypto in Singapore’s future. Ironic as it may seem (given Bitcoin’s origins), the country’s banks and regulators stand to play a key role in any such innovations.

On- and off-ramps

Under the (well-founded) assumption that crypto won’t become a Singaporean’s primary currency, users will always have a need to convert between crypto and fiat. This can’t be done without an intermediary.

Crypto exchanges rely on banks to store fiat currency and facilitate exchange whenever a user enters or exits their platform. For example, Coinbase partnered with Standard Chartered Bank in March to allow instant transfer of Singapore Dollars in and out of its platform.

Even for users investing in DeFi or storing their crypto in self-custodial wallets, when it comes time to convert their funds back to fiat, they’ll have to rely on a centralised exchange and by extension, a bank.

Coinhako’s reliable fiat-crypto rails enable us to remain relevant and competitive. Without access to our banking partners, on and off-ramp frictions will greatly hinder liquidity and trading volumes. With Coinhako’s focus on providing reliable access into and out of the crypto markets, our banking relationships are vital for our continued success.

– Henryk Abucewicz, Head of Institutional Sales of Coinhako

As seen with the collapse of Silvergate and Silicon Valley Bank — which disrupted operations for a number of crypto companies that banked with them — this partnership is integral for crypto exchanges to survive.

In the US, banks are facing regulatory pressure to stop servicing crypto-based clients, which could be a fatal blow for these platforms. Put simply, banks act as gatekeepers to the world of crypto and have significant influence over the ease and pace of crypto adoption.

How do Singapore banks feel about crypto?

Singapore’s banking sector has continued to embrace blockchain technology, exploring use-cases even through the crypto winter.

DBS is working alongside the Monetary Authority of Singapore (MAS) on Project Guardian, which looks into the application of DeFi and asset tokenisation. The bank was involved in a successful pilot that simulated the trading of tokenised government bonds.

Standard Chartered Bank, HSBC, and UOB have also undertaken their own initiatives as part of Project Guardian. These include the tokenisation of trade finance assets and the digital issuance of wealth management products.

Each of these trials look at the use of blockchain technology to make existing financial systems more efficient. This is a view wherein crypto and blockchain complement traditional finance rather than look to replace it.

Apart from Project Guardian, DBS also launched its full-service digital exchange in December 2020, becoming the first bank in Asia to do so. This February, the bank announced plans to apply for a crypto licence in Hong Kong as well.

If more banks were to follow suit and offer such services to retail clients as well, it could spell trouble for standalone crypto exchanges. Banks in Singapore already enjoy high levels of customer trust and might be a more appealing avenue for crypto investments than a third-party platform.

Finally, the fight for carbon neutrality has also registered interest in blockchain technology. Since April last year, OCBC has been working with MetaVerse Green Exchange on green financing solutions including Carbon Neutrality Tokens, which are devised to simplify the process of carbon credit trading.

Featured Image Credit: BeInCrypto