In 2023, Singapore narrowly avoided a technical recession. Nevertheless, it was still undoubtedly a challenging year, marked by a turbulent international environment, including the conflicts in Gaza and Ukraine, and rising geopolitical tensions between the U.S. and China.

But recovery was seen in the second half of the year, with expansion in the services and tourism sectors. The banking industry has also achieved significant jumps in net income in 2023 compared to previous years, as the increase in global interest rates boosted net interest margins amid post-pandemic economic recovery.

As economic activities gain momentum and companies flourish, here is a list of five CEOs (of SGX-listed companies) who have earned over S$10 million for FY 2023 based on their latest annual reports.

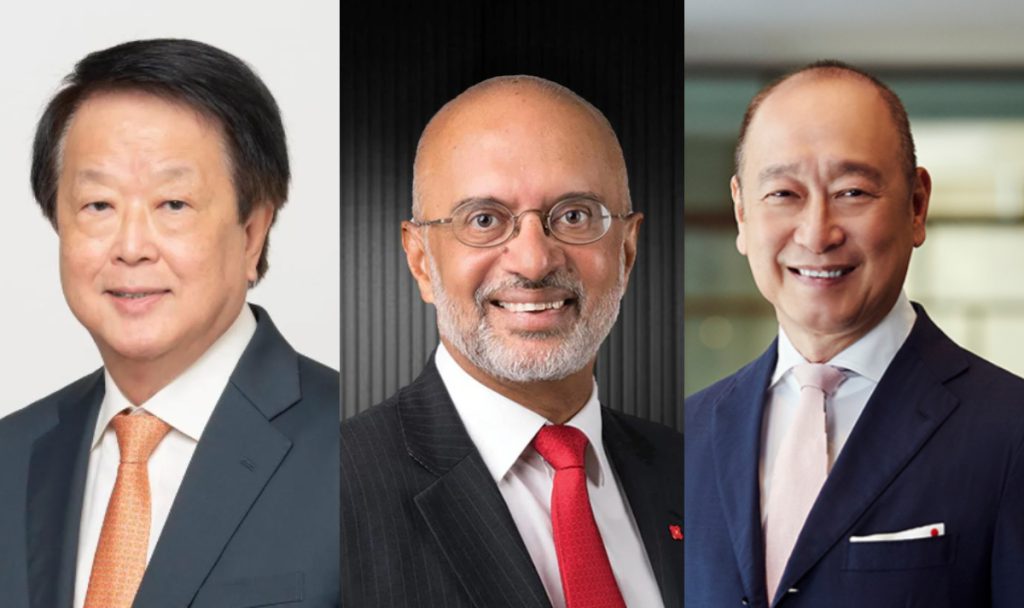

1. Wee Ee Cheong, CEO of UOB Group

S$15.9 million (S$14.2 million in 2022)

Coming in first place is UOB chief executive Wee Ee Cheong, whose salary rose as the bank’s full-year core earnings hit a new record in 2023. His annual pay for FY 2023 came in at S$15.9 million, marking a 12 per cent increase from the S$14.2 million he earned in 2022.

The CEO’s pay comprises a base salary of S$1.2 million (unchanged from 2022) as well as a bonus of S$14.7 million, as well as benefits-in-kind and transport-related benefits amounting to S$39,700.

60 per cent of Wee’s variable pay is deferred and will vest over the next three years. Of the deferred variable pay, 40 per cent will be issued in deferred cash, while the remaining 60 per cent will be in the form of share-linked units.

Earlier in April, Wee also emerged among the world’s newly minted billionaires, according to the 2024 Forbes list of global billionaires, with a net worth of US$1.6 billion.

2. Kuok Khoon Hong, CEO of Wilmar International

S$13.3 Million (S$13.2 million in 2022)

The chairman and CEO of Wilmar International, Kuok Khoon Hong, received a remuneration of S$13.3 million for FY2023, consisting of a base salary of S$1.3 million, a bonus of S$11.5 million, and shares and benefits amounting to S$519,063.

The 75-year-old founded Wilmar International, one of the world’s largest palm oil producers, in 1991 with his Indonesian partner Martua Sitorus. The enterprise soon expanded to India and China and launched an initial public offering on the Singapore Stock Exchange in 2006 with a capitalisation of S$2.38 billion.

Kuok has long dabbled in the industry prior to starting up Wilmar International. In fact, the CEO has been involved in the grains, edible oils and oilseeds businesses since 1973, playing an integral role in many projects involving the establishment of oil palm plantations across Asia and Africa.

In addition to his roles at Wilmar International, the entrepreneur holds directorships in various other listed companies, including Shree Renuka Sugars Limited, Yihai Kerry Arawana Holdings Co. Ltd, and Adani Wilmar Limited. He is also a Director of Perennial Holdings Private Limited and Perennial Group Private Limited.

3. Helen Wong, Group CEO of OCBC

S$12.1 Million (S$11.2 million in 2022)

OCBC Group CEO Helen Wong received S$12.1 million for FY2023 ended Dec 31, 2023. Her earnings surged in 2023 and marked an 8 per cent uptick from her S$11.2 million earnings the previous year, echoing the bank’s record-breaking full-year profits.

Wong’s annual pay packet consists of a base salary of S$1.44 million (unchanged from 2022), a bonus of S$6.35 million, deferred shares worth S$4.24 million, and other perks, such as club membership and car benefits valued at S$69,900, as per the bank’s annual report.

However, the increase in her pay for FY2023 was relatively modest compared to the staggering 47 percent salary leap she saw in 2022, where her earnings jumped from S$7.6 million the previous year to S$11.2 million.

Wong assumed the role of Group CEO at OCBC in 2021 and was appointed as its Executive Director in February 2023. She has four decades of banking experience under her belt, having started out as a Management Trainee at OCBC and was its first China Desk Manager, based at OCBC’s Hong Kong Branch.

Prior to returning to OCBC in 2020 as its Deputy President and Head of Global Wholesale Banking, Wong spent 27 years at HSBC, where she last served as its Greater China CEO for five years.

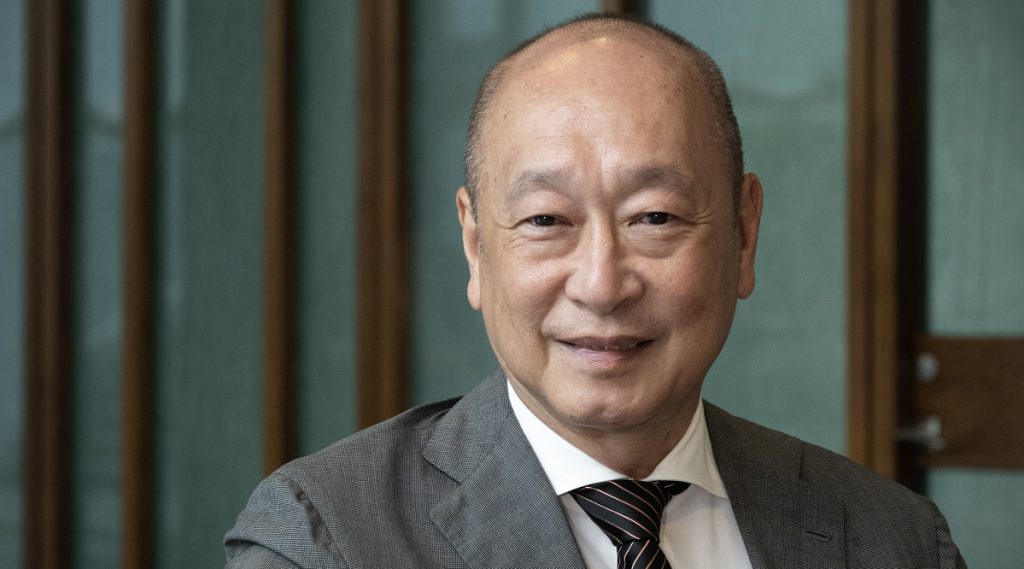

4. Piyush Gupta, CEO of DBS

S$11.2 Million (S$15.4 million in 2022)

CEO of DBS Bank Piyush Gupta, who has consistently topped the list for years, has fallen from his number one spot for FY 2023. His total remuneration for the financial year ending December 31, 2023, was S$11.2 million, reflecting a 27 percent decline from S$15.4 million the previous year.

Although his base salary remained unchanged at S$1.5 million, Gupta received a lower cash bonus of S$4.1 million, down from S$5.8 million in FY2022, and deferred remuneration of about S$5.6 million, a decrease from S$8 million the previous year. Of the deferred amount, around 17.4 percent, or S$965,874, will be in cash, with the remainder issued in shares.

Additionally, Gupta’s total remuneration for FY2023 included a non-cash component amounting to S$72,992, comprising the value of club membership, car, and driver benefits.

Gupta and other members of DBS’ group management committee received reduced variable compensation in 2023 to hold them accountable for a series of digital disruptions during the year. The bank also reported a 3 per cent year-on-year drop in fourth-quarter net profit to S$2.27 billion.

5. Dora Hoan and Doreen Tan, founders of Best World

S$10.7 million to S$11 Million (S$12.5 million to 12.75 million in 2022)

Coming in fifth place was Dora Hoan and Doreen Tan, the founders of Best World, a Singapore-headquartered manufacturer and distributor of skincare, personal care, nutritional and wellness products.

They each received a remuneration of between S$10.7 million to S$11 million, of which in the form of cash or benefits, with 8 percent from annual salary, 91 percent from annual incentive bonus, and 1 percent from benefits.

Currently, Hoan serves as the co-chairman and Group CEO/ Managing Director of Best World, while Tan serves as the President and co-chairman. Based on Best World’s annual reports from FY2014 to FY2022, Hoan and Tan’s remuneration have been identical every year in remuneration range and breakdown.

However, experts have questioned the remuneration policies of Best World, and if the founders’ pay are excessive, considering the company’s performance in recent years. Additionally, the company has not declared dividends in recent years, despite the founders receiving a generous pay package.

Will bank CEOs continue to dominate the top rankings?

This year, local bank CEOs received the highest remunerations, but the question remains: will they continue to retain these high salaries in upcoming years?

As reported by the Business Times, Singapore banks experienced a “Goldilocks year” in 2023 and they are expected to face a moderation in profit margins in 2024. This shift is attributed to the diminishing support from high interest rates and anticipated rate cuts by the US Federal Reserve.

The success of these CEOs will hinge on their adeptness in navigating these challenges and seizing emerging opportunities within the financial markets.

Featured Image Credit: Tatler/ UOB/ McKinsey