Disclaimer: Opinions expressed below belong solely to the author. The article does not constitute financial advice. Author has no stake in Sea Ltd. or any competing company.

I am typically full of admiration for how Sea Ltd. and its founder have managed to navigate the very competitive international e-commerce market, retaining high growth rates for Shopee while, effectively, running three different businesses.

But I have to say, I’m not quite sure what Forrest Li wanted to accomplish with his ill-timed memo to Sea’s staff sent out 10 days ago, announcing financial self-sufficiency of the company, followed by salary raises of five per cent for everyone.

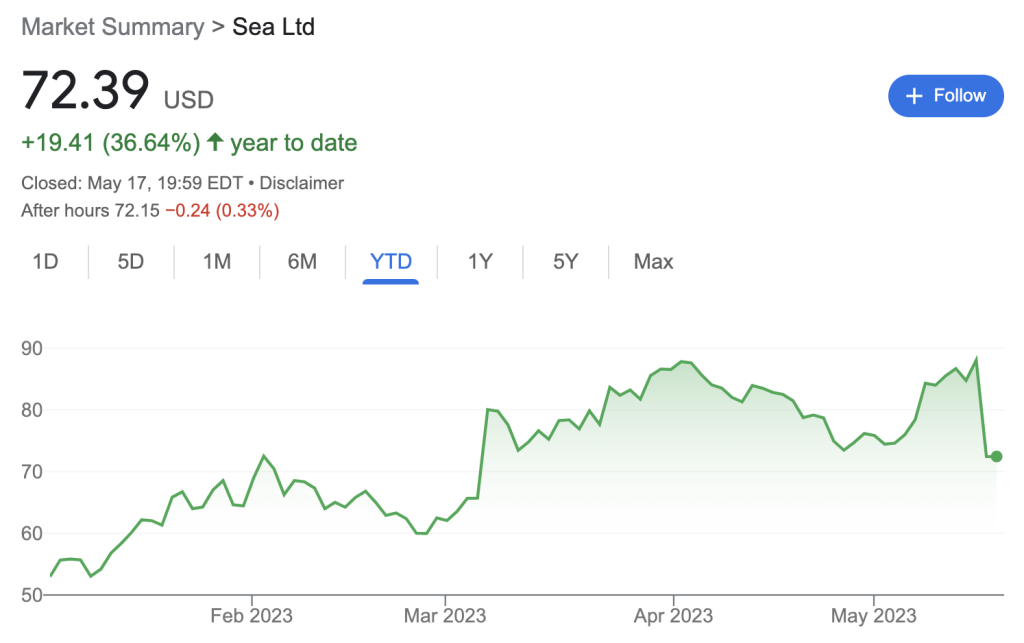

Understandably, the stock market reacted favourably to the news, jumping by 10 per cent just days ahead of expected quarterly earnings call on Tuesday.

Unfortunately, it turned out to not be what everybody expected.

Sea has still managed to turn a profit in the first quarter of this year, so that’s good news. Shopee and SeaMoney have continued to grow rapidly, while Garena appears to be settling into the new normal – considerably below pandemic boom, but still making money.

Nevertheless, the stock tumbled by over 17 per cent in a single day, not only wiping out gains recorded last week, but very nearly half of Sea’s entire rally from the beginning of the year, since these results were still a disappointment.

Overnight, its market capitalisation fell from over US$49 billion to just US$41 billion — or by an equivalent of S$10 billion (and some change), to the lowest level since March.

Perhaps expecting to miss analysts’ forecasts, Li decided to pre-emptively send out a positive message last week. After all, there was a reasonable risk that nobody would care about the good news after they heard bad ones.

This is, of course, public relations that all companies engage in, trying to make themselves look as good as possible. But in this case it appears to have backfired.

It’s possible that the current fall wouldn’t have been so steep if not for the conflicting messages released over just a fortnight. We will never know how investors would have reacted.

Of course, this sort of fluctuation is nothing unusual or catastrophic.

The real issue is trust, which I think is being tested now, and if investors are given more reasons to mistrust what the company says outside of its legally required financial disclosures, then its long-term stock market performance could be hurt as a result.

It just doesn’t seem right to trumpet a major milestone when you’re likely already well-aware that everybody is going to be sorely disappointed just a few days later.

And it takes away from the lustre of Sea’s unquestionable success that the quick dash to profitability was. I don’t think anybody expected it could extract so much value from its business so rapidly, jumping into the black by the end of 2022.

As it is, however, we’re in for another quarter of uncertainty, in no small part due to stumbles in communication.

Featured Image Credit: Guru Gamer / Sea