Disclaimer: Any opinions expressed below belong solely to the author.

According to the latest release by Economic Development Board, Singapore’s manufacturing sector continued its downward trend, seeing its output drop by 4.2 per cent in March 2023 compared to last year.

These figures echo warnings issued by economists at UOB (and other institutions) that Singapore is at a risk of entering technical recession in the first half of the year. Technical recession means two consecutive quarters of negative economic growth — on an annual basis, the country can still register positive growth if positive periods outweigh the decline.

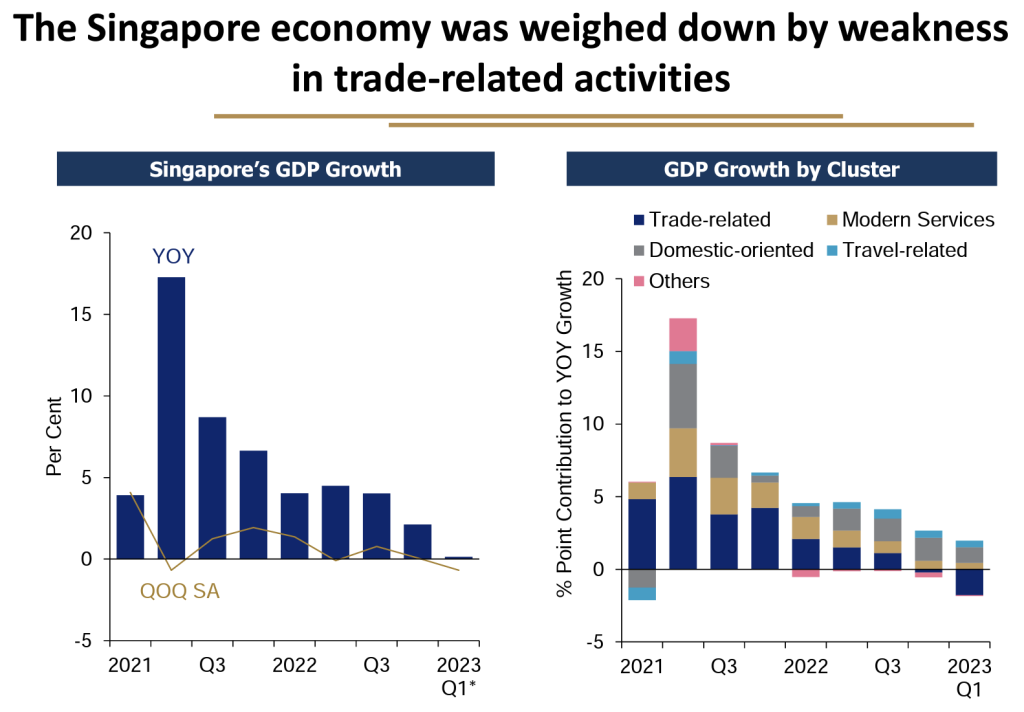

“Growth in Q1 was dragged by the manufacturing sector, while services and construction activity supported GDP. Trade-related sectors were negatively impacted during Q1. The weaker Q1 growth outcome affirms our cautious growth outlook for Singapore this year.

We still expect full-year GDP growth at 0.7 per cent in 2023 (versus the official growth forecast range of 0.5 to 2.5 per cent). We think there is a substantial risk that Singapore may enter into a technical recession in H1 2023.

– UOB

Poor manufacturing figures follow six months of decline in exports, which fell another 8.3 per cent in March 2023, as global slowdown reduced demand after a blowout 2021 and 2022, when the world was returning to life after the pandemic.

This, in turn, has had a negative impact on all trade-related enterprises up and down the supply chain.

Structural changes in electronics

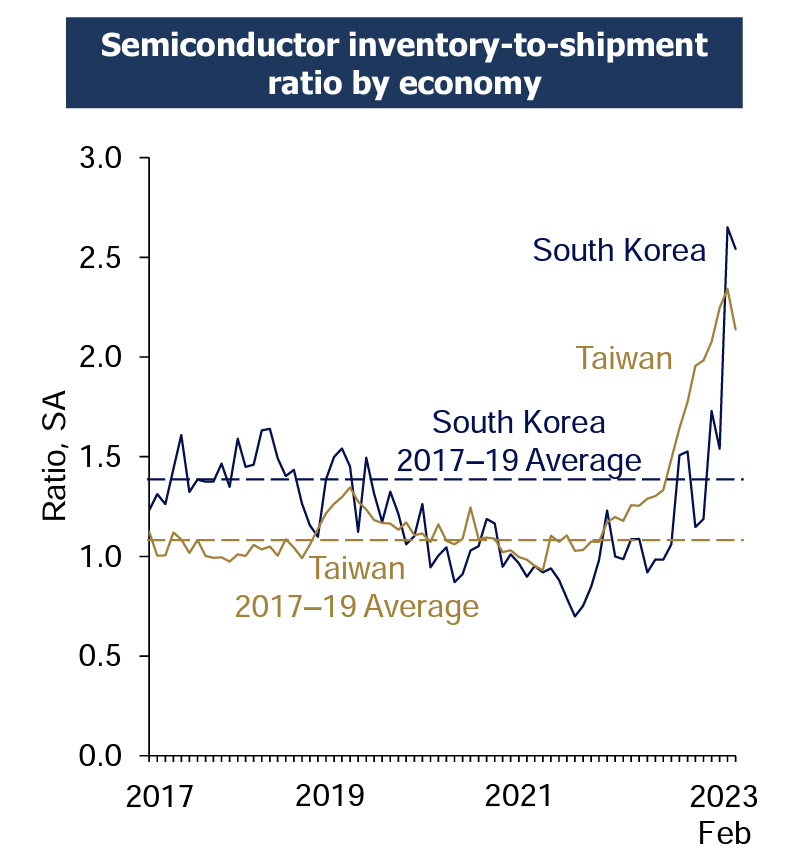

Worryingly, this decline may not only be due to a glut in the semiconductor industry, following two years of catching up to pent-up demand.

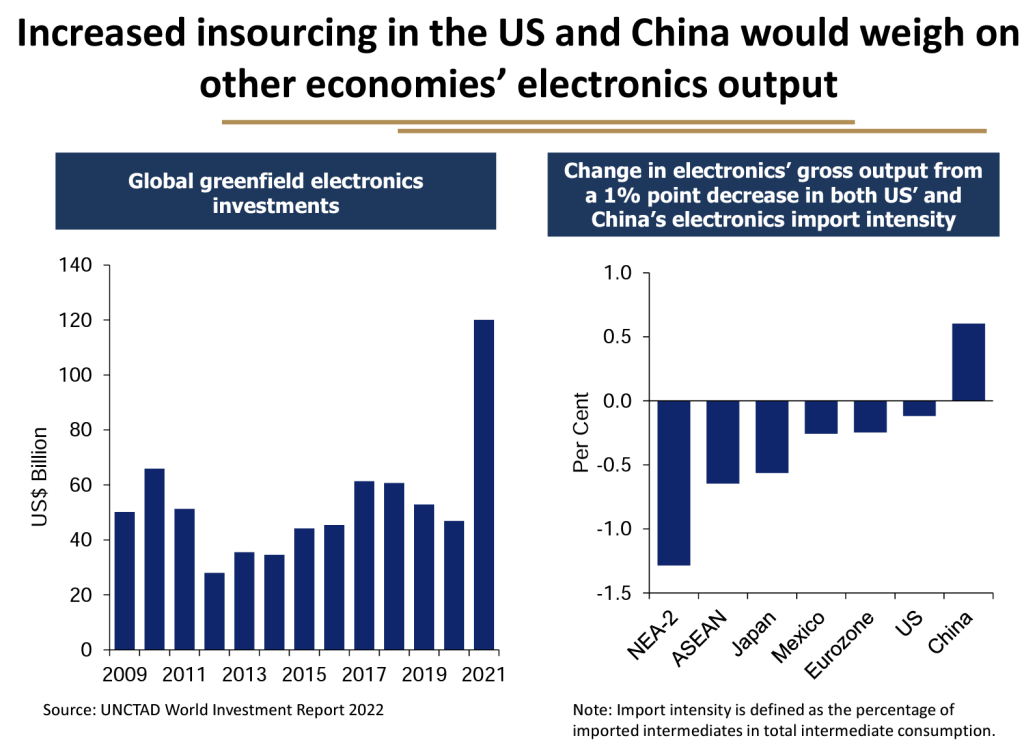

Not only are inventories full to the brim and sales have stalled, but due to political tensions, both US and China are more eager to turn to insourcing — i.e. becoming more self-reliant in chip (and related) manufacturing in the coming years, starving other countries (i.a. Singapore) of investment.

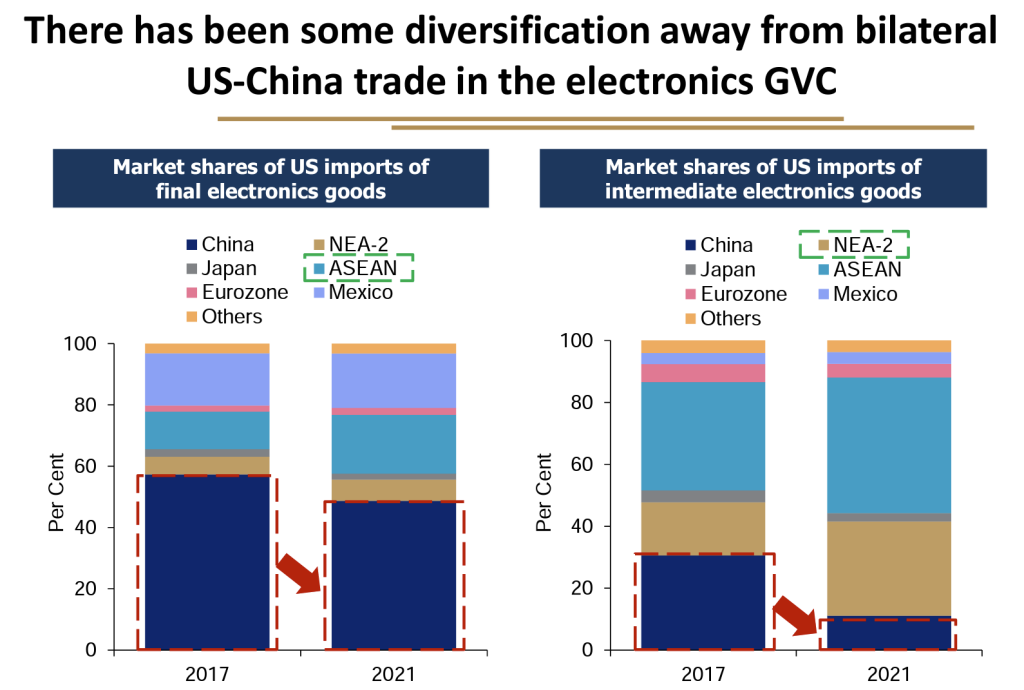

On the other hand, however, American diversification away from China may be balanced by greater investment in ASEAN, as it has already been observed in the past few years.

Furthermore, growing share of NEA-2 (comprising Hong Kong and Korea), may also see a reversal towards Southeast Asia and away from Hong Kong, which is under increasingly tighter grip of Beijing.

This reshuffling is both a threat and an opportunity to Singapore manufacturers, but it also adds to uncertainty in the local electronics sector, which is caught in between these political machinations.

The previous two years have largely been driven by post-pandemic revival, and as we’ve entered the post-COVID new normal, business and political decisions are bound to be more calculated.

Slowing inflation, rising wages

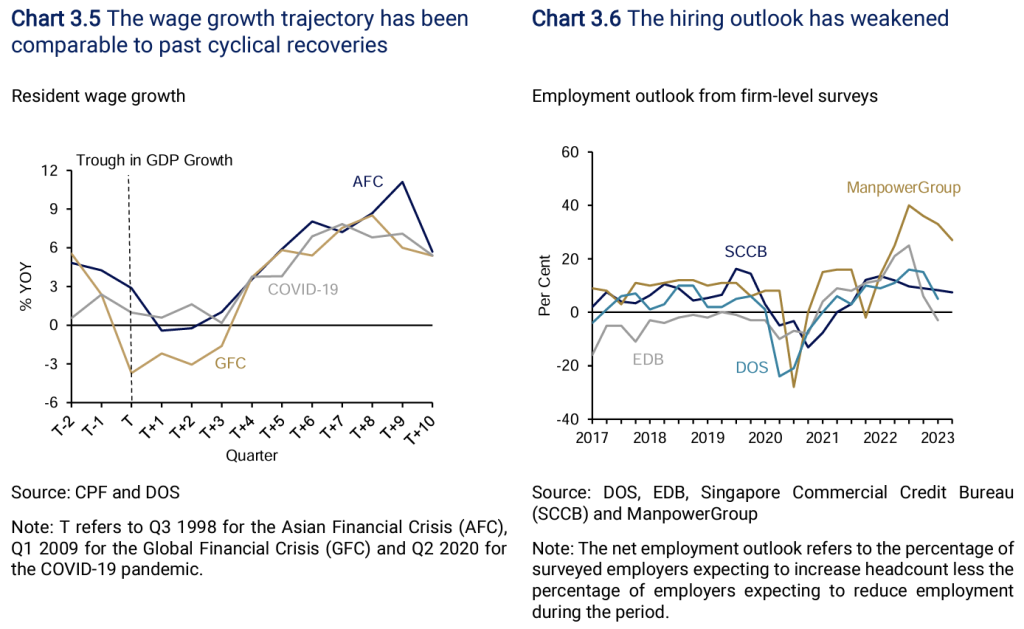

Fortunately, according to the Monetary Authority of Singapore (MAS), inflation should be past its peak already and gradually easing towards the end of the year, reducing pressure on wages as well — so the incremental raises you may expect this year are likely to be smaller than in 2022, but still above the pace of rising prices.

This growth, however, is bound to be uneven.

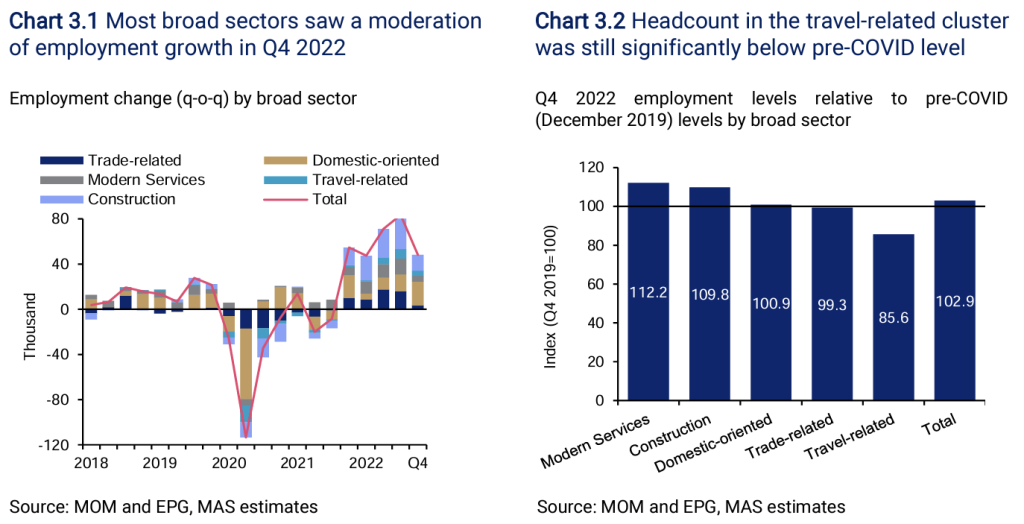

While manufacturing and trade are past their peaks, travel and hospitality are yet to rebound from pandemic woes.

At the end of 2022, Singapore’s travel sector employed only 85 per cent of its 2019 headcount, as passenger traffic at Changi Airport is still at just 80 per cent of pre-pandemic levels, and is only expected to recover by next year or later.

As a result, growth in foreign visits could ease the impact of falling manufacturing output, keeping the economy balanced throughout the year (though likely resulting in tiny, sub-one per cent growth across the entire 2023).

“The rise in wages will also likely be uneven across sectors. It will be higher for travel-related and domestic-oriented ones like construction, real estate, retail as well as food and beverage – compared with the external-oriented types like trade and manufacturing.“

– Straits Times / Monetary Authority of Singapore

Jobs still abound, but optimism waning

By the end of 2022, there were 2.33 vacancies for every unemployed person, and the unemployment levels returned broadly to pre-2020 levels at around 2.8 to 2.9 per cent.

Unsurprisingly, however, the optimism is losing steam as global inflation still sticks around, Russian war in Ukraine rages on, and economies slow down after post-pandemic bounceback.

Singapore’s Economic Development Board (EDB) is the most cautious of all organisations, predicting a risk of a small net loss of jobs. That said, all private surveys indicate positive sentiments, with more companies looking to employ than retrench.

This, perhaps, is indicative of the broader uncertainty about where the global economy — that Singapore so badly depends on — is going to go this year.

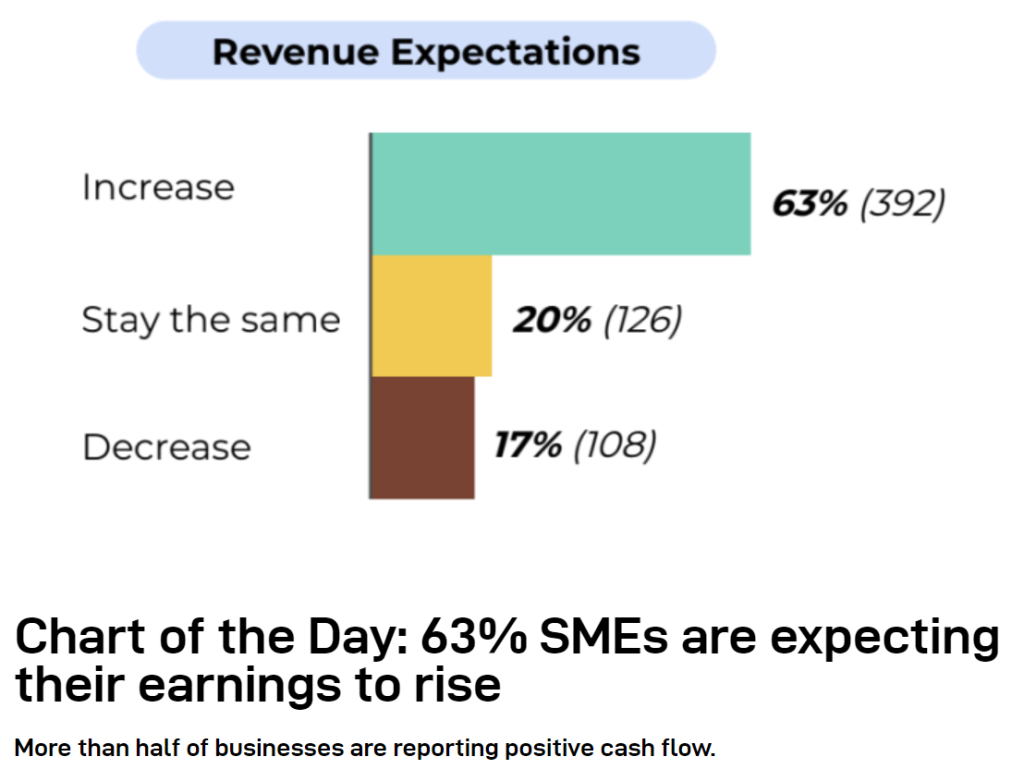

Fortunately, small businesses, which employ the majority of the population, are still optimistic as per Singapore Business Review survey from early April, with 63 per cent expecting their earnings to rise this year, as more than half are reporting positive cash flow.

What about me?

Because different sectors of the economy are out of sync with each other, your employment situation depends entirely on where you are.

Clearly all of the trade-oriented companies, from manufacturers to logistical operators, are facing sectoral recession which may freeze wages or even lead to retrenchments if the situation persists.

Meanwhile, inward-oriented industries in consumer services, construction, travel, F&B, retail and evergreen modern IT should still be doing well (aside from the largest corporations which continue laying off thousands after generous hiring spree of the past two years).

Tech talent, thus far monopolised by the giants like Google, Meta or Amazon (which has just announced another round of cuts, axing 9,000 people, including some in Singapore), is going to disperse to smaller businesses, helping to ease the prolonged labour market crunch which has prevented many companies from recruiting capable people, stalling their growth.

This is why even if Singapore dips slightly into negative territory in terms of GDP growth this year, it’s likely to be shallow and purely technical, without broad ramifications to employment.

What happens next year, however, is anybody’s guess, given the volatile times we’re currently in.

Featured Image Credit: Singapore Business Review