You might have seen reports circulating last year that merchants would be charged transaction fees for using DuitNow QR.

It was stated that merchants would have to pay 0.25% of each DuitNow QR transaction value, otherwise known as the merchant discount rate (MDR).

An official statement later clarified that measures would be taken by the central bank to minimise the potential impact small businesses might face from these transaction fees.

Then, speculations arose. Will customers foot the MDR? Might merchants hike their prices to cope with added transaction fees?

To clear the air, we first have to understand what MDR is.

Understanding the Merchant Discount Rate

Investopedia defines the MDR as a fee that merchants and other businesses must pay to a payment processing company on cashless transactions.

The MDR is typically charged to businesses using card readers, otherwise known as point-of-sale (POS) terminals to accept debit or credit card payments.

In the context of DuitNow QR, it was said that the MDR is intended to cover costs and investments needed by the financial industry to upkeep its payment systems. This includes cybersecurity and fraud prevention controls to maintain high service and security standards for payment services.

News reports circulating in late 2023 claimed that traders receiving money via the DuitNow QR would incur a 0.25% fee when transferred from a bank account, and a 0.5% fee for transfers made via credit cards to POS terminals.

Malaysia’s national payments network, Payments Network Malaysia (PayNet) pointed out that such transaction fees on DuitNow QR have always been present since the platform was introduced in 2019. These fees were simply waived temporarily amidst the pandemic.

Following the news reports though, this led to merchants questioning: If my business is going to be charged transaction fees for offering cashless payments, why not go back to cash?

There are various advantages to using cashless payments

By only accepting cash-based payments, merchants would have to hire and compensate additional employees who are trained to accurately and efficiently manage transactions.

This hassle can be mitigated when card-based payments are offered. However, there are additional fees to foot when utilising this system too, including equipment leasing fees for the POS terminal, transaction fees, statement fees, etc.

Hence, the lowest barrier to entry for micro and small businesses to offer cashless systems is through DuitNow QR, as it offers several advantages:

1. Transaction fees will continue to be waived for micro and small businesses

Most DuitNow QR merchant acquirers have announced that they will continue to waive the MDR for micro and small businesses accepting DuitNow QR payments.

In general, microenterprises are defined as having a sales turnover of less than RM300,000, or less than five full-time employees. Meanwhile, small businesses are companies with sales turnover between RM300,000 to RM3 million, or between five to 30 full-time employees.

These measures will enable micro and small businesses to keep utilising DuitNow QR payment services at zero cost, while ensuring that QR payment services remain efficient, reliable, and safe for all consumers.

2. Quick and simple to set up

It’s also simple to offer a cashless payment system like DuitNow QR.

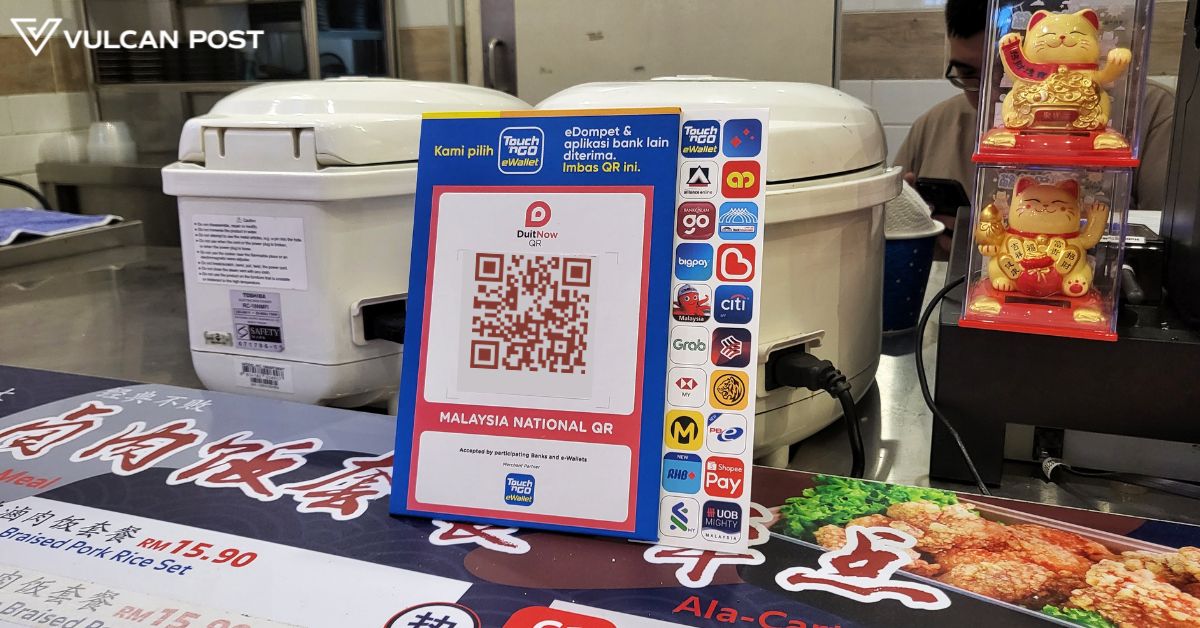

Merchants will just have to set up a business banking or ewallet account to generate a dedicated QR code, and display it for buyers to scan and pay via any banking app or ewallet of their choice.

Since 2023, DuitNow QR has made it possible to receive cross-border payments as well.

This allows international travellers in Malaysia to use their mobile payment apps to scan DuitNow QRs to make payments to merchants. Currently, this feature is available to users from Singapore, Thailand, and Indonesia.

3. Instantly receive payments

DuitNow QR also runs on a real-time transfer basis, meaning upon a customer’s transaction, merchants will receive these payments instantly in their business banking account. There’s no need to deposit large stacks of cash to the bank, reducing the operations cost for businesses.

These online banking methods will also notify both merchants and customers when payments are received at the point of sale.

-//-

At the time of writing, major banks and ewallet providers nationwide will continue to waive MDR for micro and small businesses accepting DuitNow QR payments.

Therefore, customers will only need to pay for what is stated on the price tag, while businesses will likely not raise their prices for the sole purpose of covering such transaction fees.

At the end of the day, DuitNow QR functions as an efficient, convenient and secure payment method that can further boost digital payment adoption in Malaysia.

Featured Image Credit: Vulcan Post