Disclaimer: Opinions expressed below belong solely to the author.

American Coinbase, the world’s largest publicly listed crypto exchange, has finally made a landing in Asia, obtaining a Major Payment Institution (MPI) licence from Monetary Authority of Singapore (MAS).

This enables it to offer comprehensive services to both individuals and institutional investors.

But, perhaps even more importantly, it’s another stab against the embattled Binance, the world’s largest crypto exchange, which is gradually being pushed out of lucrative markets in America and Europe — with its future up in the air.

Finally, it’s also another example of how the dream of decentralised digital economy of the future, fuelled by cryptocurrencies built on blockchains beyond governmental control, is slowly falling apart.

A lesson in risky business

The most useful takeaway from this tale of two very different companies operating in the same market is that it appears that Coinbase founders understood the need to establish a reputation via formal means — like submitting the company to regulation and becoming a publicly traded company, which requires transparency of their books.

Quite often you could see crypto projects undertaken by people who believed they could challenge the world’s governments and the established rules of doing business in the global economy.

Cheered on by millions of libertarian fans, envisioning a world slipping out of the grasp of politicians, many continue to operate on or outside of the boundaries of the law. But, more often than not, they are learning a lesson the hard way: not only is it really not possible to challenge the existing order, but most of the potential users don’t want it either.

Coinbase seems to have accepted that in a business perceived as very risky, it has to take on features of an old-school corporation to build trust with customers and win some leniency from regulators.

That didn’t make it immune to lawsuits launched by the American Securities and Exchange Commission (SEC) in June, which allege that the company has been operating as an unregistered securities exchange and broker. But the commission stopped short of accusing Coinbase of fraud, money laundering or pressing charges against its founders — something that Changpgeng Zhao of Binance has to grapple with.

It would appear that the secret to survival in this novel industry is behaving just like traditional financial institutions would. Blend in instead of standing out.

Big is beautiful after all

What it also means is that the emergence of crypto isn’t going to change much about how we deal with finance or use it to do business, invest, or save. Major exchanges behave, essentially, like big banks or brokers of yore.

While they do not necessarily occupy prime real estate in major cities, they too employ thousands of people and, ultimately, are forced to submit themselves to the rule of law of every country they operate in or risk getting cut off from transactions in local fiat currencies, dominance of which no crypto coin has been able to dent.

In fact, the emergence of exchanges themselves has been the first sign of a turn towards centralisation, with few people choosing to transact directly between individual wallets.

With regulatory requirements and preference for locally registered businesses, with at least some physical space and executives present on the ground, we’re really largely back to business as usual. New finance is looking an awful lot like old finance.

The only difference seems to be the underlying technology.

Slow and steady…

…wins the race. It would be quite a remarkable paradox if one of the hottest, innovative industries, promising to change the world, ended up being dominated by slower and more deliberate players. But in a world where people are largely conservative and rules are written by the old guard, it may very well end this way.

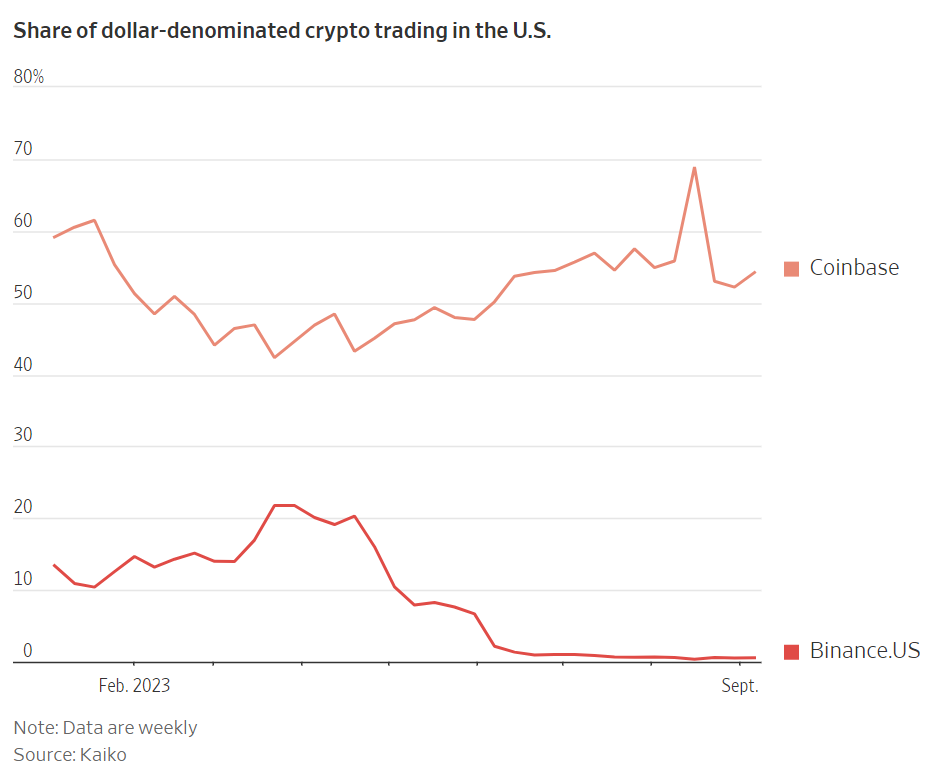

While Binance remains the largest crypto exchange by volume, its recent problems in Europe and the US (where it was forced to de facto suspend its operations, despite already having deployed a separate entity to cater to local customers) are undermining its position versus a more established competitor like Coinbase (which was quick to pick up Binance’s stranded customers in America).

Binance planned to obtain a licence in Singapore back in 2021, only to abandon the effort, reportedly due to its inability to fulfil local anti-money laundering requirements.

Rumours had it that the company would be back in the Lion City this year, this time limiting its ambitions to obtaining licensing for custodial services for institutional clients, under the brand Ceffu, but no updates about the effort have been reported since March.

Seeing Coinbase walk away with a full MPI licence may force CZ to question his business choices and whether his way of running Binance is not self-defeating in the long run. After all, nobody is going to rewrite the laws for him and his company. Comply or die.

There’s only one model of operations that’s going to be approved in this business and, if anything, more countries are likely to copy solutions implemented by developed economies, gradually pushing non-compliant participants out.

Coinbase may be smaller, more expensive and not as diverse in its offering — but none of it matters if it has a much better chance of survival. Ultimately, to change the world, you have to still be around when its future is decided.

Featured Image Credit: Depositphotos