[This is a sponsored article with PayWithDebit.]

Disclaimer: This article is for educational and informational purposes only. It is not intended to be a substitute for financial advice. Readers are encouraged to do their own research before arriving at any conclusions based solely on this content. Vulcan Post disclaims any reward or responsibility for any gains or losses arising from the direct and indirect use and application of any contents of the written material.

We all want to save money. And whether it’s by denying ourselves that RM50+ brunch once a week, or putting off an overseas vacation, everyone has their own ways to go about it.

Maybe you already have some money management systems in place, but you’re frustrated that they aren’t working effectively for you, or aren’t disciplined enough to stick to them.

Perhaps there are other, better ways to go about saving?

In partnership with PayWithDebit, we reached out to five Malaysian finance bloggers and content creators to learn about their practical personal savings hacks. They are:

- Suraya Zainudin of Ringgit Oh Ringgit

- KC Lau of kclau.com

- Helmi Hasan of Helmi Hasan Media

- Anis of Budget With Anis

- Nafisah Amran of Brilliant Budget Planner

1. Take on the 100 envelope challenge

This trend on finance Instagram is where you prepare 100 envelopes that are numbered 1-100.

Each week, you’ll randomly pick out two envelopes. According to the numbers written on them, you’ll set aside that amount of cash.

Complete all 100 envelopes in 52 weeks (a year), and you should be left with RM5,050 to invest elsewhere, pay off debt, or save for a holiday, amongst other things.

“My trick is, I’ll start from 100 and move my way down to one,” Anis shared. “This makes it easier to complete the challenge when the number is smaller by the end of the year.”

She added that any money received outside of her full-time salary, including gifts, claims, tax refunds, and the like, is allocated to the 100 envelopes.

Similarly, Nafisah uses the 52 weeks challenge. Instead of setting aside a predetermined figure, she puts away small amounts of cash each week for a year.

The accumulated amount is then channelled into her investments.

2. Use the sinking fund method

Sinking funds are set up to prepare ourselves for any expected expenses. Here, you’ll set aside cash in advance so that when the payment is due, you’ve already saved up for it.

“Let’s say your car insurance is RM1,200 per year, so your sinking fund for car insurance is RM100 per month,” Suraya explained in our previous interview.

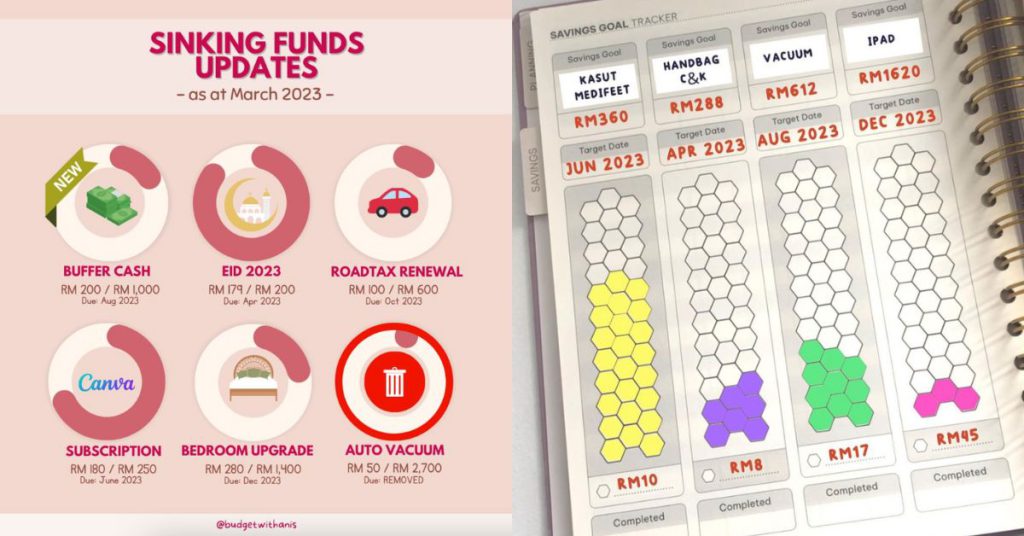

Nafisah and Anis practise this by saving up for things like a bedroom upgrade, an annual Canva subscription, a vacuum cleaner, and the list goes on.

3. Adopt a “pay yourself first” system

According to KC, many people have a tendency to spend first and only save what’s left over from their income.

Prioritising his savings, KC adopts a “pay yourself first” system by allocating 30% of his income to his investments. That way, his financial commitments and expenses are confined to the remaining 70%.

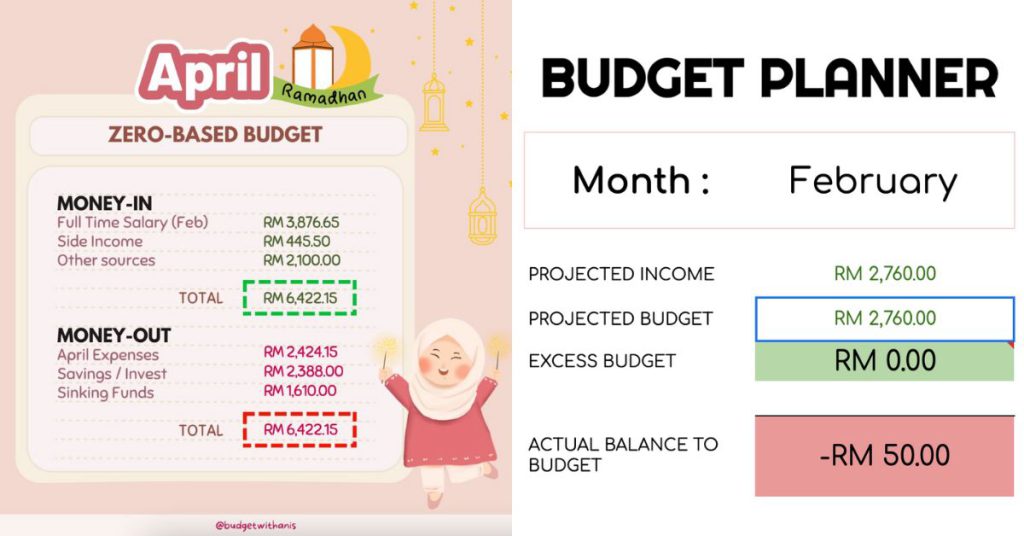

Anis exercises zero-based budgeting (ZBB), where every Ringgit and cent of her income is allocated to something. This budget is revised often to constantly keep her expenses in check.

Other than her needs, Anis’s ZBB accounts for expenses like birthday celebrations, and even for her 100 envelope challenge and sinking funds.

4. Opt for lower-cost alternatives in your lifestyle

Understandably, when income is low, it can be challenging to budget for your savings.

“But the key is to live below your means,” KC advised.

“[For example], when I was a fresh graduate and not earning much, I rented a basic room and not some fancy condo unit. Furthermore, I didn’t buy a new car, but instead used a 20-year-old Datsun 120Y my father lent me.”

Helmi stays frugal by:

- Using a cheaper phone plan

- Opting for a used scooter as his main transportation, instead of a car

- Sharing his premium entertainment subscriptions with family members

- Meal prepping and only eating out on the weekends

- Making use of cashback sites and point-based credit cards

It’s worth noting that being prudent shouldn’t sacrifice your quality of life, as Suraya once experimented with.

“Back in my early 20s, I was so frugal that I crossed the line to cheapskate territory. I’d look for unconventional ways to save money, even a few cents,” she confessed.

“One of the more memorable experiments was the ‘no poo’ experiment—not shampooing my hair, but only using water and apple cider vinegar to rinse it. Totally hated it, never again!”

5. Truly evaluating your wants

Anis recognises that it can be tough to distinguish between a want and a need because sometimes, this can be flipped when you decide to have the higher-end version of your needs.

“For example, you need a vacuum, but you want the most expensive brand like Dyson,” Anis illustrated. So before she purchases high-value items, she’ll ask herself these questions:

- Who needs this? (Priorities are given when it’s requested by my parents, partner, or cats);

- Do I have money for this now? (Cash in hand or withdrawable savings);

- Will spending affect my budget this month? Will it impact my savings by more than 10%? (If it does affect my savings by more than 10%, another question is, “Will I be able to refund this amount within three to six months?”)

If one of the questions gets a quick no, she’ll wait until she has the funds for it, i.e. her sinking fund, or not spend at all.

Suraya echoed this and shared that she keeps a list of cheap or free things she could distract herself with when the shopping mood strikes.

“Usually the feeling goes away, but I also allow myself certain wants if I’ve thought about it for months or even years,” Suraya added. “As they say, life’s too short to just pay bills and die.”

KC believes that wants should be budgeted as well, say with an allocation of 10%. “Those are ‘fun money’ included in your budget, so you know you won’t overspend,” he stated.

6. Limit your spending by separating your accounts

Splitting your funds into different bank accounts can also be a good way to manage your spending. For instance, having dedicated accounts for daily expenses, bills, loans, savings, and more.

Most bank accounts come with their own debit cards, providing the user with easy access to their funds via contactless payments.

Although, debit cards can be seen as a double-edged sword. This instant access to your current or savings account might serve as an easy way to mindlessly spend.

But the finance bloggers have an interesting take on this.

A strategy Suraya uses is to purposely keep her debit account’s balance low, and if she needs it for payments, she’ll transfer some money over. This friction reduces her impulse spending.

“Once the money runs out, it runs out, no chance for overdraft,” she added.

Expanding on this, Anis believes that debit cards can be useful for those who have no control over their spending.

“Like giving allowances through this card to your children for them to spend from [the dedicated account],” Anis shared. “Parents can see what they are spending on and how they’re spending, without their child having to ask the parents for money every time.”

Secured by the bank, card users are also prompted for a PIN for any transactions above RM250. Daily spending limits can also be set on the card.

Nafisah appreciates the convenience of not having to track her expenses from a debit card, since her spending limit from that account has already been budgeted for.

As Malaysians move into a cashless society, using a contactless card also saves you the embarrassment of holding up check-out lines while you gather the exact change for your bill.

Featured Image Credit: Nafisah Amran of Brilliant Budget Planner / KC Lau of kclau.com / Suraya Zainudin of Ringgit Oh Ringgit / Helmi Hasan of Helmi Hasan Media