Singapore’s Ministry of Manpower has just released its latest Report on Wage Practices providing insights into developments of workers’ pay in Singapore over the past 2 years.

The overall situation remains positive, with wages continuing to edge out inflation, as all industries are reporting an average increase in pay across the economy.

Of course, your personal situation may vary depending on your company, its performance and your performance in it, although only 6.5 percent of establishments cut salaries last year, with 10 times as many offering raises.

Their scale, however, depends also on the industry you’re in, with the top performers reporting nearly twice the pace of the backmarkers:

Total Wage Change by Industry

| Industry | 2022 | 2023 | Cumulative increase over 2 years |

| Accommodation | 9.7% | 8.0% | 18.5% |

| Real Estate Services | 8.6% | 8.0% | 17.3% |

| Financial Services | 9.0% | 7.6% | 17.3% |

| Information & Communications | 7.7% | 6.2% | 14.4% |

| Administrative & Support Services | 5.2% | 7.1% | 12.6% |

| Professional Services | 7.6% | 5.1% | 13.1% |

| Retail Trade | 6.7% | 5.6% | 12.7% |

| Transportation & Storage | 6.8% | 4.9% | 12.0% |

| Community, Social & Personal Services | 5.7% | 5.0% | 11.0% |

| Insurance Services | 6.9% | 4.4% | 11.6% |

| Food & Beverage Services | 5.4% | 4.9% | 10.5% |

| Construction | 5.8% | 4.2% | 10.2% |

| Wholesale Trade | 5.8% | 4.1% | 10.1% |

| Manufacturing | 5.7% | 4.0% | 9.9% |

Following the post-pandemic thaw, the Accommodation sector has continued to raise wages most rapidly, adapting to rising traveller demand.

Similarly, real estate services have seen a real boom, with rising property prices and high demand, compounded by disruptions of the previous two years.

Meanwhile, high inflation leading to higher interest rates has continued to improve the results of financial institutions, with banks like DBS posting record profits — which appear to be reflected in workers’ pay as well.

Speaking of profits…

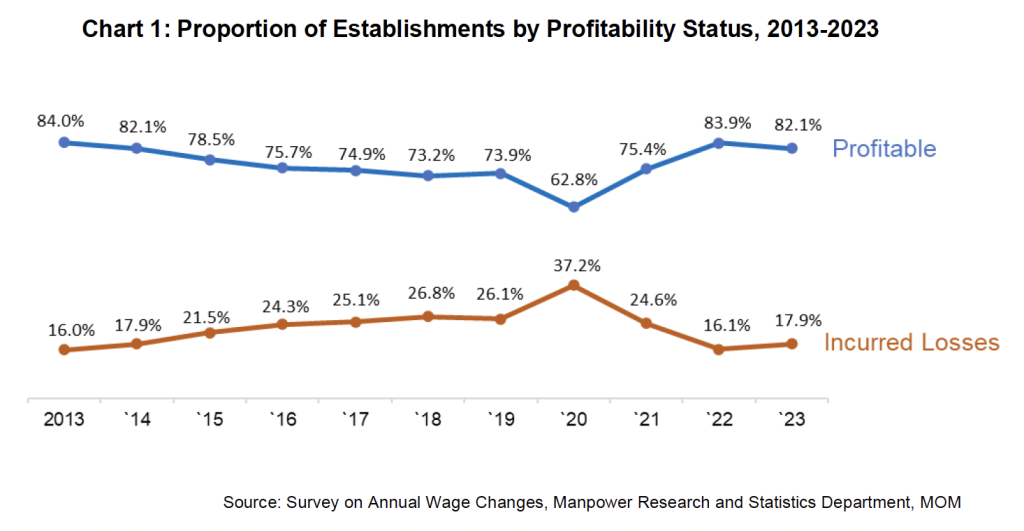

Profitability remains highest in a decade

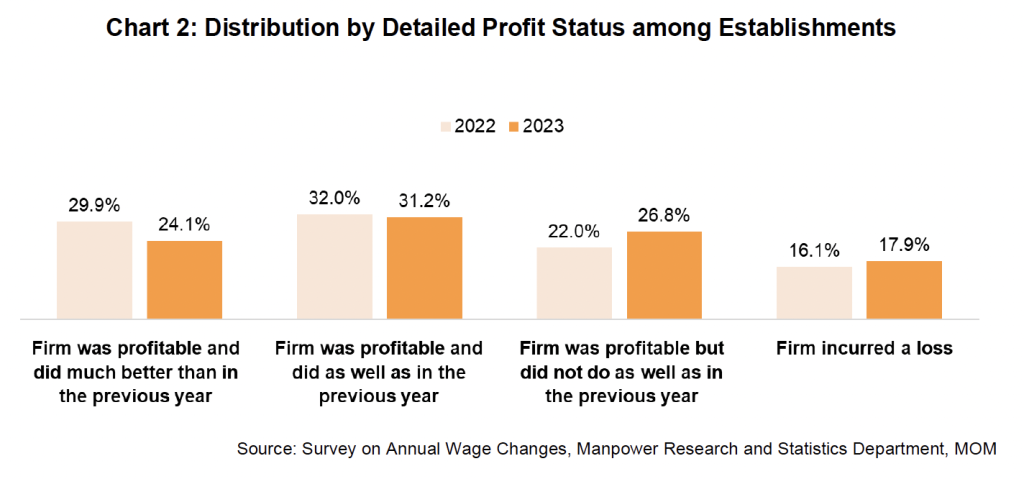

Businesses have, by and large, seen very good results following the pandemic, and are still reporting their highest profitability levels in 10 years, even though they slightly dipped in 2023.

More than a quarter of companies incurred losses prior to 2020, with fewer than one in five reporting negative results today, a proportion last registered about a decade ago.

Over half of them reported as good as or better performance in 2023 compared to 2022, with a minority admitting to a downturn in results:

Senior management accepts smaller increments

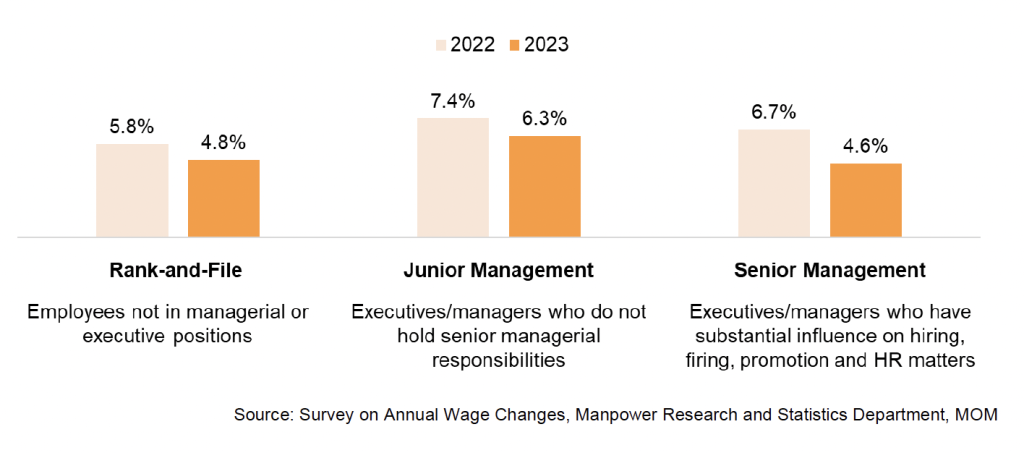

The average pay boost last year was the lowest among the top brass, although, across two years, it’s still above the rank-and-file staff (not by much, though).

The lowest-paid local employees have something to look forward to, however, as the Local Qualifying Salary for Singaporeans is getting a boost this year from S$1,400 to $1,600, a jump of over 14 percent, which is bound to find some reflection in the statistics for 2024, reducing the gap between the highest and lowest paid individuals.

With positive economic forecasts for Singapore, seeing GDP growing by about 2.5 percent this and next year, and inflation under control, real wage growth should rebound, leaving a bit more money in our pockets.

Instead of chasing prices, wages should finally meaningfully outpace them in the next two years.