Ever feeling like an octopus at work, where you often feel overwhelmed with your workload, are pressed for time and end up working overtime as a result?

This is the most common sentiment I hear from my peers, even a senior colleague from a previous internship stint — and that’s all from working in one full-time job.

On the other hand, I have also met those who have picked up side hustles on top of their day jobs, including many entrepreneurs who had passion projects before turning them into full-fledged businesses.

This occurrence is known as moonlighting, and it is becoming increasingly common in Singapore. Most recently, a job survey conducted on Singaporean employees by Indeed revealed that moonlighting is the second-highest work trend in 2023, with 13 per cent of respondents “pursuing it extensively.”

The same survey also found that 18 per cent of respondents are likely to moonlight this year. While it is legal in Singapore, employers disdain it due to potential conflicts of interest and breaches in employment contracts.

So, why do some Singaporeans still do it? Is it because they want to? Or because they have to?

A growth opportunity for some…

For some, moonlighting provides a safety net, allowing them to explore other job opportunities to prepare for a possible economic downturn.

Earlier in January, many tech companies and brands conducted layoffs, axing more than 10,000 jobs. Having another job makes them “less likely to worry” about losing their income streams.

Nothing is certain. Businesses fail, and people get retrenched… If one job doesn’t work out, the other hopefully will.

Mr Louis Wong, in an interview with TODAY

Mr Wong works in client management at a logistics firm but also moonlights as a real estate agent, a partner in a tuition centre and an owner of a bird’s nest business.

A notable financial trend that exponentially increased the number of moonlighters was the FIRE (Financial Independence, Retire Early) movement — a lifestyle defined by frugality and people sometimes resorting to extreme measures to save and invest.

The movement also made financial goals, including saving S$100,000 by 30, seem more attainable; and many were inspired to work towards achieving said goals with the likes of individuals such as He Ruiming, the co-founder of the homegrown financial blog The Woke Salaryman.

In his article, which went viral upon release, he shared how his life changed since adopting the FIRE lifestyle and the changes and sacrifices that helped him achieve his goal—including working at an acquaintance’s backpackers hostel and offering services as a freelancer.

…and a means of survival for others

However, there are also other Singaporeans who work multiple jobs to make ends meet, given the rising cost of living in the city-state.

According to a 2022 survey by Qualitrics, 46 per cent of Singaporean employees find it harder to pay for their day-to-day expenses, and more than half of them have begun looking for or are planning to look for a second job.

Some Singaporeans have also taken up side gigs that risk breaching their contractual obligations. In an article by The Straits Times, Mr Q, a product manager at a media company, took a gamble and decided to provide private graphic design services on the side to support his family.

My main income is definitely not enough, especially if I have to pay for my children’s education.

Mr “Q”, in an interview with The Straits Times

He went on to explain that he earns slightly less than S$3,200 after Central Provident Fund (CPF) deductions every month, which is lower than the market rate. However, through his graphic design business, he was able to earn twice as much more to cover his personal and family expenses.

“The money I make from my primary job goes straight to my savings and the money I make from graphic designing is used for my family expenses, such as my kids’ tuition fees,” said Mr Q.

More extreme cases of moonlighting can be seen in other Asian countries, such as South Korea and Taiwan, where university graduates struggle financially and have to work two or more jobs to get by.

But some might argue that even with these additional jobs, how much more can they actually earn to eventually live comfortably?

Work smarter, not harder

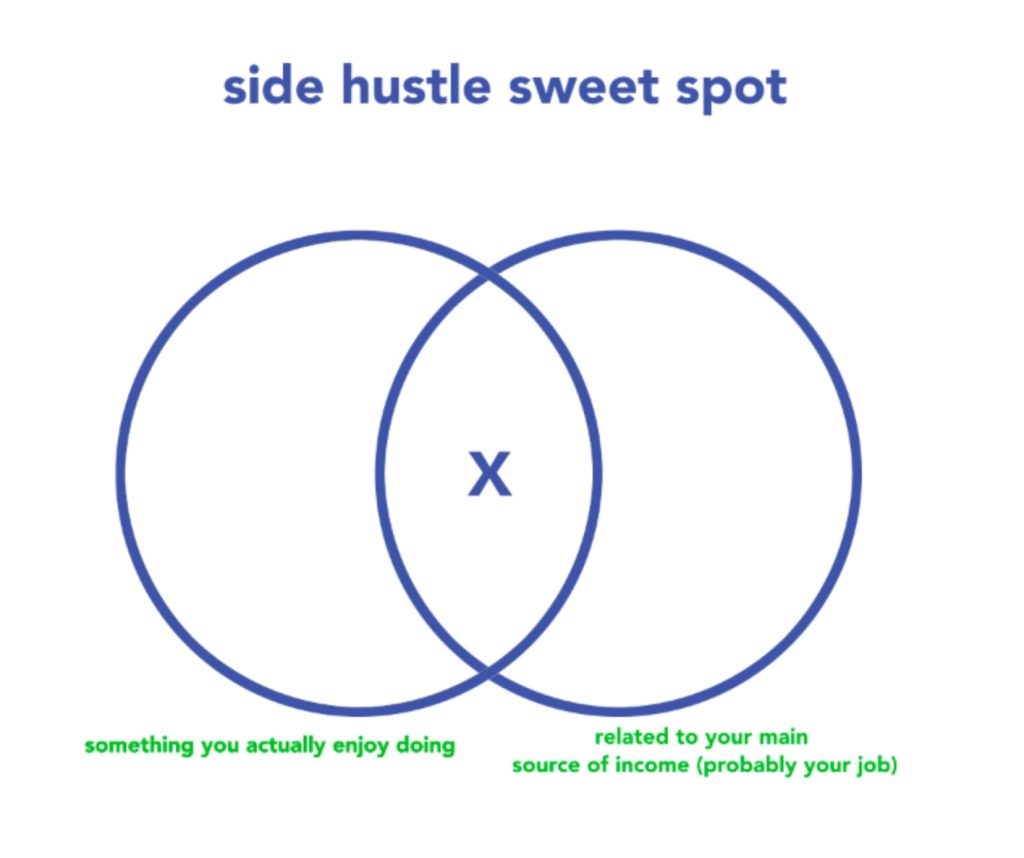

When it comes to picking an additional job, one needs to choose a role that will increase one’s earning power in the long term. According to Ruiming, his side hustle in hospitality did not help him much in his journey towards financial freedom.

You aren’t going to save money with a side hustle that doesn’t develop your skills in any way. Other than covering some living expenses, moonlighting as a dishwasher will not contribute significantly to your $100,000.

He Ruiming, in the The most important things I had to do to save $100,000* before I turned 30 in Singapore.

One will also need to be realistic about the work that they will take on, as working around the clock 24/7 can lead to serious physical and mental repercussions down the road. Instead of vying for another full-time role, consider offering your services as a freelancer or looking for part-time or contract roles that give you flexibility.

Will we live in the same extremes as our Asian counterparts?

That said, there is no telling when we will experience the same extremes as our Asian counterparts. Right now, we’d say we are safe, but we may live the same realities if the socioeconomic environment does not change.

To put it simply, if the cost of living continues to increase but our salaries and earning power remain the same, more people will be pushed to live to the same extremes to get through their lives day by day.

Staying in small rental housing units, working part-time at a convenience store at night after your day job, and eating expired food or instant meals every day – sounds like something out of a dystopia, but that is the life that some millennials in Asia are living as we speak.

Of course, as the younger generation of workers has become more outspoken with their adulting struggles, it did not come without any pushback from their senior colleagues.

Whether it is by calling them the “strawberry generation” or “snowflakes”, their sentiment remains unchanged: “Hard work always pays off. You are only suffering because you did not work hard enough.”

While it is true that hard work does pay off, that is not the reality for all; and it’s not that the current working class is not trying hard enough — they are doing the best they can to rise above their challenging circumstances.

But in a world where connections and privilege can give some the golden ticket to a comfortable life, many will continue like hamsters in a hamster wheel. Therefore, it is important for the current working population to remain hireable, even if that means taking on a second work gig.

Featured Image Credit: People Matters