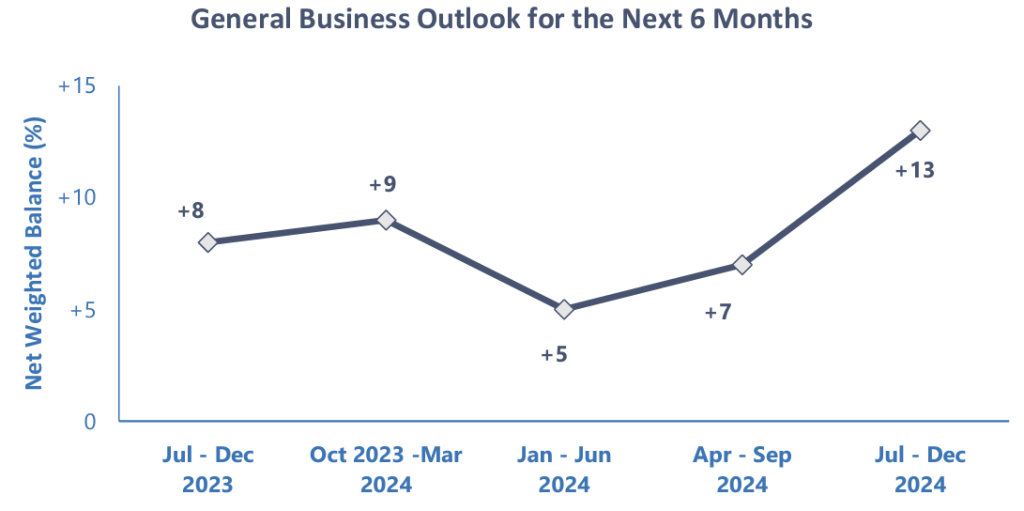

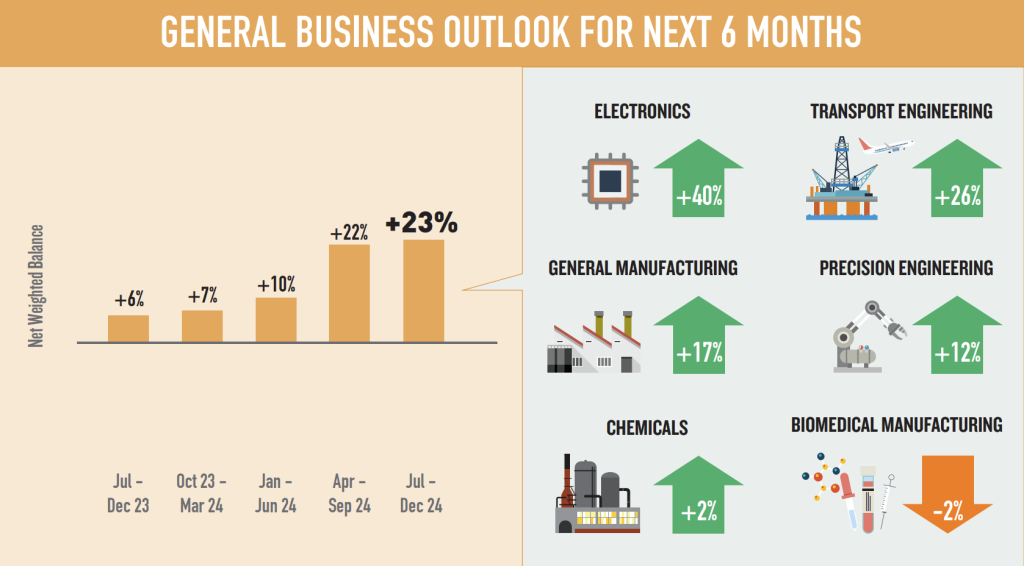

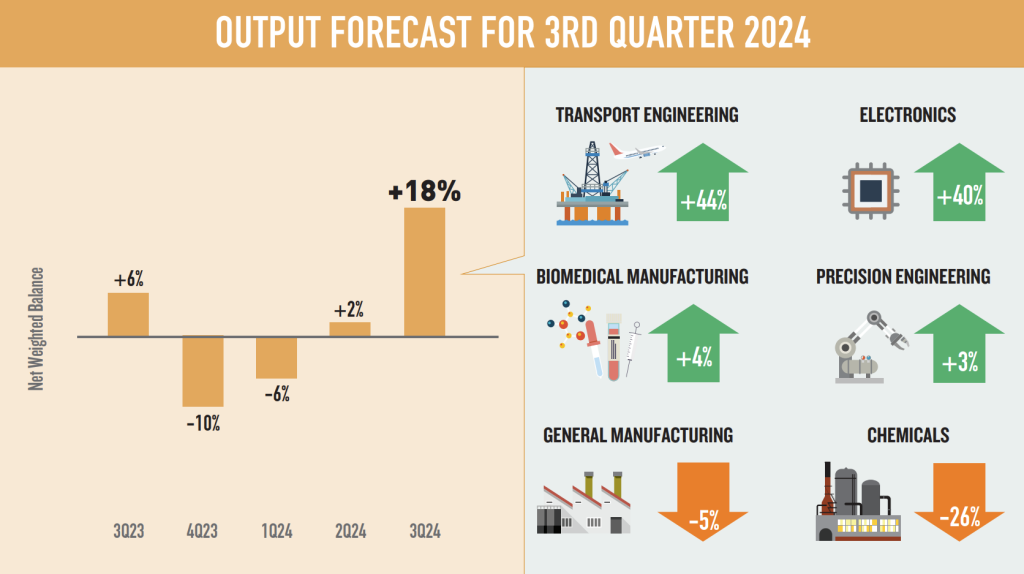

The Economic Development Board (EDB) and the Department of Statistics published their Business Expectations surveys for Singapore’s services and manufacturing sectors, gauging sentiments for the ongoing third quarter and six months between July and December of 2024.

The moods are quite upbeat across the entire economy, with few exceptions. General business outlook for the second half of the year recorded a net positive score of 13 per cent in services and 23 per cent in manufacturing.

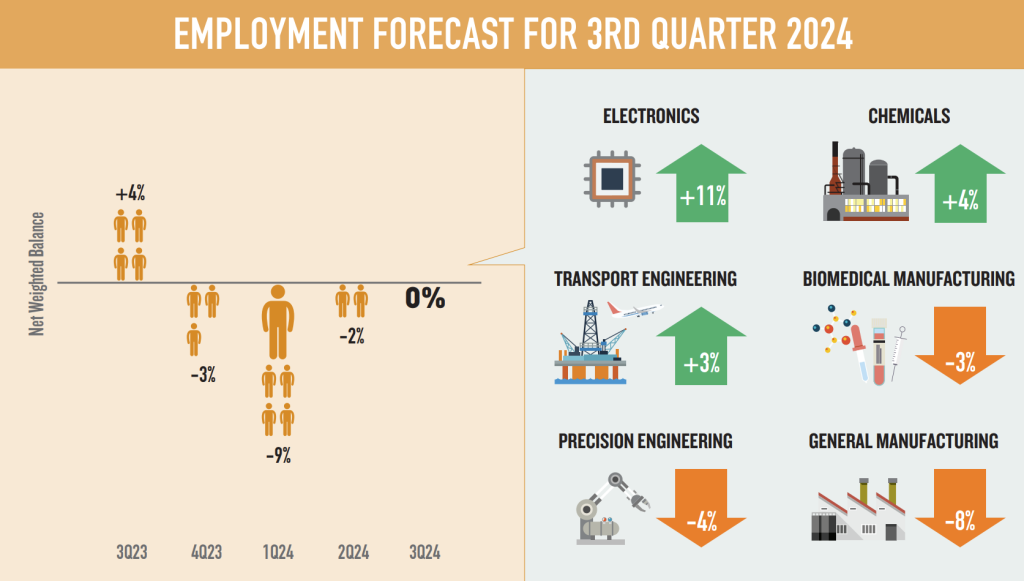

It’s good news, particularly for the latter, which has suffered some headwinds in the past three quarters, as post-pandemic manufacturing boom waned and output declined across the board, leading also to job cuts.

While employment for the entire sector is expected to remain stable, with about as many companies expecting to hire as reduced headcounts, you can expect stronger hiring sentiments in the electronics segment as demand picks up once again.

Strong employment demand in services

However, the demand for workers is the highest in services. All but 2 out of 11 categories report a net positive employment outlook, with four scoring strong, positive double digits.

Please note the numbers reflect the proportion of companies intending to hire over those who intend to lay people off (and not the absolute change in employment):

| Sector | Net employment outlook Q3 2024 |

| Accommodation | +40% |

| Recreation, Community & Personal Services | +23% |

| Information & Communication | +21% |

| Administrative & Support Services | +17% |

| Wholesale Trade | +10% |

| Professional Services | +5% |

| Food & Beverage Services | +4% |

| Finance & Insurance | +3% |

| Retail Trade | +3% |

| Real Estate | 0% |

| Transportation & Storage | 0% |

Accommodation and Recreation are still strong performers, given how the tourism industry is still in a post-pandemic rebound, expecting to cater to a growing number of visitors from abroad.

But there is also a strong demand for talent in IT (as ever, perhaps) and Administrative Services, suggesting that companies are growing their operations.

This seems to be in line with strong GDP forecasts for Singapore, indicating growth of as much as 3 per cent this year.

Overall, the risk of layoffs is low and limited to a few manufacturing sectors, still slightly lagging behind the rest. In services, however, the bread and butter of Singapore, the situation remains positive and improving after a slower 2023.

Coupled with declining inflation, this may translate into higher real wage growth, as companies share the spoils with their staff, easing the pressure of living costs, which have been on the rise over the past 2 years.