Singapore carpool startup Ryde has just announced its IPO listing on the New York Stock Exchange (NYSE) today (March 6).

This follows their announcement in September last year, where they expressed their goal to raise US$17 million for their IPO. In a news report by BNN, this decision represents a strategic move for the ride-hailing company in expanding its innovative transportation and delivery services to a broader market.

Ryde was founded in 2014 by Terence Zou as a carpooling app, it has raised S$1 million from a venture capital company two years since their inception. They subsequently received an additional S$2.5 million to support their service expansion efforts in 2017.

The startup has also previously entered into a partnership with ComfortDelGro in 2017, and acquired Singapore logistics provider Meili Technologies last year.

Challenges ahead for Ryde despite the IPO

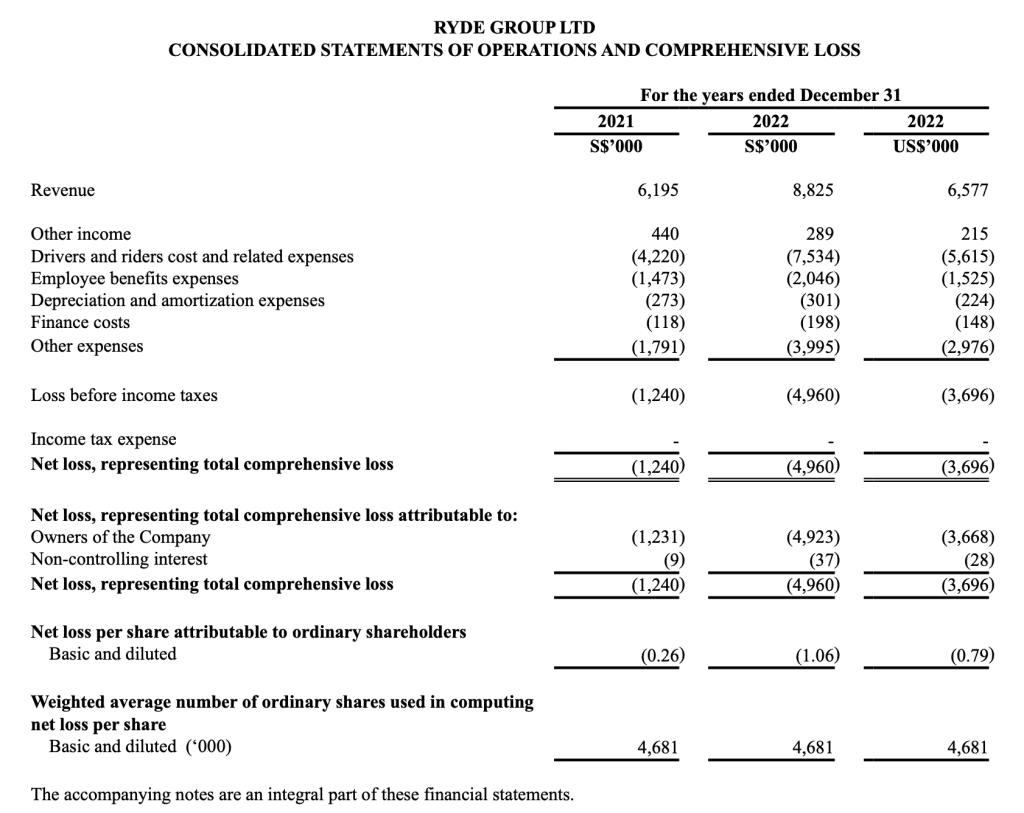

But the path ahead might be extremely challenging for the homegrown startup. According to disclosed financial statements, Ryde has incurred a net loss of S$4.96 million for the 2022 financial year despite raising approximately S$8.8 million in revenue.

In their preliminary prospectus, the company has also stated in they may not be able to continue raising sufficient capital or achieve profitability as it is dependent to reduce the amount of driver partner and consumer incentives paid relative to the commissions and fees they receive for their services.

The prospectus also stated that the startup is also facing doubt from auditors, who questioned the sustainability of the business.

Amidst stiff competition from other ride-hailing applications, notably Grab, Ryde has spent almost S$2 million on marketing efforts to differentiate itself. It has managed to increase the number of unique active users by 17,000 for the 2022 financial year.

Despite their best efforts, Ryde still has a long way to go to catch up with their competitors, as Grab reported 32.7 million unique monthly transacting users for that same year. According to an article by Tech In Asia, Ryde commands 2.5 per cent of the mobility industry, making them the fifth-largest player in the sector.

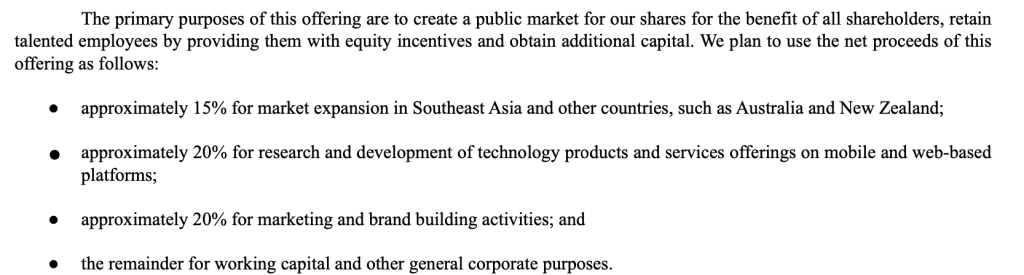

The startup has since expanded its range of services and is working towards becoming a “super mobility app.” With the proceeds from the IPO, Ryde has earmarked funds for marketing and growth beyond Singapore, as they hope to explore potential markets in Southeast Asia, Australia and New Zealand.

However, in the light of many tech layoffs in recent months, the tech industry has been experiencing many uncertainties and pressure, hinting that Ryde’s IPO might not be as smooth-sailing as they thought.

Featured Image Credit: Ryde