AEON Bank, Malaysia’s first Islamic digital bank, has officially launched in Malaysia on May 26. It’s the second digital bank to launch in Malaysia, following GXBank, which we’ve covered here.

With over four decades of history in Malaysia, you likely recognise the AEON brand as the supermarket chain with outlets across the country.

One of the five digital banking licence holders awarded by the Ministry of Finance and Bank Negara Malaysia, AEON Bank commenced operation early this year in January, offering Shariah-compliant digital financial solutions.

At launch, AEON Bank is already offering quite the range of personal banking digital product services. Here’s what they’re offering, including products as well as perks.

1. Savings Account-i

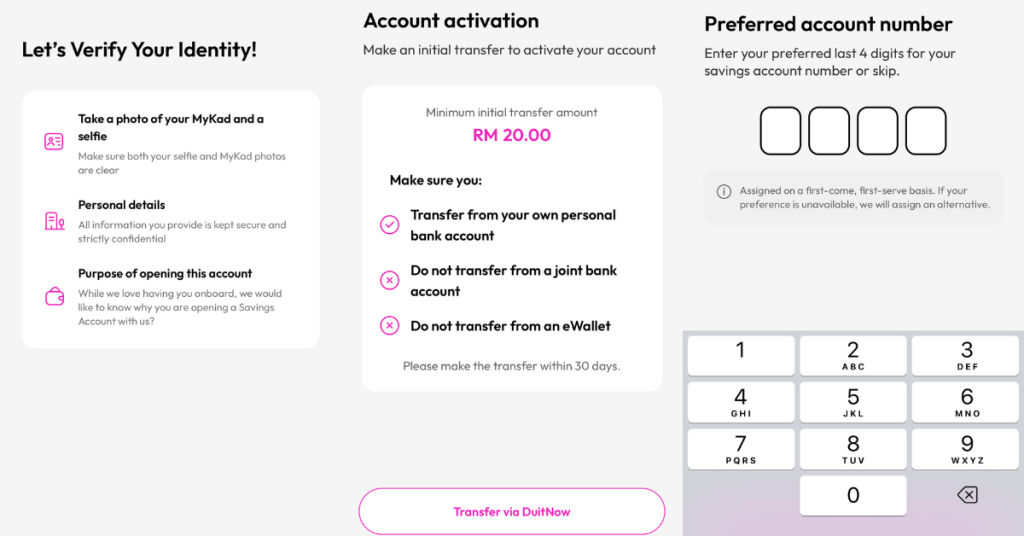

Of course, one of the most basic products of a bank is a savings account.

Something interesting with AEON bank is that you can actually personalise the last four digits of your account number. Number availability is based on first come first served basis.

For those risk-averse users who are worried about the safety of a new bank, be assured that it’s PIDM-protected up to RM250,000 for each depositor.

2. Savings Pots

The Savings Pots is a tool that lets users segment money into different funds for various categories such as vacation, specific purchases, education, wellness, pets, or pretty much anything else.

Users can also automate their savings, putting money away into these pots to ensure their savings are on track.

This is somewhat comparable to GXBank’s Saving Pockets.

3. Budgeting tools

The AEON Bank app features a Budget Centre that lets bank holders set and track budgets for different transactions and categories. To help people stay on budget, there’s a system that notifies users when they reach their targeted spending.

Here, users can also access a comparison of their current month’s spending versus previous months.

4. Debit Card-i

Users that activate their account will be able to immediately access their virtual AEON Bank x Visa Debit Card-i and request for their own physical Debit Card-i, which will be delivered to your registered address.

At this time, AEON Bank is waiving the RM12 issuance fee.

The debit card can be used to withdraw cash at ATMs with the MEPS or Visa logo. Local cash withdrawals at MEPS ATMs will cost users RM1 per transaction while foreign cash withdrawals at Visa ATMs will cost US$1.

5. AEON Points

The AEON Points Programme is a rewards programme where customers can earn AEON Points through eligible transactions.

These points can then be redeemed for cash and automatically credited into their AEON Bank Savings Account-i.

Those who already frequent AEON and have the AEON Wallet will recognise this points system. This programme is available in both AEON Bank and the AEON Wallet, and they are actually the same programme operated by AEON Credit Service (M) Berhad.

Points accumulated under this programme are synchronised across AEON Bank App, and all other apps within the AEON Group in Malaysia.

Customers that are already part of the AEON Points Programme will automatically have their membership linked with the AEON Bank app, which will enable them to enjoy extra benefits and rewards when they make payments at AEON Group’s outlets and merchants.

That includes AEON Mall, AEON Supermarket, AEON Wellness, La Boheme Bakery, AEON Fantasy, and more.

6. DuitNow QR transfers

Unlike when GXBank first launched, users can already use DuitNow’s QR transfer features, making it particularly functional even before users receive their Debit Card-i.

AEON Bank users can also receive or transfer funds to other external bank accounts via instant DuitNow transfer.

7. 3.88% p.a. profit rate

As part of its introductory campaign from now until August 31, 2024, the bank is offering 3.88% per annum profit rate for its Savings Account-i and Savings Pot.

Dictionary time: Profit rates are comparable to interest rates. Islamic banks compute their profit rate based on investment returns, unlike traditional banks that charge interest.

The profit rate is calculated based on the total balance of users’ Savings Account-i at the end of each day, but the profit will be paid only on the last day of the month.

8. Incentives for new users

To further encourage Malaysians to join the new digital bank, new AEON Bank customers that activate their account will be entitled to a sign-up bonus of 3,000 AEON Points.

On top of that, they’ll get 3x AEON Points with transactions using the AEON Bank x Visa Debit Card-i.

More features underway

Moving forward, AEON Bank aims to expand its financial services to serve the underbanked community. This includes micro and small businesses, and AEON Bank specifically highlighted serving suppliers and tenants of their retail business.

The bank will be holding its public launch campaign at AEON Mall Shah Alam’s Concourse Area until June 2, 2024. Through this on-ground activation, they anticipate to engage more than 10,000 AEON Members and consumers.

The activation efforts will involve special performances, family-friendly activities, exclusive merchandise giveaways, and discounted F&B promos by participating brand partners.

According to the press release, the company will be bringing these activations on a nationwide roadshow, visiting locations in Kelantan, Kuala Lumpur, Johor, Penang, Negeri Sembilan, Perak, Melaka, and Sarawak from June till November 2024.

As a regular AEON shopper myself, I’m excited to see that the digital bank is being integrated into the ecosystem, and that the group is cleverly leveraging their network of brands and physical touchpoints to reach the underbanked.

Overall, we’re also excited to see Malaysia’s digital banking scene continue to develop and make progress.

Stay tuned for a more in-depth review of the new Islamic digital bank.

Also Read: Malaysia’s quest for 5 unicorns by 2025 is now in the hands of MDEC’s game plan

Featured Image Credit: AEON Bank