In recent years, digital money has made a strong case for its role in the future of finance. It comes with benefits such as seamless cross-border transactions, reduced costs, and ease of access to financial systems. However, digital money can take on a number of different forms and not all of them are made equal.

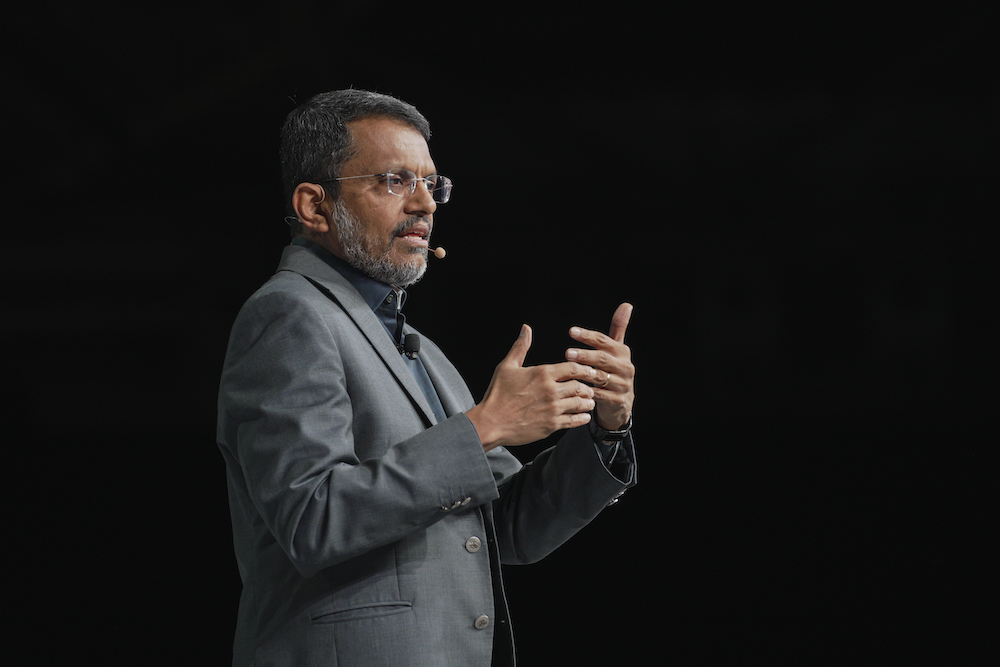

At the Singapore Fintech Festival 2023, Ravi Menon, the Managing Director of the Monetary Authority of Singapore (MAS), spoke about four “contenders” in the race to make digital money ubiquitous.

Starting off, Menon writes off privately-issued cryptocurrencies which have become popular speculative investments in the last decade. This includes crypto coins such as Bitcoin and Ethereum, which are being treated as stores of value by retail and even institutional investors today.

“Private cryptocurrencies have failed the test of digital money,” Menon says. “They have performed poorly as a medium of exchange or store of value. Their prices are subject to sharp speculative swings, and many investors in these cryptocurrencies have suffered significant losses.”

Next, there are tokenised bank liabilities and central bank digital currencies (CBDCs), both of which Menon believes can work hand-in-hand while playing the role of digital money.

The future of digital money

Tokenised bank liabilities represent customers’ claims on a bank’s balance sheets. For example, a customer who has S$1,000 deposited at a bank would receive an equivalent amount of tokens to transact with. When a purchase is made, these tokens would be transferred to the merchant, who’d be able to claim them from their respective bank.

This is known as clearing, a process through which banks are informed of the amounts which their customers’ account needs to be credited or debited with. Traditionally, clearing houses would facilitate this process, acting as a mediator when transactions are made between banks. Tokenisation allows clearing to be automated, removing the need for middlemen and improving efficiency.

After clearing comes the settlement process, which involves the physical movement of money between banks to fulfil their obligations to one another. This is where CBDCs come into play.

As the name suggests, CBDCs refer to digital currencies issued by a country’s central bank. They enjoy the same level of stability as their fiat counterpart, while leveraging the benefits of blockchain technology.

CBDCs can exist on the same infrastructure as tokenised bank liabilities, allowing the clearing and settlement process to be carried out simultaneously.

“Since 2016, MAS has conducted many experiments with other central banks and the financial industry to explore the use of wholesale CBDCs to facilitate real-time cross border payments and settlements,” Menon explains.

Next year, the MAS plans to take this a step forward, moving on from test environments and piloting the live issuance of wholesale CBDCs. Banks will be able to use these CBDCs for the real-time settlement of domestic payments.

Outstanding interbank obligations arising from [transactions made using tokenised bank liabilities] will be settled via the automatic transfer of wholesale CBDCs that the banks are holding. So clearing and settlement will occur in a single step on the same infrastructure, unlike the current system in which clearing and settlement takes place on different systems and settlement occurs with a lag.

– Ravi Menon, Managing Director, MAS

What about stablecoins?

Menon refers to stablecoins as the fourth and final contender for digital money. “Stablecoins, if well-regulated, can potentially play a useful role as digital money alongside CBDCs and tokenised bank liabilities,” he says.

Earlier this year, the MAS finalised a new regulatory framework governing stablecoins. This framework includes criteria – such as value stability and capital requirements – which issuers must fulfil for their stablecoins to be recognised as MAS-regulated.

As the legislative amendments surrounding this framework will take at least a year to take effect, the MAS has taken an interim approach to recognise entities whose stablecoins already demonstrate compliance. Three companies have been granted in-principle approval under the Payments Services Act (PSA), including StraitsX which issues the Singapore-dollar-backed stablecoin XSGD.

“Once the legislative amendments take effect, these stablecoins will be regarded as MAS-regulated stablecoins and receive the credibility that goes with it,” Menon says.

The MAS believes that well-regulated stablecoins could help spur innovative use-cases. “One example is Purpose Bound Money (PBM) showcased through Project Orchid.”

PBM refers to a protocol which specifies the conditions under which an underlying digital currency can be used. As part of Project Orchid, StraitsX is trialling the use of XSGD to facilitate escrow arrangements in e-commerce transactions.

“This ensures that funds are released to merchants only when the customer receives the purchased items, providing greater assurance to both parties. This has been tested at the Singapore FinTech festival, in partnership with Amazon and Grab.”

Building digital infrastructure

Along with digital assets, there’s also a need to develop the underlying infrastructure – i.e. blockchains – which they operate on. Currently, public permissionless blockchains remain in the spotlight with significant investments being made to develop apps on chains such as Ethereum and Solana.

Menon points out that such blockchains come with limitations which makes them unfit to serve as the basis for the global financial infrastructure. “Public blockchains suffer from a lack of accountability and normality of service providers,” he says.

These problems are addressed by private blockchains such as Ripple, however, they suffer from a lack of interoperability instead. “This could potentially lead to fragmentation of liquidity in digital assets, which is what we’re trying to solve in the first place.”

The ideal solution, as per Menon, requires open and interoperable networks, which are also compliant with relevant regulatory requirements. In line with this vision, the MAS has teamed up with a group of industry players – BNY Mellon, JP Morgan, DBS and MUFG – to develop Global Layer One, an open, digital infrastructure to facilitate seamless cross-border transactions and enable tokenised assets to be traded across global liquidity pools.

“MAS welcomes interested financial institutions, international policymakers, and others to join this initiative.”

Featured Image Credit: Singapore Fintech Festival 2023