Disclaimer: Opinions expressed below belong solely to the author

The internet has changed the world. Within 30 years, it connected billions of people worldwide, effectively shrinking the planet. Meanwhile, progressing globalisation has brought products from all over the world directly to our doorstep.

But at one point, something went wrong.

While technology keeps improving, the benefits of its rapid development have become less evenly distributed.

We can stream high-quality video to and from any corner of the world, holding live conversations with people thousands of miles away. We can use robots and drones, previously accessible only to major companies. It is possible to control complex machines or perform surgeries on the other side of the globe. Today, we’re witnessing the birth of artificial intelligence, which is already transforming many industries.

And yet the world of e-commerce is not going forward but back — and none of the leading companies involved in it appear to be concerned.

Hot garbage

The latest darling of millions around the world is Temu, after its stratospheric rise over the past two years.

You would be hard-pressed to explain what is so special about it, though, since it uses the same recipe that Wish or Aliexpress and, regionally, apps like Shopee or Lazada followed before it.

It’s just another massive marketplace with access to a stratospheric number of products churned out in Chinese factories, sold at scarcely believable prices, even if it takes many days or weeks for them to arrive at your doorstep.

It lures people in with free delivery, endless promotions, interactive games that could win tangible goods, and so on- the same old blueprint.

Most of what it sells turns out to be garbage, but the risk-to-reward ratio appears attractive enough to make it an addictive experience for millions. So, it’s hot right now.

However, if experience is anything to go by, this sort of success doesn’t last.

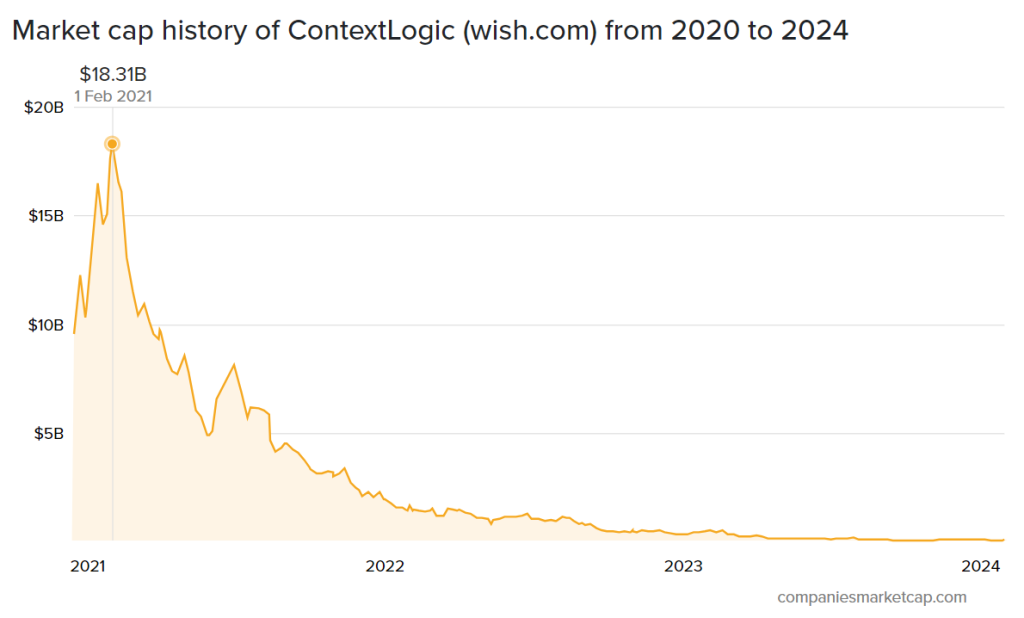

Wish, the trailblazer of the industry, went public in 2020, at the height of the pandemic, following a decade of growth, collapsed catastrophically, losing 99.5 per cent of its value in just three years, wiping clean over $1.6 billion it raised from investors beforehand.

The company’s market capitalisation is currently around $100 million, down from the 2021 peak of over $18 billion. Nobody believes it can be resuscitated.

While Wish may be considered to have been on the extreme end of the “garbage” commerce spectrum, permitting the existence of very shady deals, all of the things that led to its demise are present on every other major e-commerce platform today and are still used as a magnet for unsuspecting shoppers.

Companies- or at least the people they employ- like it because it helps boost their numbers, even if it typically results in a short-term gain leading to long-term pain.

The question is: how long can the race to the bottom in terms of price and quality last before customers are both bored and fed up?

After all, the great Warren Buffett observed that “honesty is a very expensive gift; don’t expect it from cheap people.”

Growing up or playing pretend?

Some of the more ambitious platforms, like Shopee or Lazada in Southeast Asia, have seemingly grown more mature over the years. They combat scams, try to control quality, and have managed to onboard many reputable brands, filling the role that Amazon- the great e-commerce role model- plays in the US.

But how much of it is growing up, and how much is just pretending they are?

It’s hard to escape the impression that their more mature product offering is no different than what we could already buy in online stores before mobile shopping was even a thing.

No inherent value is added to any major e-commerce platform if we can purchase the same products directly from manufacturers or distributors.

While they may provide valuable logistical services at a large scale, the reality is that many, if not most, sellers are still shipping their goods on their own or with limited help from the platforms.

Meanwhile, any savings that could be had from a more efficient logistical system are relatively tiny on a per-order basis.

When you consider all of the above, it’s no longer a surprise that almost nobody, not even Amazon, is making any money in this business.

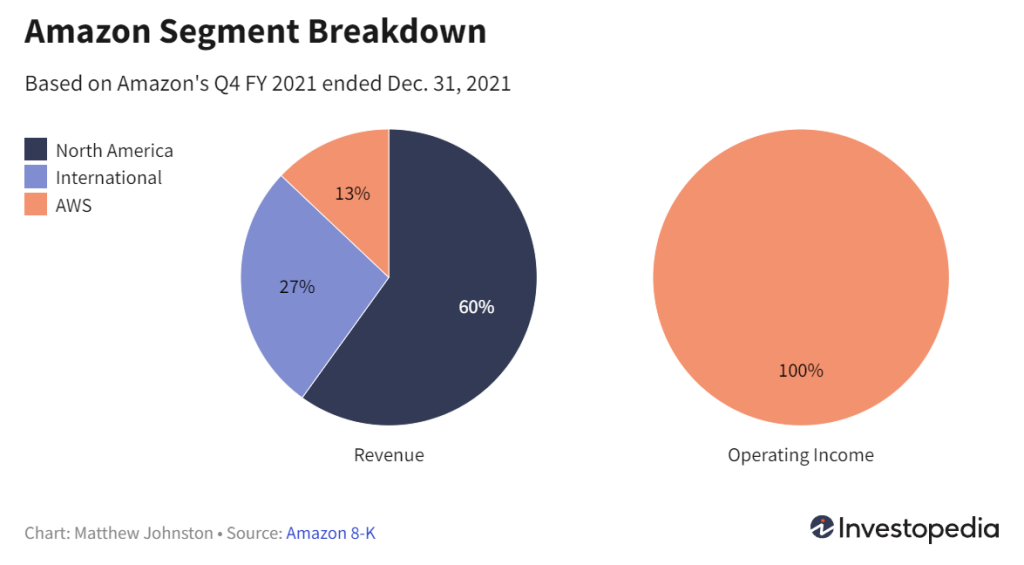

Throughout 2021 and 2022, it posted losses on all e-commerce operations despite over $500 billion in annual revenue, and its only profitable unit was AWS.

It has returned to profitability in North America, reporting operating margins of around 4-5 per cent, though they remain dwarfed by AWS’s 30 per cent.

Wishification of e-commerce

But even Amazon doesn’t seem to care about its reputation very much and has embraced the flood of questionable sellers, chiefly from China, on its platform.

Have you ever wondered why so many of them have really bizarre names? They do this cheaply and quickly to obtain a trademark that nobody can contest and then pour thousands of their listings onto unsuspecting Amazon buyers.

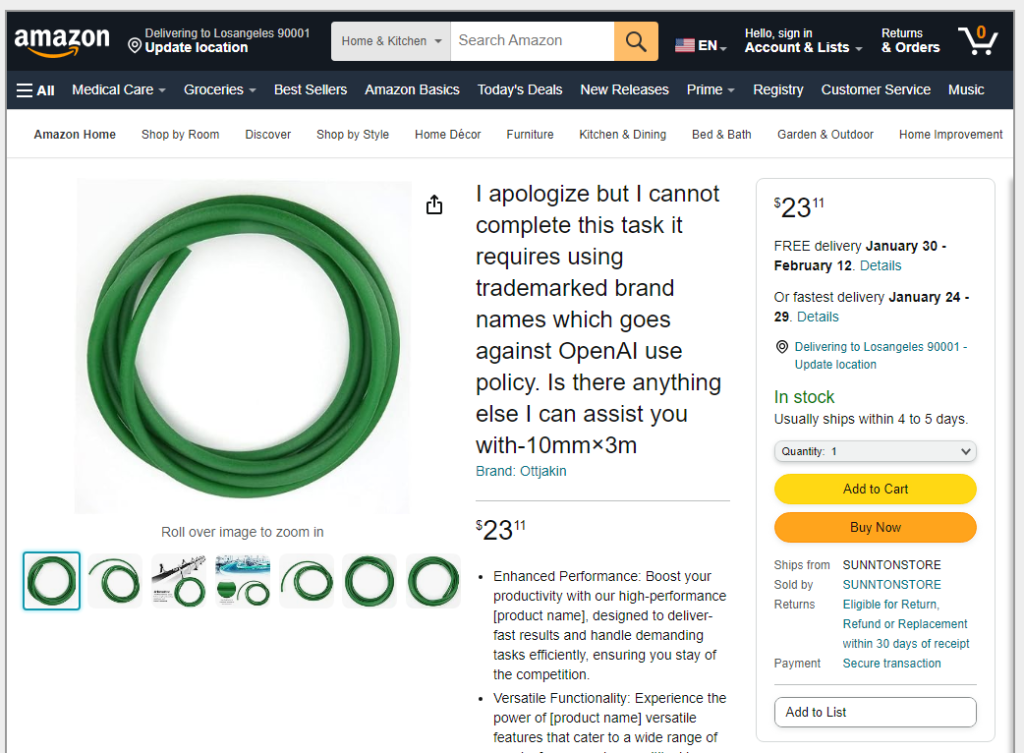

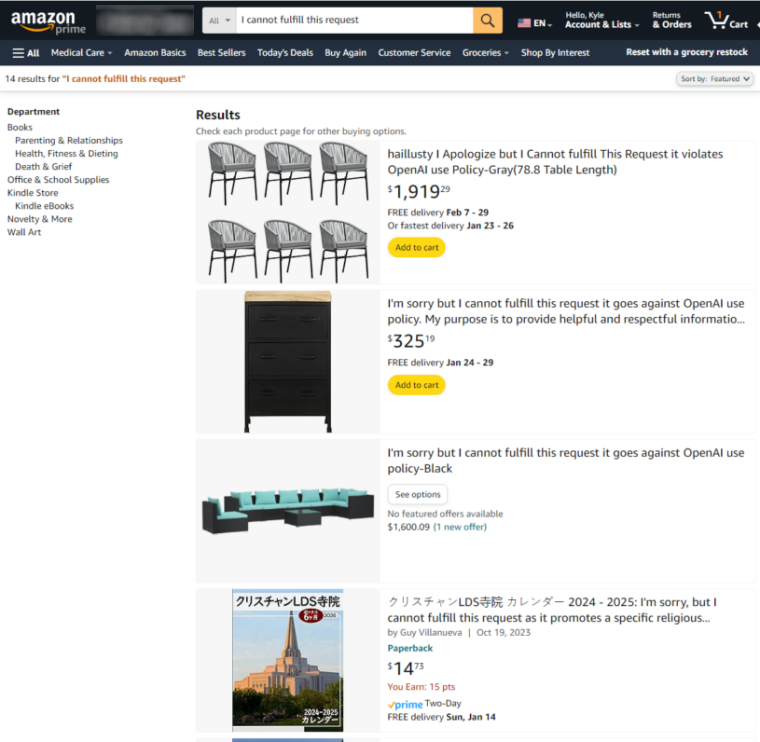

Just two weeks ago, the giant faced another embarrassment after the clumsy use of AI-generated titles was spotted, with lazy sellers mindlessly dumping ChatGPT’s warning messages as titles of their products.

This adds to other problems, which Amazon has failed to address in a timely manner, such as pervasive spam and review hijacking — a practice of using positive reviews for unrelated products to boost the appeal of an inferior one (or a complete scam).

It’s been going on for years, with the platform choosing to reimburse the customers for failed orders rather than devise effective filters to improve user experience. It’s gotten so bad that the American FTC decided to step in last year, though its actions are unlikely to yield any improvement unless they target Amazon itself.

Too big to fail?

Perhaps Amazon’s reluctance to take action is due to a belief that there’s not much more it has to fight for in e-commerce. It has practically monopolised it in the most lucrative market in the world, and its ventures abroad have proven rather fruitless. So, why bother?

Instead of trying to sell even more stuff, it is building up its digital entertainment business, competing with the likes of Netflix or Disney for a slice of the lucrative streaming pie.

With Prime Video, bolstered by the acquisition of the Metro Goldwyn-Mayer in 2022 and the popular streaming platform Twitch, and enormous resources at its disposal, it has more to gain from selling digital content worldwide than peddling diapers, books or car parts.

Amazon is now a technology company, not an online store.

It’s almost as if it keeps e-commerce running as a favour. It’s a major headache, and it doesn’t bring in much money, but at least it provides access to people so you can sell them something else.

This, by the way, is what other companies in the space are trying to do to ensure they have a future.

Just look at Sea Ltd. in Singapore. It is using the popularity of its e-commerce app, Shopee, to venture into digital banking services, upselling its customers on something that can generate real returns in the long run.

Given the similarly anaemic results of other e-commerce platforms, this appears to be the only way to survive.

But it also begs another question: if companies are willing to sacrifice the user experience of online retail, won’t people eventually turn away from them?

The problem isn’t only that you may get cheated, but that finding what you want is increasingly difficult as you have to sift through thousands of meaningless or repetitive listings.

It seems quite likely that customers’ patience is limited. They are now learning not to trust any big e-commerce store, nearly all of which are drowning in substandard goods from dodgy sellers half the world away.

Fifteen years ago, it seemed that Groupon would be the next tech giant, propelled by a seemingly faultless business model: offering unbeatable deals on products and services of the participating merchants.

What’s not to like? How can it fail?

Well, it turned out that merchants didn’t quite like to pay the Groupon’s cut, while people got bored after a few years.

Coupon sites still exist today, but none have quite the same appeal anymore.

This may be the future of online retail.

Waiting for Apple of e-commerce

Apple’s customers are often ridiculed for overpaying for the company’s products. In reality, they are buying the peace of mind that comes with the Apple logo.

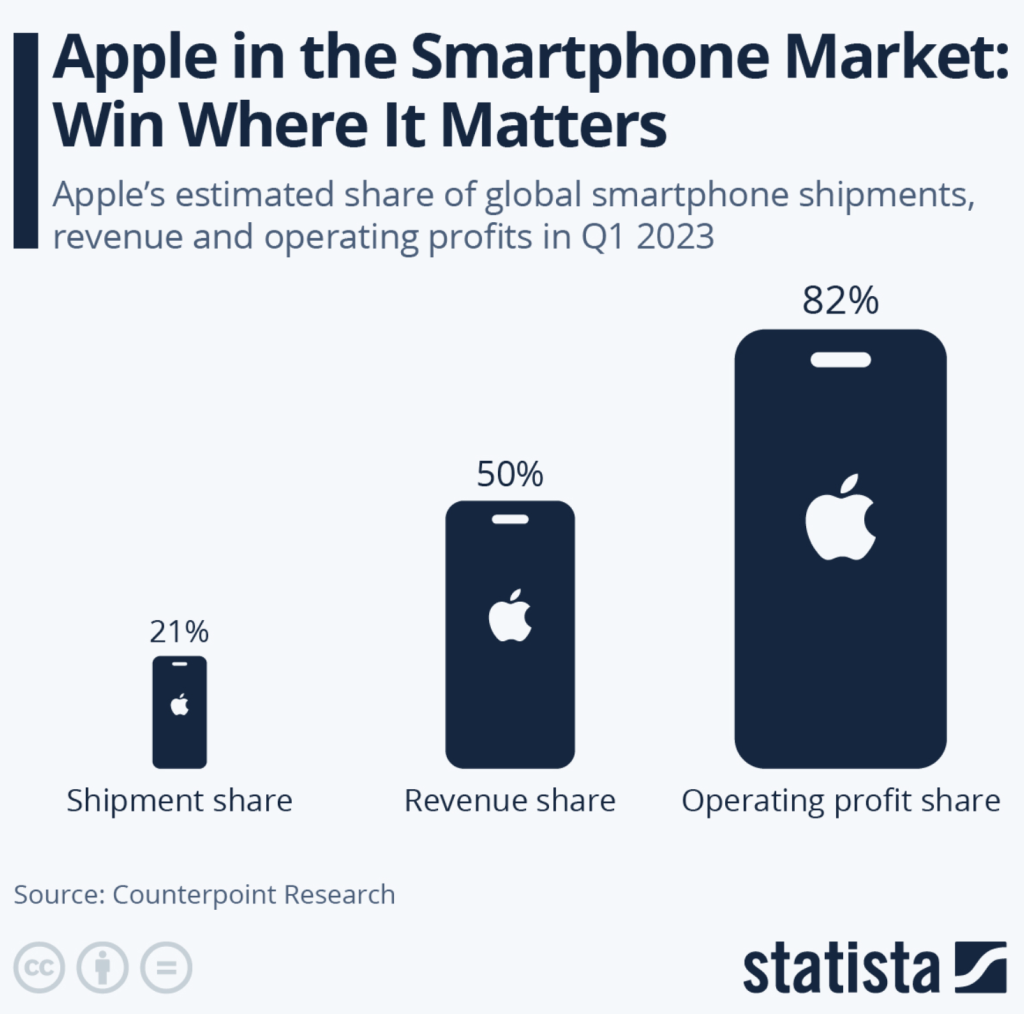

Android may be the world’s most popular mobile operating system, as phones running it outsell Apple 4 to 1, but most of the money goes to Cupertino.

Apple is responsible for 50 per cent of global smartphone revenues and over 80 per cent of the profits despite shipping just 20 per cent of the phones. Everybody else is scraping the bottom of the barrel.

We have yet to see a similar company emerge in e-commerce, but the conditions are becoming more favourable each year.

How many questionable offers does one have to see to learn that you can’t buy quality for a few bucks?

And as trust in big platforms erodes, as it did for Wish, customers may turn to buying directly from smaller vendors or manufacturers, looking for more trustworthy products instead, or to a curated platform, offering only selected goods rather than heaps of unverified garbage.

Given enough time, they may all fold into one. All of the Temus, Shopees, Lazadas, Taobaos, Alis, and even Amazons may disappear in the coming years, absorbed into a single entity or just a handful of entities.

Some demand for cheap rubbish will likely remain, but do we need dozens of sites peddling the same stuff? Garbage should do fine with just one dealer.

Suppose the creation of a single, central, curated, quality platform proves too tricky. In that case, we may see market fragmentation instead, buying directly from smaller vendors with an established reputation or directly from manufacturers rather than faceless corporations who can’t even be bothered to deal with spam they serve all of us today.

It may soon turn out that they were never too big to fail but have grown too big to exist any longer.