The Business Times (BT) reported on 2nd July 2024, that the Bank of International Settlements (BIS) has announced a groundbreaking initiative that will enable Instant Payment Service (IPS) providers to transfer funds across borders, significantly reducing the time and cost for consumers and making international payments near instantaneous.

This development means that you will soon be able to use a mobile app like PayNow to pay your Malaysian supplier, and the funds you transfer will be received and cleared within minutes.

The BIS, an international bank owned by 63 central banks representing 95 percent of the world’s GDP, aims to promote global monetary and financial stability through international cooperation. Its recent establishment of the Nexus Scheme Organisation (NSO) aims to connect domestic instant payment systems to improve the speed, cost, transparency of and access to cross-border payments.

The BIS Innovation Hub is now working with the central banks of India, Malaysia, the Philippines, Singapore and Thailand towards a live, first implementation of Nexus, although a specific launch date was not stated.

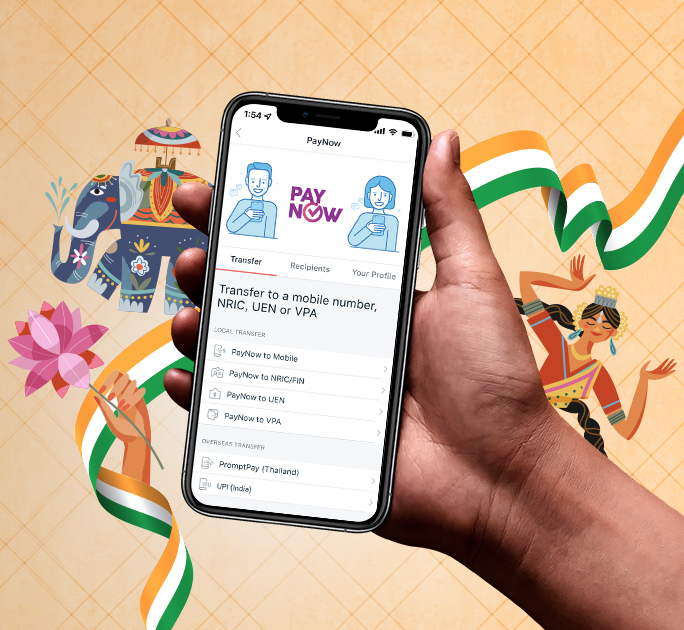

PayNow currently offers two cross-border transfer services, PayNow-PromptPay for Thailand and PayNow-UPI for India, but they are individual agreements. Nexus will become a single global standard for 63 countries, revolutionising the landscape of international payments.

Feature Image: Gerd Altmann @ Pixabay