Disclaimer: Any opinions expressed below belong solely to the author. The following article does not constitute financial advice. As of writing, the author had no stake in Sea Ltd. or any related company.

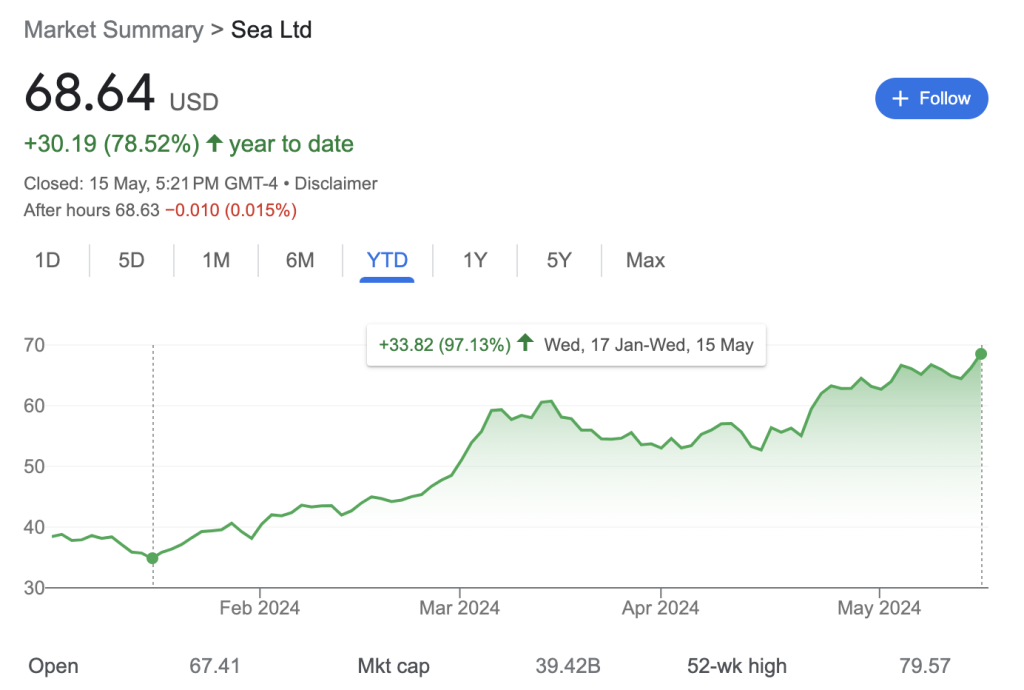

Following Tuesday’s quarterly earnings report, the Southeast Asian company known primarily for its hit ecommerce platform Shopee, has extended the stock market rally by another 6 per cent.

Since hitting a low of under $35 per share on January 17, it experienced a turnaround pushing the price up towards $69 placing it market cap at $39.4 billion, marking a near doubling in value in just four months.

Proving doubters wrong again

This strong performance follows a year of uncertainty, when the company embarked on a campaign of cost-cutting measures in search of profitability amid worsening uncertainty caused by the global inflation crisis which followed on the heels of a deflating stock market bubble in late 2021, cutting off access to cheap capital.

Companies like Sea used this easily accessible pool of money to fuel rapid growth in the years prior and have now found themselves fighting to stay afloat on their own.

While the initial results of this cost rationalisation exercise were optimistic, as Sea posted its first profit towards the end of 2022, subsequent problems at keeping results positive while growth was taking a hit, cut the company valuation by more than half by the end of 2023.

Sea had shown it could survive but now it had to prove it could find growth again, this time without burning billions of dollars in the process.

And that’s what it has so far managed to do in 2024.

Loss like a profit

Despite posting a small loss this quarter — and one that was a bit worse than expected, but only marginally so — the market feedback was very positive given the growth reported across the board, which more than makes up for the puny $23 million in the red.

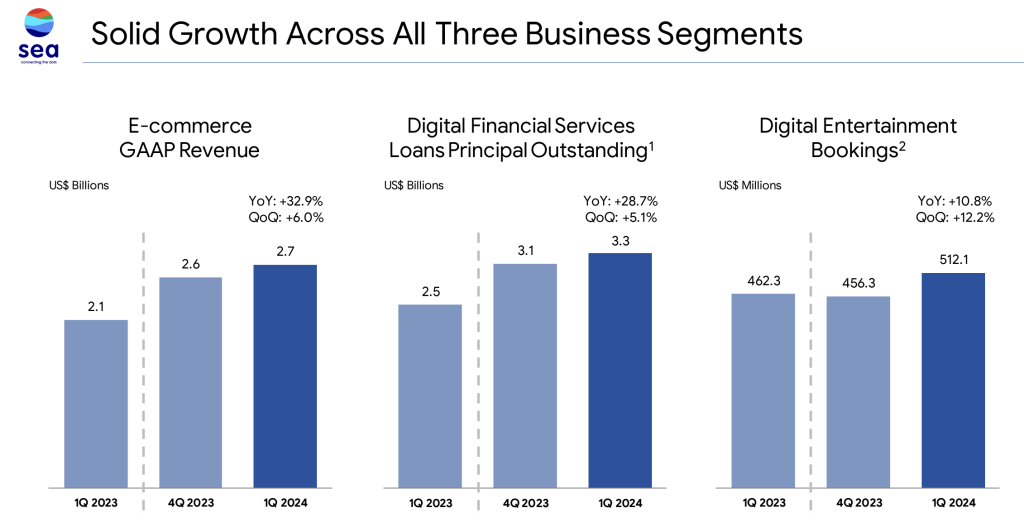

All constituent businesses posted double-digit year-on-year revenue growth, including Garena which was recently struggling to find its footing back following the retreat of pandemic gamers.

Shopee did not only see its revenue and GMV of the products sold go up by over 30 per cent — some of which could be attributed to rising prices, after all — but an impressive near 57 per cent jump in the number of orders, totalling 2.6 billion this quarter.

More orders mean more interactions with customers, giving the company more opportunities to sell them additional services, like those offered by SeaMoney.

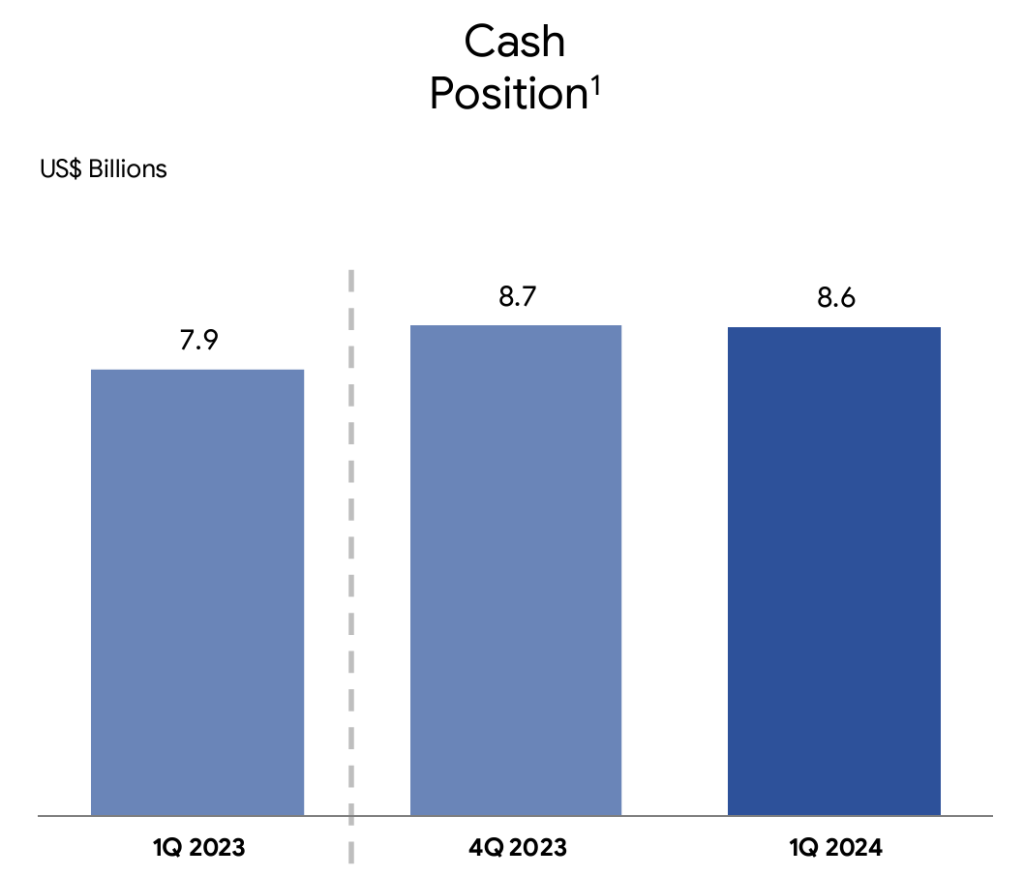

All of this was achieved while maintaining a stable financial situation, which was a point of concern amid the downturn of 2022 and 2023.

At the company’s previous burn rates, reaching up to $1 billion in losses per quarter, the money it has accumulated could have run out in as little as 2 to 3 years.

As it is, however, it has managed to find a sweet, stable spot and its cash holdings remain solid, while it has greatly improved efficiency of its operations.

No miracles

What the company is less eager to advertise is that it didn’t just conjure its good performance out of thin air — it had to spend money to achieve it. And spend it it did.

Sea’s sales & marketing expenses for the quarter nearly doubled compared to last year, when it spent US$400 million (against US$769 million now).

However, by achieving savings elsewhere, its operating expenses increased by only US$190 million, while producing considerably higher sales.

No miracles here, then, just competent management making a bigger bang for the buck.

The next step

One last question Sea has to answer is whether it can return Shopee to the path to international expansion, that it was forced to retreat from over the past 2 years, shutting its operations in Europe and India, and scaling back engagement in Latin America.

The notion that it could become a truly global marketplace was what once put Sea’s valuation at around US$200 billion.

Today, in a different reality, we know that it has matured, is not under any risk of insolvency and has found solid growth in the markets it remains in.

However, they are still relatively small compared to the size of the global ecommerce pie.

With inflation stabilising and a high likelihood of interest rates going down in the coming year, we might see Shopee back in the hunt for new customers sooner rather than later.